I see this often, but it's not accurate to be clear.

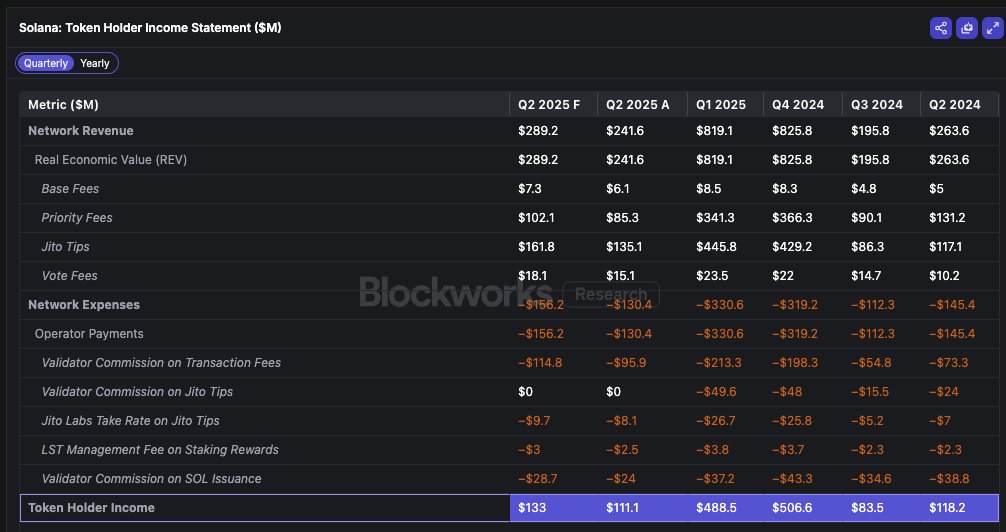

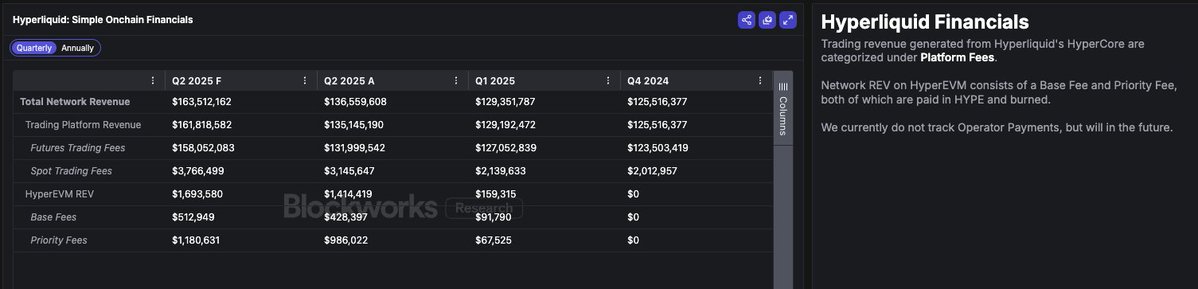

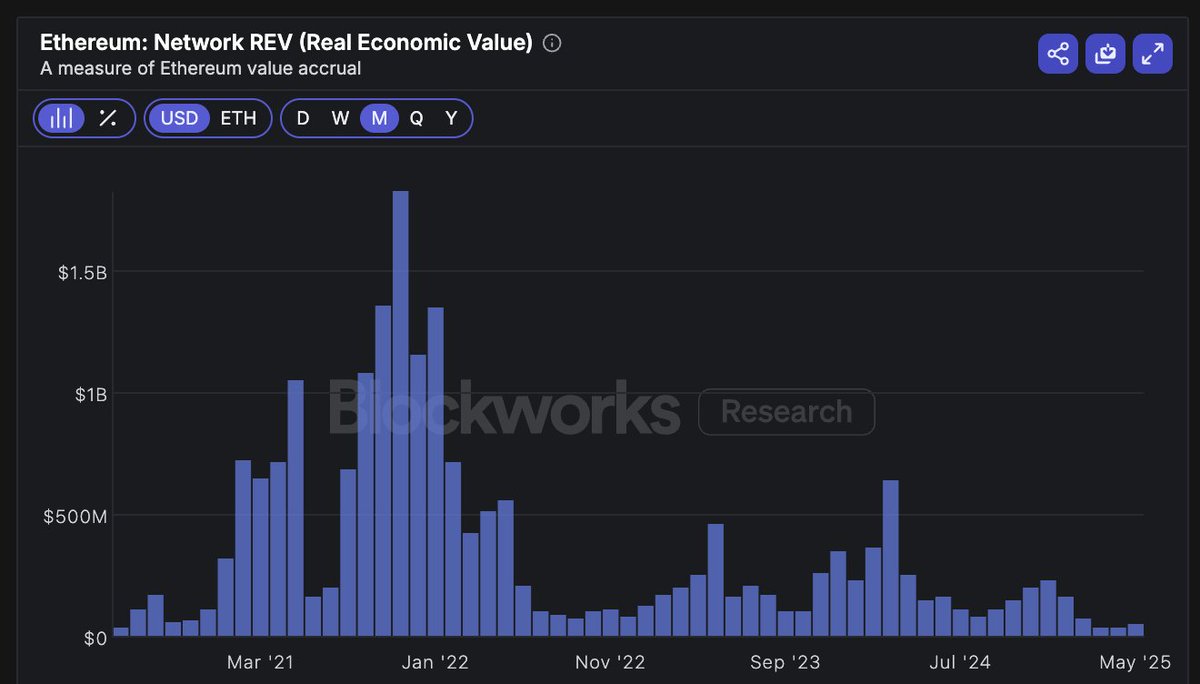

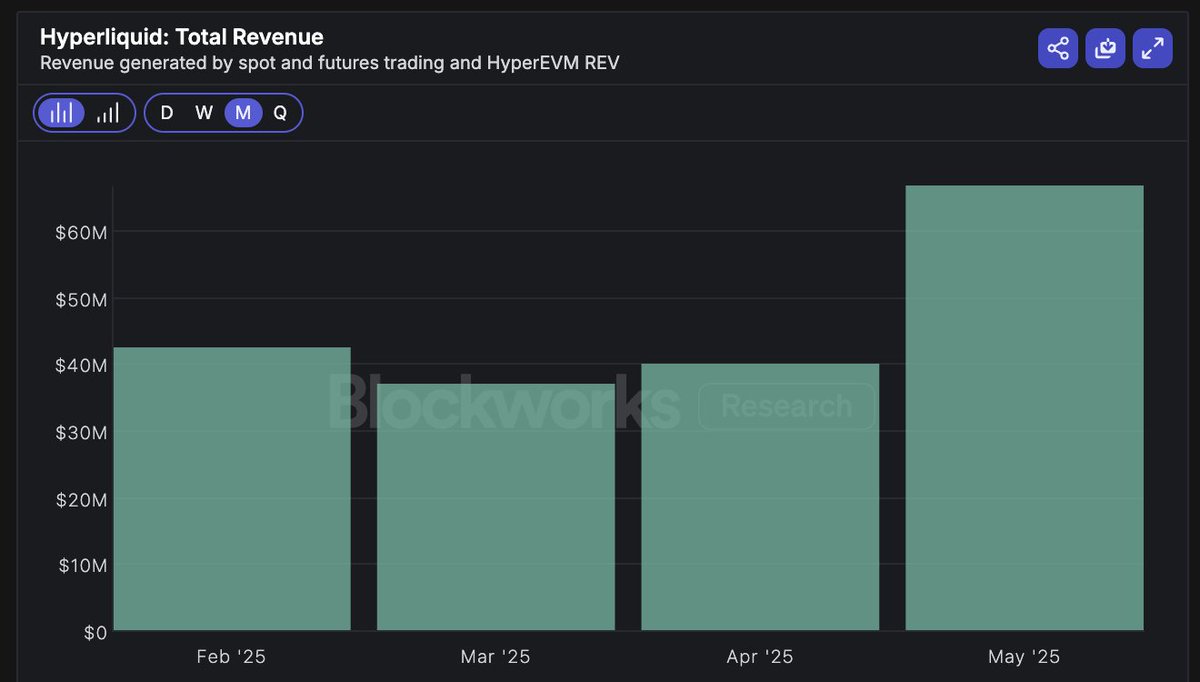

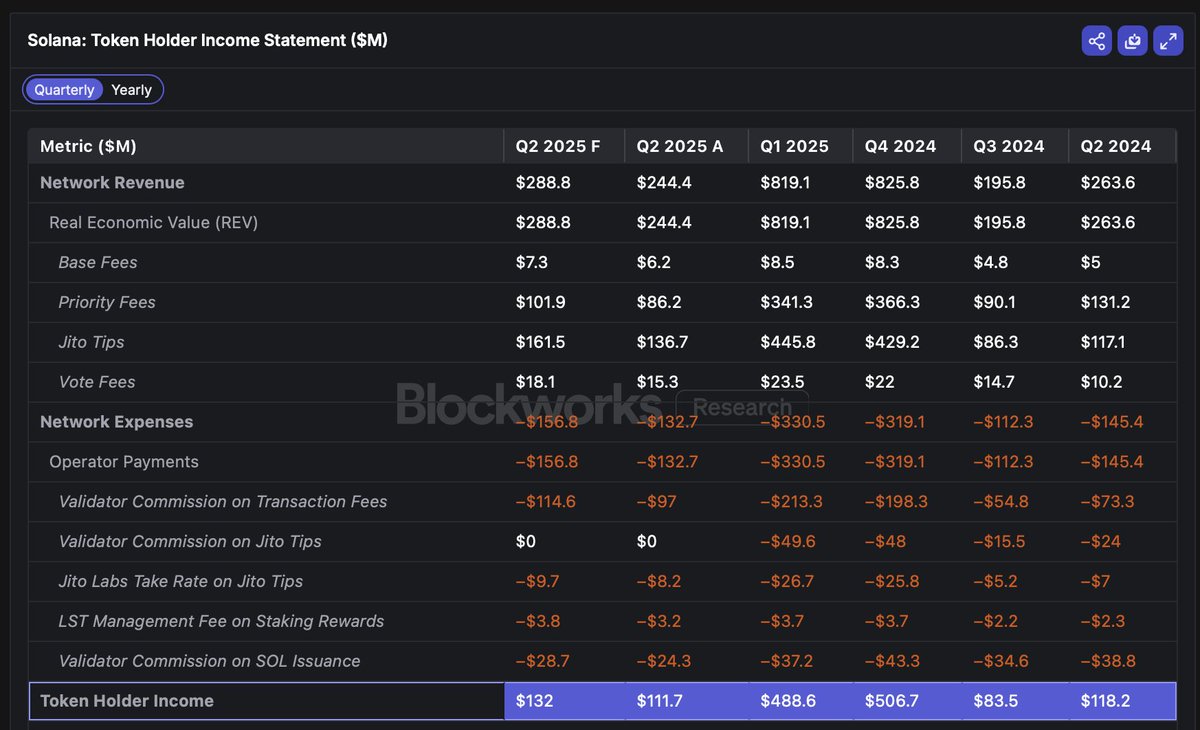

HYPE generates a bit more $ than ETH, but SOL still generates ~2x what HYPE does (& is priced at ~2x HYPE's FDV).

(We own both SOL & HYPE)

@Keisan_Crypto @defi_monk That is #2 here, once again a separate comp, & once again SOL is still generally in the lead (by how much depending on time horizon selected)

Try again

@leoyanzon "sell pressure" isn't an expense

the relevant realized expense is the portion of inflation and REV that actually is paid out to operators

@chainyoda SOL receives dividends (prio fees / MEV)

Investors can buy SOL to receive dividends

Pump selling SOL is quite literally irrelevant here

Everything is priced on supply and demand

@chainyoda Pump selling SOL is *at worst* still slightly positive for net sell pressure, and even that requires you to assume:

- users paying SOL to pump spend all of their SOL and hold none remaining more than they would’ve otherwise

- pump sells all of their SOL

@chainyoda Line 3 is irrelevant to cashflows and still strictly positive vs alternative (pay for app in USDC/other)

Line 2 literally read my OP and replies (a lot)

86.21K

177

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.