Michael @Saylor is conducting a hostile takeover of the bond/fixed income market.

You think this is hyperbole, but you have to understand how early we are.

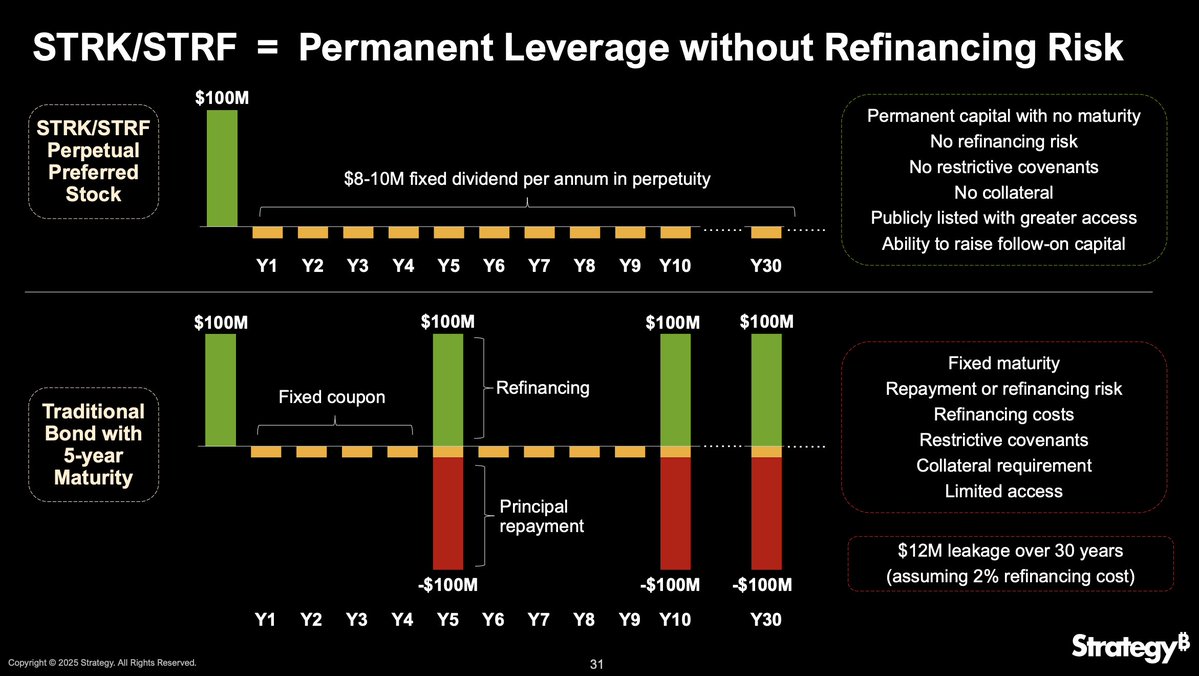

Every pension fund, insurance pool, and yield-starved zombie chasing 4% on 30-year treasuries is about to wake up and realize they can buy a publicly listed, perpetual-yield instrument backed by the hardest asset on earth… and Saylor never has to pay them back.

They’re the financial equivalent of a vampire that never dies and never repays principal.

Meanwhile, your traditional bond structure is a pathetic boomer treadmill of refinancing risk, collateral demands, and some Goldman rat breathing down your neck every five years asking if your EBITDA looks “healthy.”

This is the type of financial brilliance Bitcoin offers.

Bitcoin is going to EAT the ENTIRE FINANCIAL SYSTEM.

Show original

105.61K

1.41K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.