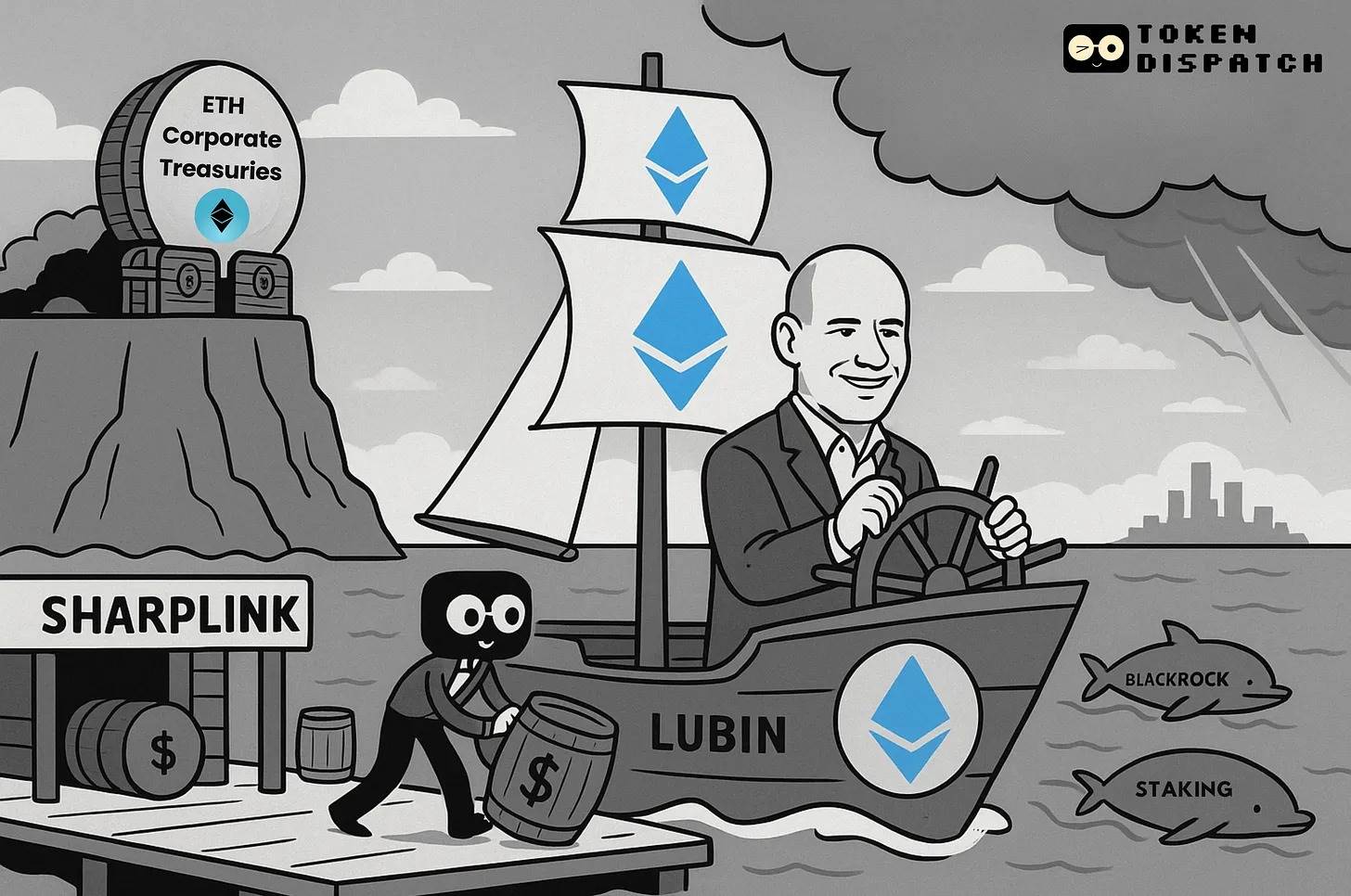

Ethereum's battle for revival: Lubin navigates the 425 million treasury strategy

Words: Prathik Desai

Compilation: Block unicorn

Foreword

Two weeks ago, Joe Lubin, co-founder of Ethereum and founder and CEO of ConsenSys, announced that he would be serving as SharpLink Chairman of Gaming's Board of Directors and led its $425 million Ethereum vault strategy.

The move adds a new chapter to the revival of Ethereum, the world's second-largest cryptocurrency, after more than four months of hovering below $3,000.

The move is in line with the strategy promoted by Michael Saylor, whose Bitcoin-focused financial strategy inspired a large number of publicly traded companies to participate in the construction of Bitcoin vaults.

In this article, we analyse whether this is one of the best opportunities for an Ethereum revival.

Ethereum

Vaults When SharpLink Gaming announced funding to build an Ethereum vault, the market reacted quickly and clearly.

Its stock price skyrocketed by more than 450% in a single day, soaring from $6.63 per share to more than $35. In five trading days, the stock price skyrocketed more than 17 times from $6.63. Even after the pullback, it is still trading at a price more than 3 times higher than it was at the beginning of the rally.