✅ 2nd source of liquidity activated.

$140K btc incoming.

5 sources of liquidity I’m monitoring since QE is out for now. Powell made it loud and clear.

→ End of QT

The end of QT is enough to send everything flying. Q2.

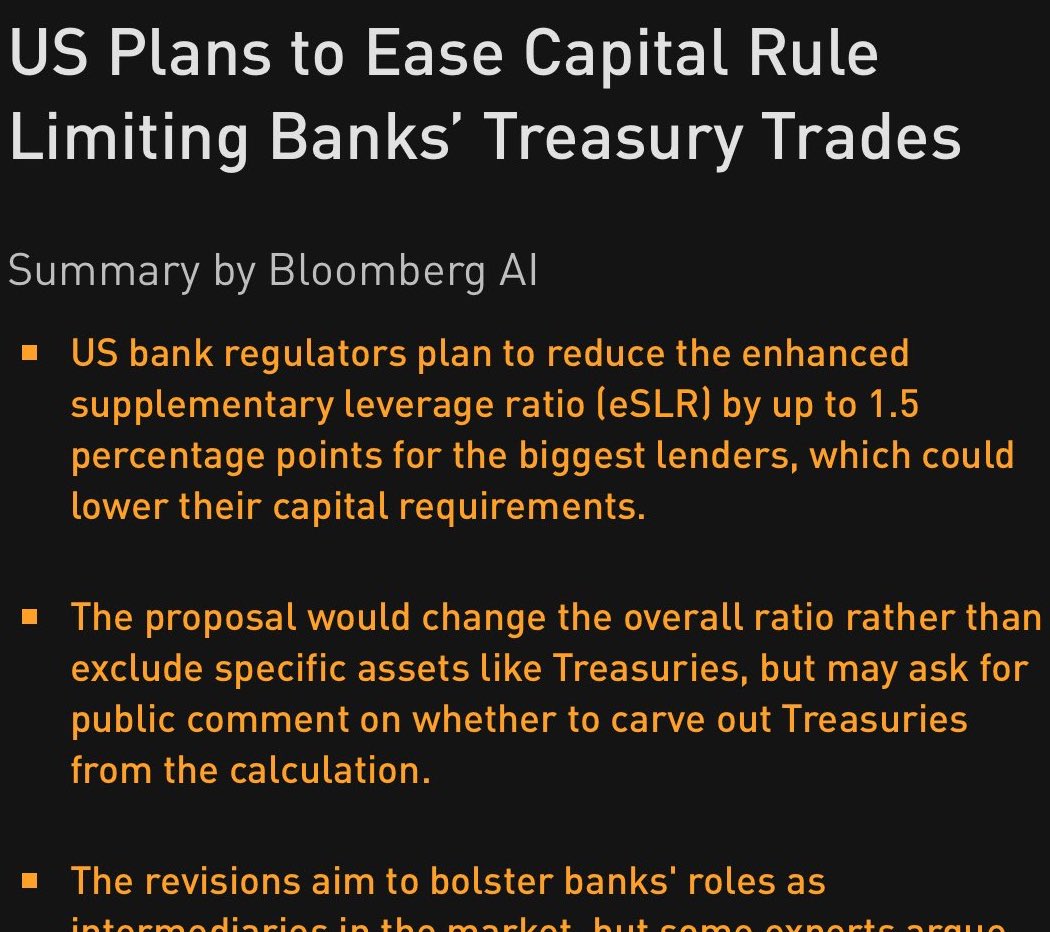

→ Permanent SLR exemption

Easing regulatory requirement for banks to maintain a certain level of capital against their assets.

There’s been discussing this exemption, indicating possible policy changes in 2025

Good reference:

→ Discount window

Fed to ask the banks to use the discount window on a running basis. DW is a central bank lending facility meant to help commercial banks manage short-term liquidity needs. Asking them will be a long term liquidity positive as it’s a legislative change.

→ TGA draw down

It’s everywhere on X. Everyone talking about it.

Good post from Thomas

→ Widening swap spread

By adjusting bank capital costs, private sector liquidity will increase.

Good reference:

No matter how tight the situation, there will always be a way to kick the can down the road. Remain bullish.

741

72.96K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.