Glad to see more DeFi projects building AI products & using @virtuals_io as the distribution after the success of @BasisOS

- Jarvis by @fractality_fi (prev. Y2K Finance — launched one of the most unique products during Arb szn: exotic derivatives for pegged assets, letting users bet on the downfall or hedge against stablecoins depeg)

The team pivoted last year to Fractality, focusing on basis-yield strategies vaults (similar vibes to BasisOS / Ethena). Jarvis seems to be a DeFAI abstraction layer for on-chain actions, especially cross-chain bridging, aiming to drive more TVL to Fractality vaults.

Jarvis is launching on Genesis Launch in about an hour (product not yet out though).

- @Maneki_DeFi by @rivoxyz (prev. Locus Finance — on-chain indexes offering top DeFi yields + one of the best UI/UX for onboarding normies into DeFi)

The team pivoted to Rivo / Maneki, a DeFAI abstraction layer focused on portfolio optimization i.e. The agent recognizes your holdings and suggests strategies to optimize your stablecoins, majors, etc., so idle capital isn’t just sitting around.

Maneki is launching on Genesis Launch in about a week (closed beta of the product is live for you to play around with).

Hope to see more & more DeFi projects launching AI products soon!

Disclaimer: Not endorsing anything here, just spotting a trend. NFA / DYOR if you decide to ape lol

Additional thoughts on Virtuals Genesis Launch / Virgen Points

Turns out @RWAIAgent playbook works — allocating a small part of tokenomics to KOLs at >5x starting FDV with some lockups and partial unlock at TGE.

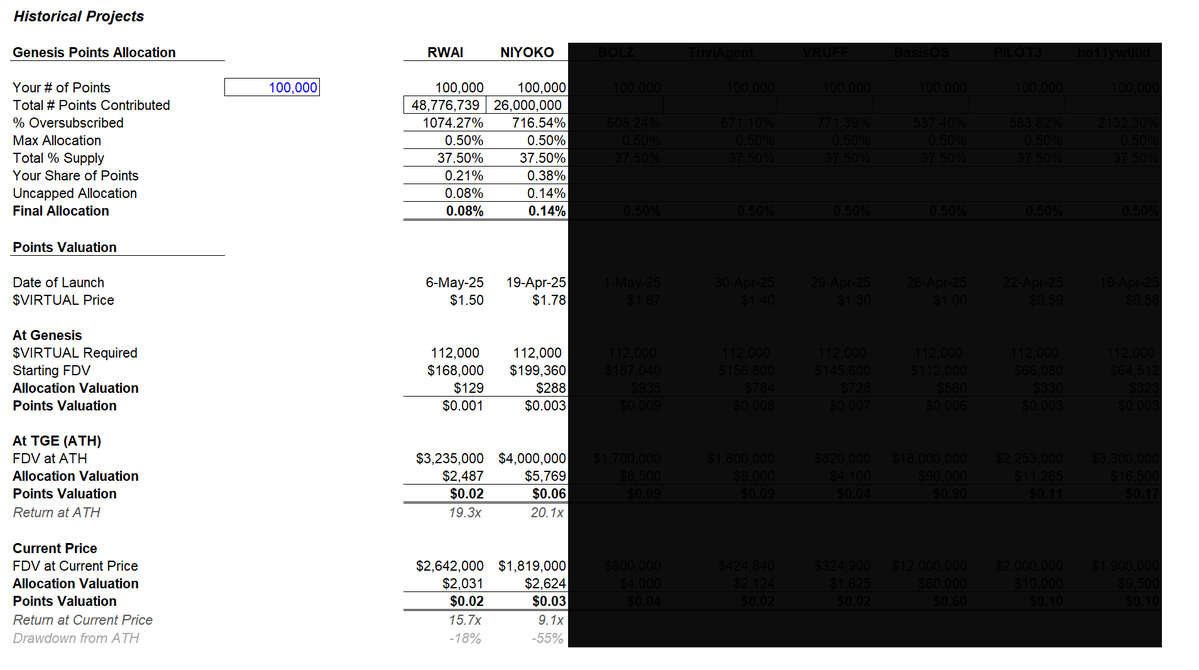

End result: 1,074% oversubscribed with ~50m points contributed to the sale. If you put in 100k points, you're only getting 0.08%. To max out allocation (0.5%) on RWAI, you'd need 650k points (vs. 350k points for NIYOKO to get max allo).

The impact of jeet jail shenanigans combined with private round KOL hype inflates the total points, leaving small retail players with minimal allocations.

The upside: no one loses money on the sale.

The downside: if the bug isn't fixed soon, playing this Genesis game might not be worth the opportunity cost. Better to back solid agent teams with proven products & track records.

RWAI playbook will likely be replicated more but this time with Virtual KOLs getting allocations (instead of outsiders). Hopefully, this comes with more transparency around tokenomics.

Current launchpad iteration makes it tough for bigger projects to launch — they can't raise from VCs or strategics at high valuations (for runway & operations).

^ The only viable option now: launch two tokens — an agent token representing the AI agent and an ecosystem token that accrues the majority of revenue streams. (But this model isn’t sustainable long-term, as airdropping the eco token to keep the community happy often leads to dumping of the AI agent token.)

But... who knows, we might see more success stories of small teams hitting $100m+ valuations from launching on Genesis, and bigger teams launching AI agent tokens with a product that can sustain the PA for both tokens.

Genesis launches can be a goldmine — only if you play the allocation game strategically

Note: I blacked out the section on the right because I don't have historical data points on "Total # Points Contributed," so I couldn’t calculate point valuations for past projects. If you have this data, would appreciate it if you could share — e.g., for BasisOS, Triviagent, ho11yw00d, and other hyped launches.

32.46K

79

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.