Huma Finance: A PayFi network that redefines global payment liquidity|46 million+

As a long-term user who has been following the DeFi and payment track, the emergence of Huma Finance @humafinance has made my eyes shine. It is not just an ordinary lending protocol, but a PayFi network that focuses on "payment scenario liquidity". To put it simply, Huma Finance's goal is to make global payment behaviors no longer plagued by broken capital chains, whether it is corporate payroll, supply chain settlement, or personal cross-border payment, they can get instant liquidity support.

Project Basics: PayFi's unique positioning

The core logic of Huma Finance is "Invoice Financing". For example, a company has an account receivable that takes 30 days to arrive, but it urgently needs funds to pay employees or suppliers, and the traditional financial process is cumbersome and time-consuming. Huma converts this "future income" into instant liquidity through on-chain credit assessment and asset tokenization, without the need for overcollateralization.

Unlike general lending protocols such as AAVE and Compound, Huma focuses on "payment scenarios" and supports different chains and payment ecosystems (such as payroll, BNPL, supply chain finance, etc.) through modular design. Its bottom layer consists of two key parts:

Credit Risk Engine: Dynamically assess borrower credit through on-chain/off-chain data (such as DAO Treasury, corporate cash flow records, etc.).

Liquidity pools: Fund providers (LPs) can participate and earn yield through stablecoins or tokenized assets (such as USDC, DAI).

Project Advantages: Why Huma Could Be a Dark Horse?

Deep cultivation in vertical fields: The DeFi lending track is already a red ocean, but the liquidity of payment scenarios is still not fully developed. Huma targets the trillion-dollar B2B and cross-border payments market.

Credit evaluation innovation: Traditional DeFi relies on overcollateralization, while Huma introduces the concept of "credit line", which is similar to the credit model of traditional finance, but is more user-friendly.

Modular scalability: Huma's architecture allows it to access different payment protocols (such as Request Network and Sablier), and may become the underlying financial layer of Web3 payments in the future.

Tokenomics: Incentives and Governance

Huma's token $HUMA has not yet been launched, but judging from the white paper, its design is biased towards utility + governance:

Staking rewards: LPs and borrowers can increase their credit limit or receive fee discounts by staking $HUMA.

Protocol Governance: Holders vote on risk parameters (e.g., collateral ratio, default liquidation rules).

Revenue share: A portion of the agreement revenue, such as interest differentials, may be used for buybacks, burns, or dividends.

The key point is that $HUMA value capture is directly tied to the size of payments on the Huma network – if more businesses adopt its financing services, the demand for tokens will rise as fees grow.

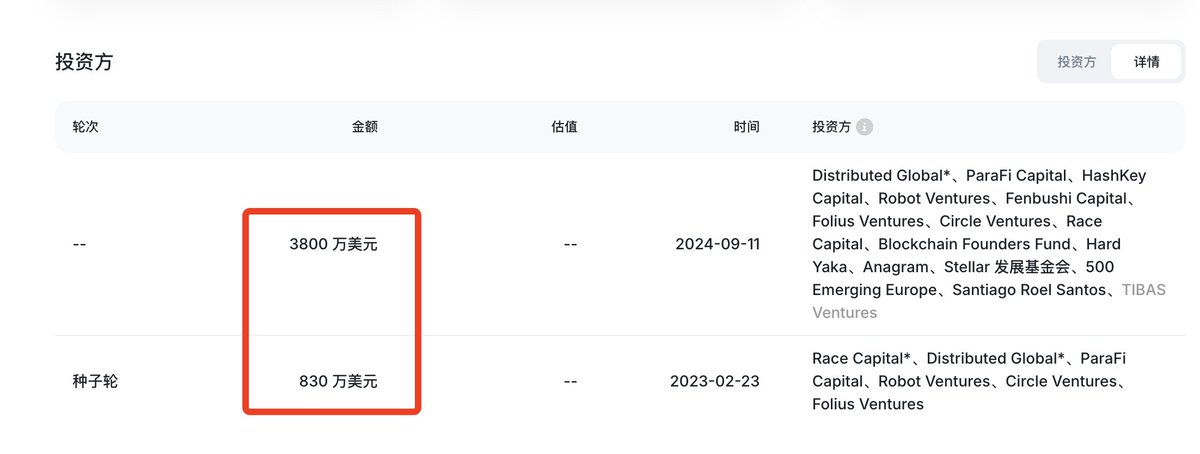

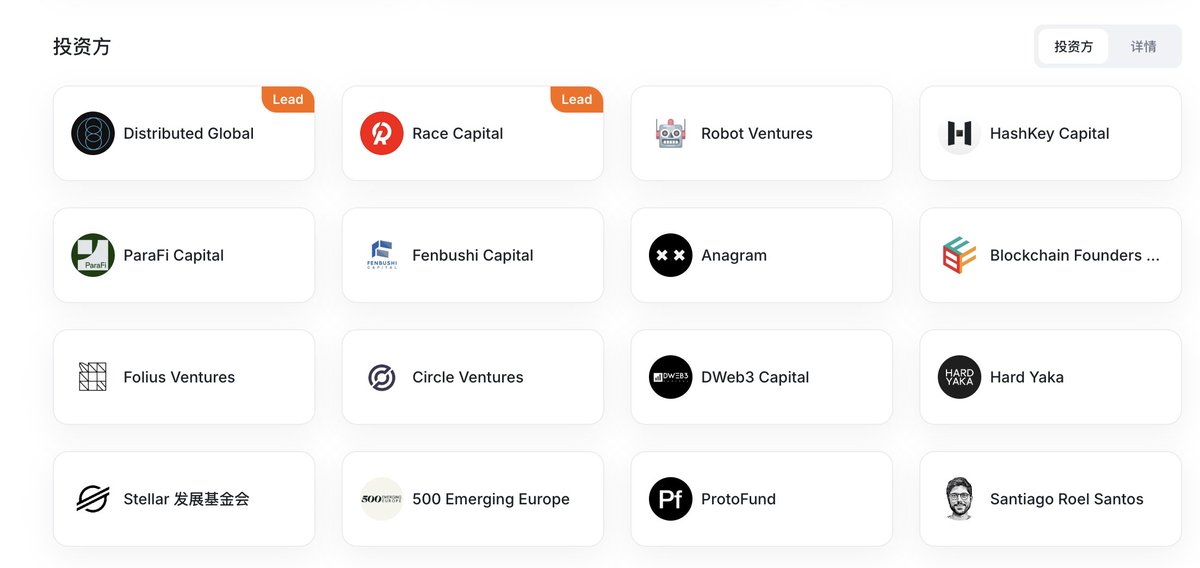

Financing Information: Why is Capital Optimistic?

Huma's fundraising journey is worth noting:

February 2023: $8.3 million seed round, led by Race Capital and Distributed Global.

September 2024: $38 million Series A, with participation from traditional financial institutions such as Tiger Global and BlockTower.

The large amount of financing shows two points: first, the market recognizes the potential of the PayFi track, and second, Huma's team and technology (core members from PayPal, Stripe, etc.) have the ability to land.

Future Prospects and Challenges

Huma has a lot of room for imagination, especially in the areas of RWA (real world assets) and cross-border payments. For example, small and medium-sized enterprises in developing countries can quickly obtain advance financing for international orders through Huma without relying on local loan sharks.

But the challenges are also clear:

Credit risk: On-chain data is not sufficient to fully assess borrower eligibility, and it may be necessary to introduce Oracle or KYC mechanisms.

Regulatory compliance: When it comes to cross-border payments and tokenized receivables, differences in national laws can be a barrier to expansion.

Personal opinion: cautiously optimistic

As a user, I think the concept of Huma is very much in line with real needs – especially in the current context of the global economic downturn and tight cash flow. However, the success of PayFi depends on ecological cooperation (such as integration with Stablecoin issuers and payment gateways), not purely technical advantages.

In the short term, Huma needs to prove that its bad debt ratio is manageable and attract more real business users (rather than speculators). If it can do this, it has a chance to become the Web3 version of "Stripe Capital".

Summary: Huma Finance is not yet another "DeFi Lego", but an innovative protocol that tries to solve the pain points of the real economy. Despite the uncertainties ahead, its $38 million funding and clear positioning deserve long-term attention. @KaitoAI

(The above views are personal opinions only and do not constitute any investment advice)

Show original

142.9K

47

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.