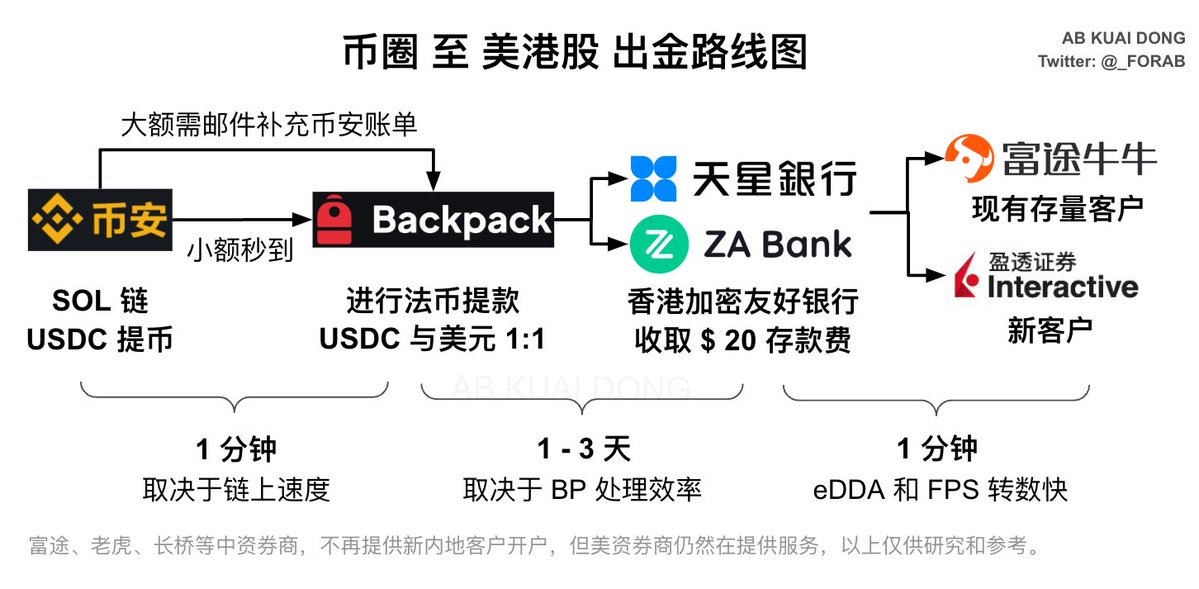

Recently, I've been receiving private messages asking how to transition from the crypto space to US and Hong Kong stocks, so I'll share this pathway. The total fee is about 20 USDC.

Step 1: Register on Binance

· Prepare USDC

· Withdraw to Backpack via the SOL chain

· To prevent being asked for source proof later, export the transaction statement for backup

Step 2: Register on Backpack

· Complete KYC for all levels

· Transfer USDC from the SOL chain

· Withdraw via fiat currency, filling in bank receiving information

· USDC and USD will be automatically exchanged at a 1:1 rate for withdrawal

Step 3: Bank Receipt

· After 1 - 3 days, you will receive an email from a Hong Kong bank

· It will show a remittance from "Royal Bank of Scotland"

· If it's ZA, a service fee of 20 USDC will be deducted; other banks do not charge

Step 4: Transfer to Broker

· Pre-register and complete KYC with a US and Hong Kong stock broker

· Then deposit funds into the US and Hong Kong stocks via eDDA or Faster Payment System using a Hong Kong card

· This completes the entire operation

Note:

Based on past experiences withdrawing USDC from Binance to Backpack, if the amount is below 20,000 - 50,000 USDC, it usually arrives instantly, and you can directly apply for withdrawal.

If the amount exceeds this range, you will likely be asked to provide additional source proof via email, at which point you will need the statement from Step 1.

Currently, all withdrawal platforms recognize Binance's source proof. If you use second or third-tier exchanges to deposit large amounts of USDC into Backpack or Kraken, they may not recognize these smaller exchanges when asked for additional source proof, leading to potential freezes.

Currently tested, Binance's statement is recognized.

As for US and Hong Kong stock brokers, including Futu, Tiger, and Changqiao, they no longer open accounts for new clients from mainland China, but brokers like Interactive Brokers still allow account openings.

However, a more complicated issue is that Chinese brokers have tax synchronization issues with mainland China, while US brokers also have tax synchronization issues with the US, which is something to consider if you make significant profits in the future.

Additionally, there are other channels available, such as Kraken - European bank - Hong Kong bank - broker, but the fee rates are higher than this pathway, so I only recommend this route, hoping it helps everyone.

Show original

301.56K

1.98K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.