1/ Three months after Futarchy and the Grants Council each selected 5 projects to receive growth grants, we’re exploring how the selected projects fared in terms of Superchain TVL increase!

We’re also rewarding the top forecasters based on prediction accuracy.

2/ Congrats to 1st place @0xSkyMine, 2nd place @joanbp_dk, and 3rd place @0xyNaMu.

See the comment section on this forum post for full rewards announcement:

3/ Key learnings: Futarchy and GC initially selected 2 overlapping projects

( @RocketPool_Fi and @superformxyz), and 3 unique projects.

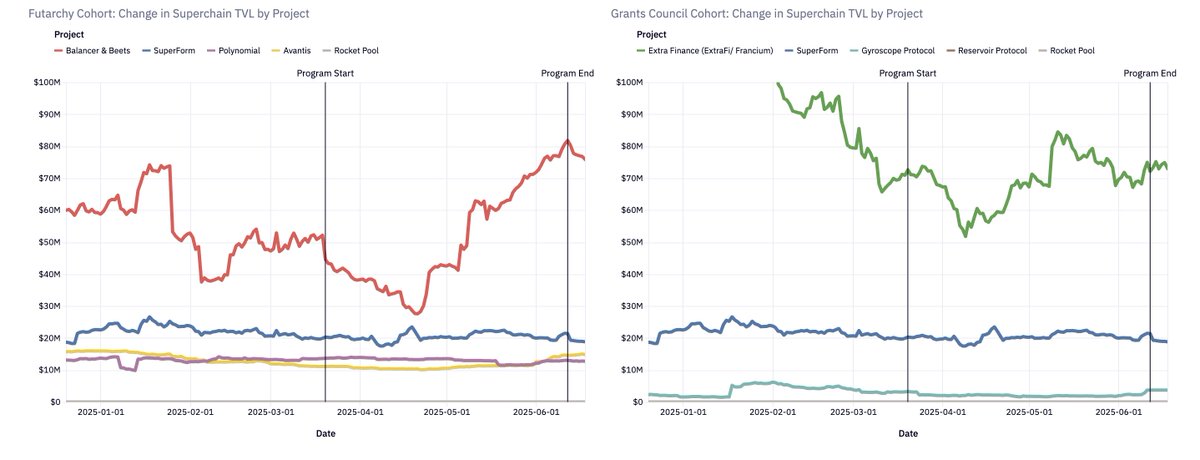

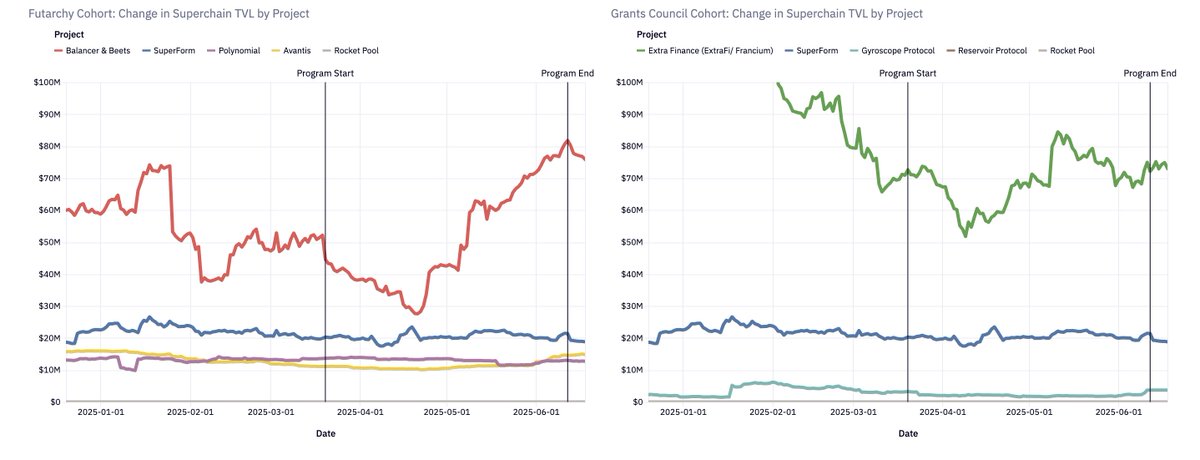

Comparing those projects, the Futarchy projects appear to have seen a higher increase in Superchain TVL, though that is driven largely by outlier @Balancer & @beets_fi (who narrowly missed the cutoff by GC and was ranked sixth).

Check out the full analysis post here:

4/ Wider variance and appetite for risk among Futarchy?

While Futarchy selected the two projects that saw the highest increase in TVL out of the full set, they also selected a project with a larger net negative TVL than any of the GC projects.

Both Futarchy and GC failed to select multiple high-performing projects.

5/ In terms of prediction accuracy, Futarchy estimates were considerably higher than even the projects’ estimates themselves, and much higher than the actual outcomes.

The play money setup (no penalty for a project to push predictions up to influence grant outcomes) likely influenced this finding.

6/ Separately, we are also exploring the impact of grants on Superchain TVL, and you can find the full analysis forthcoming in the discussion section of this forum post:

Please also check out @OSObserver‘s dashboards, and @butterygg’s analysis, to dive deeper:

OSO’s Futarchy v1 Data Dashboard:

OSO’s Season 7 Grants Data Dashboard:

Butter’s analysis:

7/ To recap, data suggests that Futarchy performs at least as well as traditional decision-making structures in selecting projects that would most increase in Superchain TVL, but our specific implementation also highlighted some important weaknesses.

We’re excited to continue to experiment with Futarchy, and explore the differences with play versus real money incentives, in future experiments.

9.33K

99

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.