Virgen Points — @virtuals_io Genesis Launches Trends

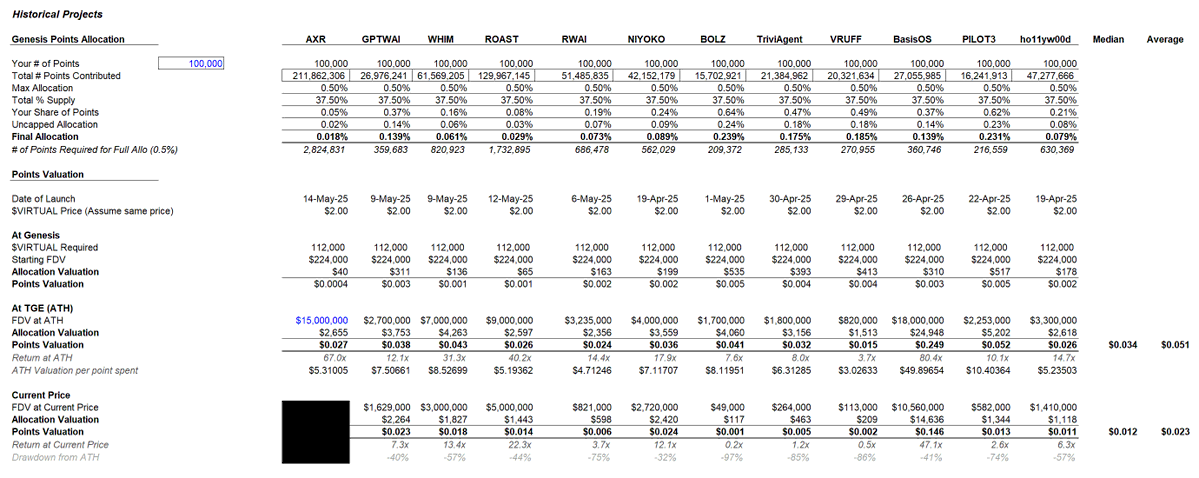

- # of points required for max allo continues to increase from 200-600k points contributed per projects to 800k-1.7mn in recent projects (Whimbet & Burnie)

- @AIxVC_Axelrod becomes the most hyped project with already 211mn points contributed already (w/ about 2 hours to go before the end of the sale). You need to spend close to 3mn points in order to get max allo.

- Doesn't make sense to spend points here as return per point spent is likely to be low.

I've gleaned the return per point spent based on calculating ATH valuation per point spent (taking estimated FDV of $15mn divide by total points contributed) — buying at TGE might provide better entry as only the top contributors that contribute millions of points are getting significant amount of supply (0.5%)

- Generally, each Virgen point is worth between $0.012 - $0.034 per point. Price point of the points remain at a solid range BUT the amounts of points getting contribute to projects continue to increase at rapid pace = you'll get less allocation in each new hyped launch = lower entry size

- Would max lock your $VIRTUAL to veVIRTUAL help? It definitely would. Initially, 15m-19m points per day was going to all $VIRTUAL held in circulation (650mn tokens). Now the same number of points are going to 1.35mn veVIRTUAL (you do the math lol)

- Does it make sense to max lock for 2 years? This really depends on your conviction in the ecosystem.

If you think that Virtuals can continue bringing in builders to launch unique projects on Genesis Launch for an extended period of time, and you can derive more value than the amount that you staked, then sure.

If not, better keep your $VIRTUAL stack liquid OR lock it for a shorter amount of time OR only max lock a small part of your $VIRTUAL stack

Have fun trenching Virgens

I'll share my strategy on how I plan to play this later on my Substack for those interested

(The analysis assume same $VIRTUAL price across all projects to exclude the impact of $VIRTUAL price to the ROI of the projects)

Glad to see more DeFi projects building AI products & using @virtuals_io as the distribution after the success of @BasisOS

- Jarvis by @fractality_fi (prev. Y2K Finance — launched one of the most unique products during Arb szn: exotic derivatives for pegged assets, letting users bet on the downfall or hedge against stablecoins depeg)

The team pivoted last year to Fractality, focusing on basis-yield strategies vaults (similar vibes to BasisOS / Ethena). Jarvis seems to be a DeFAI abstraction layer for on-chain actions, especially cross-chain bridging, aiming to drive more TVL to Fractality vaults.

Jarvis is launching on Genesis Launch in about an hour (product not yet out though).

- @Maneki_DeFi by @rivoxyz (prev. Locus Finance — on-chain indexes offering top DeFi yields + one of the best UI/UX for onboarding normies into DeFi)

The team pivoted to Rivo / Maneki, a DeFAI abstraction layer focused on portfolio optimization i.e. The agent recognizes your holdings and suggests strategies to optimize your stablecoins, majors, etc., so idle capital isn’t just sitting around.

Maneki is launching on Genesis Launch in about a week (closed beta of the product is live for you to play around with).

Hope to see more & more DeFi projects launching AI products soon!

Disclaimer: Not endorsing anything here, just spotting a trend. NFA / DYOR if you decide to ape lol

35.74K

168

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.