HashKey Trading Moment: Bitcoin maintains its all-time high price as Japanese bond yields soar and tariff wars resume

1.Market Watch

Keywords: BTC, ETH, VIRTUAL

Long-term Japanese bond yields hit record highs, the macro environment is tight, and gold and bitcoin have shown a safe-haven effect. Jeffrey Ding, chief analyst at HashKey, believes that global central bank policy divergence in 2025 (e.g., tightening in Japan, easing in the US) and fears about the credit of US bonds may exacerbate the transfer of capital from traditional to crypto assets. For example, the recent surge in the New Taiwan Dollar is one of the manifestations of the current environment: that is, many investors in Taiwan, China, originally held a large number of U.S. bond assets and pledged them in circulation, and the continued decline in the price of U.S. bonds led to passive deleveraging, and panic forced their funds to return to Taiwan after selling, so the New Taiwan dollar soared in the short term. Therefore, investors should pay attention to the Fed's monetary policy signals (such as interest rate hikes or QE cadence), U.S. Treasury auction data (such as subscription multiples and penny spreads), and Bitcoin on-chain metrics (such as the number of active addresses and trading volumes) to capture changes in capital flows and market sentiment. Despite its historically high volatility, Bitcoin's safe-haven role in diversified portfolios is becoming increasingly significant, especially as the traditional financial system faces both credit and inflation challenges.

Tariff wars are back in swing, and tariff negotiations between the EU and the US continue to be tense in May 2025. At the beginning of the year, the Trump administration imposed tariffs of 20% to 50% on the European Union, covering steel, aluminum, automobiles and other fields, and the European Union responded by imposing retaliatory tariffs on American goods. On May 23, Trump proposed a direct 50% tariff on EU products from June 1, 2025. As soon as the remarks came out, Bitcoin saw a slight pullback. On May 26, Trump said that the European Union had requested an extension of the window for trade talks and had agreed to extend the deadline until July 9, after which Bitcoin briefly rebounded above $109,000.

2. Key data (as of 12:00 HKT on May 26)

(data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

- Bitcoin: $109677 (+17.41% year-to-date), daily spot trading volume of $46.66 billion

- Ethereum: $2,560 (-23.43% YTD), daily spot trading volume of $14.03 billion

- Greed Fear Index: 73 (Greed)

- Average GAS: BTC: 1 sat/vB ETH: 0.39 Gwei

- Market Share: BTC 63.3%, ETH 9.0%

- Upbit 24-Hour Trading Volume Ranking: XRP, BTC, AERGO, NXPC, WCT

- 24-hour BTC long-short ratio: 0.9782

- Sector change: AI (+3.29%), SocialFi (-0.5%)

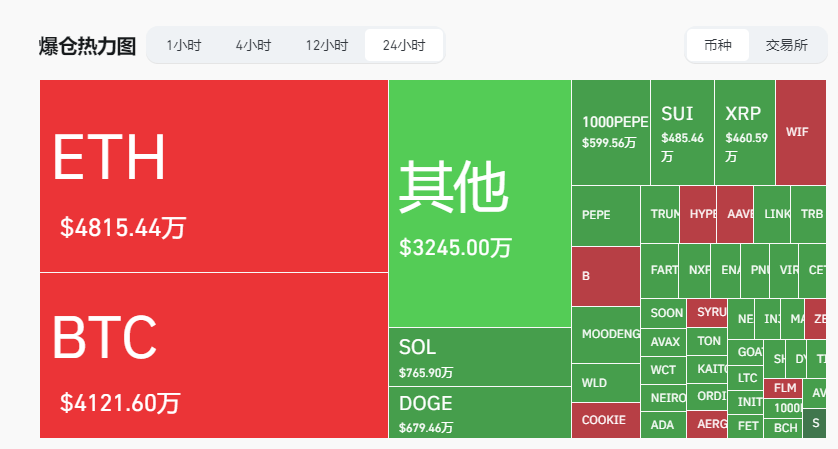

- 24-hour liquidation data: A total of 85,825 people around the world were liquidated, with a total liquidation amount of $202 million, of which BTC liquidated $41 million, ETH liquidated $48 million, and SOL liquidated $7.66 million

- BTC medium- and long-term trend channel: along the upper and lower lines of the channel ($103,016.97), along the lower line ($100,977.03)

- ETH medium- and long-term trend channels: along the upper and lower lines of the channel ($2,342.62)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend, and vice versa, it is a bearish trend. When the price repeatedly passes through the cost range in the range or in the short term, it is a bottoming or topping state.

3.ETF Flows (as of May 23)

- Bitcoin ETF: +$211 million

- Ethereum ETF: +$58 million4

. Today's preview

of the 212th Ethereum ACDC conference: Fusaka Devnet-0 will go live on May 26th

U.S. stocks will be closed for one day on May 26BNB

Chain announced the Maxwell hard fork: BSC block time will be shortened to 0.75 seconds, and the testnet will take the lead in upgrading on May 26Initia

issued an inflation correction and pledge exit subsidy proposal, which intends to significantly reduce the inflation rate to an annualized rate of 1.25%

The largest increase in the top 100 market capitalization today: HYPE rose 11.1%, VIRTUAL up 9.1%, EOS up 7.5%, ZEC up 6.5%

5. Hot

NewsWhale James Wynn once again opened a long position in PEPE with 10x leverage

, and the market value of HYPE surpassed SUI and ranked 13th in the cryptocurrency market capitalization

Inferno Drainer leverages Ethereum's EIP-7702 to carry out a novel attack that has already caused a single $150,000 loss

, and the Coinbase-backed Base network plans a major upgrade to challenge Solana

,Dubai Land Authority, launches real estate tokenization project in partnership with tokenization platform Ctrl Alt

, and the US-EU tariff talks have been extended until July 9

This article is powered by HashKey, Hong Kong's largest licensed virtual asset exchange and Asia's most trusted fiat gateway for crypto assets. It is committed to defining a new benchmark for virtual asset exchanges in terms of compliance, capital security and platform security.