From DeFi to DeETFs: Who is quietly rewriting the underlying logic of DeFi asset allocation?

Introduction: From Geek's Toy to Wall Street's New Favorite, How Did DeFi Do It?

In the past few years, there has been a buzzword in the financial world that has been brought up constantly - DeFi (decentralised finance). A few years ago, when geeks were just starting to build some bizarre financial instruments on Ethereum, no one could have imagined that these "little toys" would finally attract the attention of Wall Street's traditional financial bigwigs.

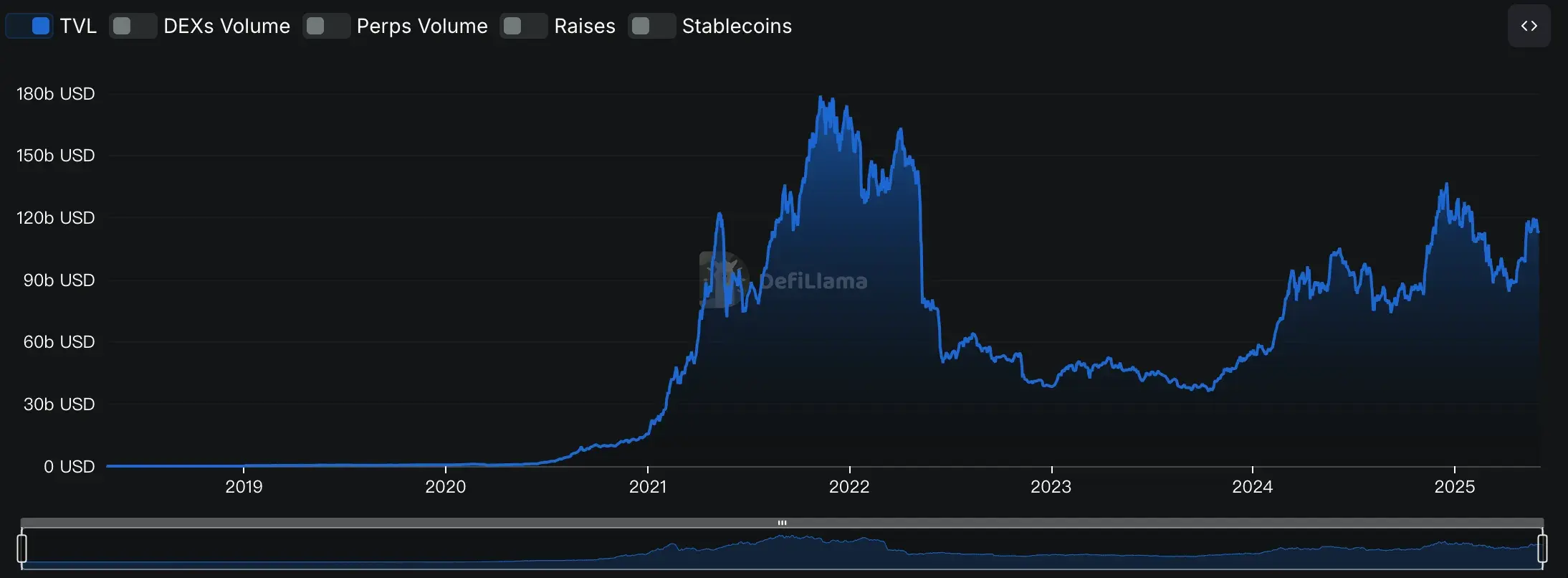

Looking back at 2020-2021, DeFi rose to prominence at a jaw-dropping rate. At that time, the total market value (TVL) soared from more than a billion dollars to a peak of $178 billion. Strange-sounding protocols like Uniswap and Aave have become popular projects in the global crypto world for a while.

However, for most ordinary investors, DeFi has always felt like a labyrinth full of pitfalls. Wallet operation is a headache, and smart contracts are difficult to understand like Martian, not to mention the need to be careful to prevent assets from being hacked every day. The data shows that even though DeFi is so popular, less than 5% of investment institutions in the traditional financial market actually enter the market. On the one hand, investors are eager to take the plunge; On the other hand, they are hesitant to act because of various thresholds.

But the sense of smell of capital is always the keenest. Since 2021, a new tool has emerged that specifically addresses the question of "how to easily invest in DeFi", and that is the Decentralized ETF (DeETF). It integrates the concept of ETF products in traditional finance and the transparency of blockchain, which not only retains the convenience and standardisation of traditional funds, but also takes into account the high growth space of DeFi assets.

It can be understood that DeETFs are like a bridge, connecting the "hard-to-enter" new world of DeFi on one end and investors who are familiar with traditional financial products on the other. Traditional institutions can continue to invest with their familiar financial accounts, while blockchain enthusiasts can easily combine their investment strategies as if they were playing a game.

So, how exactly did DeETFs emerge as DeFi grew? How has it evolved, and how has it become a new force in the field of on-chain asset management step by step? Next, we will talk about the story behind the birth of DeFi and the story behind this new financial species.

Part 1: From DeFi to DeETFs: The History of the Rise of On-Chain ETFs

(1) Early Exploration (2017-2019): The Initial Attempts and the Foreshadowing

If DeFi is a financial revolution, then it must have started without Ethereum. Between 2017 and 2018, several early projects on Ethereum, such as MakerDAO and Compound, showed the world for the first time the possibilities of decentralised finance. Although the scale of the ecosystem was still very limited at that time, new financial games such as lending and stablecoins have already set off a small wave in the geek circle.

Inlate 2018 and early 2019, Uniswap was launched, offering an unprecedented "Automated Market Maker (AMM)" model, which made "trading" much easier without having to be tormented by complex order books. From 2017 to 2018, MakerDAO and Compound demonstrated the possibilities of decentralised lending and stablecoins. Subsequently, Uniswap's Automated Market Maker (AMM) model, launched in late 2018 and early 2019, greatly simplified on-chain trading. By the end of 2019, DeFi's TVL was approaching $600 million.

At the same time, the focus on traditional finance has also quietly begun. Some keen financial institutions have quietly deployed blockchain technology, but at this time, they are still plagued by complex technical problems and cannot really participate in it. Although no one explicitly proposed the concept of "DeETF" at the time, the need for a much-needed bridge between traditional funds and DeFi is already beginning to emerge at this stage.

(2) Market Explosion and Concept Formation (2020-2021) :D eETF On the eve of the debut of eETFsIn

2020, a sudden epidemic changed the direction of the global economy and prompted a large amount of capital to flow into the cryptocurrency market. DeFi exploded during this period, and TVL soared at an astonishing rate, from $1 billion to $178 billion a year later.

The influx of investors has been so frenzy that the Ethereum network has become so clogged that there has even been an extreme situation where transaction fees exceed $100 at one time. A series of dazzling new models such as liquidity mining and yield farming have made the market hot quickly, but at the same time, they have also exposed a huge threshold for user participation. Many ordinary users sighed: "Playing DeFi is really much more difficult than trading stocks!" "

It was at this time that some traditional financial companies began to keenly seize the opportunity. DeFi Technologies Inc. (ticker symbol: DEFTF), a publicly traded Canadian company, is a prime example. The company, which originally had nothing to do with crypto, made a decisive transformation in 2020 and began to launch financial products that track major DeFi protocols (such as Uniswap and Aave), allowing users to participate in the DeFi world as easily as buying and selling stocks on traditional exchanges. The emergence of this kind of product is also a sign of the official germination of the concept of "DeETF".

At the same time, the decentralised track is also quietly moving. Projects like DeETF.org have begun to experiment with decentralised management of ETF portfolios directly with smart contracts, but this period of experimentation is still in its infancy.

(3) Market reshuffle and model maturity (2022-2023) :D formalisation of eETFs

, and the popularity of DeFi did not last long. At the beginning of 2022, Terra collapsed, FTX went bankrupt, and this series of black swan events almost destroyed investor confidence. The DeFi market, TVL, fell straight from $178 billion to $40 billion.

But crises often come with opportunities. The sharp market turmoil has made people realise that the DeFi space urgently needs safer and more transparent investment vehicles, which has instead driven the development and maturity of DeETFs. During this period, "DeETF" was no longer just a concept, but gradually developed into two clear models:

-

Traditional financial channels have been further strengthened: Institutions such as DeFi Technologies have taken advantage of the trend to expand their product lines and launch more and more robust ETPs (exchange-traded products), and list on traditional exchanges, such as Canada's Toronto Stock Exchange. This model greatly lowers the threshold for retail investors to participate, and is also favoured by traditional institutions.

The -

rise of the decentralised model on the chain: At the same time, on-chain platforms such as DeETF.org and Sosovalue were also officially launched, realising asset management and portfolio transactions directly through smart contracts. These platforms do not require centralised custody, and users can create, trade, and adjust portfolios themselves. In particular, it attracts crypto-native users and investors who are looking for absolute transparency.