Why @babylonlabs_io will actually work.

While everyone's debating whether Bitcoin needs DeFi, Babylon is quietly solving the real problems that killed previous BTCFi attempts.

Here's what makes it different & why it matters🧵

1/ The trust problem is actually solved. Previous BTCFi required trusting like…

- Centralized custodians (WBTC)

- Smart contract bridges

- Multisig operators

@babylonlabs_io changes this. Your Bitcoin never leaves the Bitcoin network. No wrapping, no bridges, no custody risk.

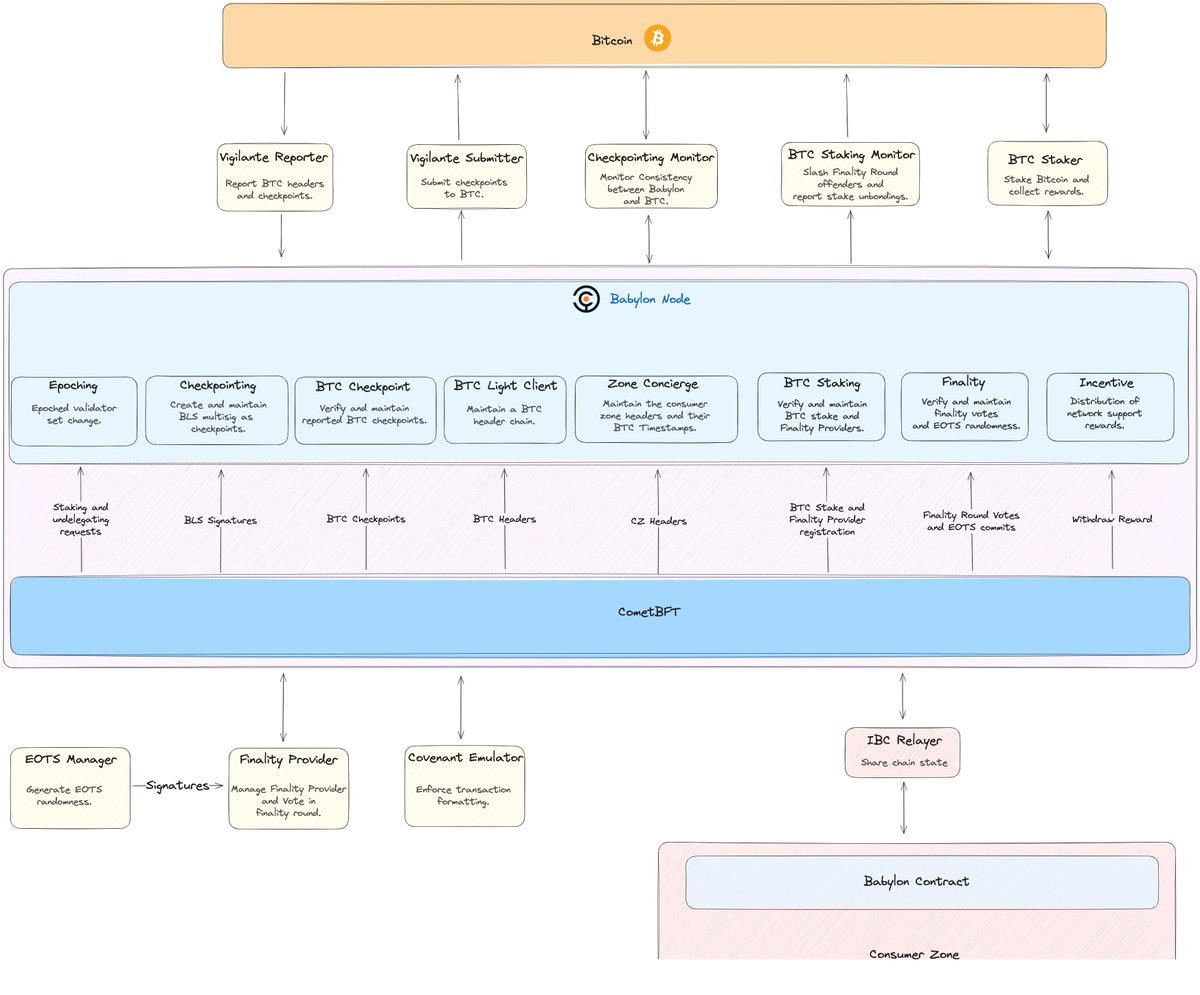

2/ How it actually works👇

Babylon uses something called EOTS (Extractable One Time Signatures)

Meaning if you try to cheat (double sign), your private key automatically gets exposed & your Bitcoin gets slashed.

It's like having a self enforcing contract written in Bitcoin's own language.

3/ Most Bitcoin L2s are just Ethereum rollups w Bitcoin branding. Babylon is different.

- Uses actual Bitcoin script functionality

- No token wrapping required

- Inherits Bitcoin's security model

- Works with existing Bitcoin infra

🚨 Fresh off the Bitcoin Conference… $BTC has held above $100K for 30+ days. a first in history.

But are you staking your $BTC?

It's now possible with @babylonlabs_io's native Bitcoin staking. We spoke with @menzel_clayton on how it works non-custodially and why it matters.

🎥 Watch and learn:

Timestamps:

1:05 - What is Babylon? Staking, security, and liquidity

2:41 - How Babylon enables native BTC staking

4:19 - The non-custodial nature of Babylon

7:01 - Institutional appetite for Bitcoin staking?

9:57 - How staking works with Babylon Genesis

11:19 - Babylon Genesis chain and BSNs

13:01 -Compares to EigenLayer and restaking

15:51 - Bitcoin staking UI/UX

17:47 - Wallet, exchange integrations and more

4/ Babylon's vision is simple let ANY chain borrow Bitcoin's security.

Imagine Polygon or Avalanche secured by Bitcoin hashpower.

That's the Bitcoin Supercharged Networks concept.

5/ Yes, Babylon's TVL is only $5B, but…

- Launched recently vs WBTC's multiyear head start

- Growing without venture capital hype cycles

- Built for institutions that move slowly but with size

Now that Babylon Genesis V2 is live, it’s time for the next phase of BTCFi.

6/ Previous BTCFi failed because of…

❌ Custody risks

❌ Complex user experience

❌ Regulatory uncertainty

Babylon addresses👇

✅ Non custodial design

✅ Native Bitcoin operations

✅ Cleaner regulatory profile

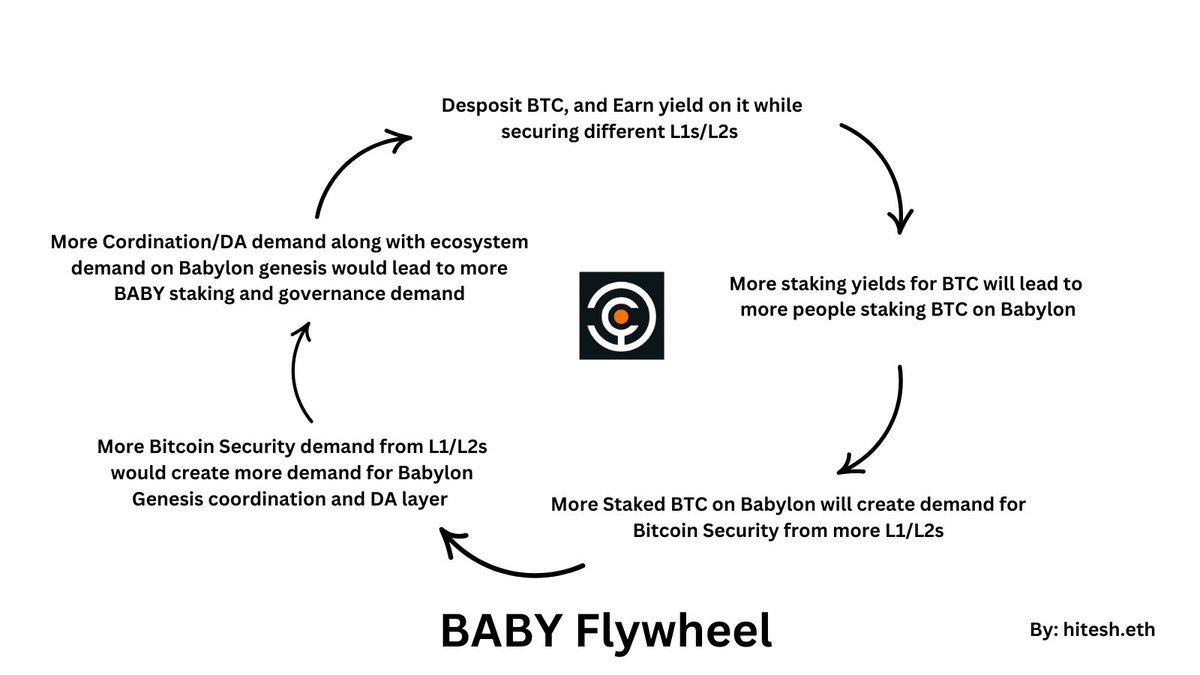

Thoughts on $BABY Flywheel

(The Clear Case of Potential Speculative Demand)

$BABY is one of the most important token launches of recent times, which most of you have faded, I'm pretty sure.

Babylon, the project behind $BABY, managed to get over $4.6B worth of BTC staked through its staking layer, including Bitcoin LST @Lombard_Finance.

They are building a supply side of staked BTC, which is going to be used to secure L1/L2 networks.

Bitcoin-secured chains would be called BSNs.

The first BSN is being launched and it’s called Babylon Genesis, which would also work as a coordination and DA layer for other BSNs.

Around $73M worth of BTC has been staked to Babylon Genesis so far—it's the first L1 secured by Bitcoin.

People who staked BTC to Babylon Genesis will get rewards in $BABY — the yield you get on BTC would eventually come from BSNs.

BSNs would provide protocol rewards to BTC stakers. $BABY demand would come from more onchain activities on Babylon Genesis, as it’s a gas token used by other BSNs through integration with Babylon Genesis, apart from its own ecosystem-side activities.

Babylon will charge some fees to BSNs to use coordination services like timestamping and bridging. That part of revenue would be distributed to $BABY stakers.

The core demand for $BABY is coming from the protocol yield it could potentially generate from the activities on Babylon Genesis — Babylon Genesis has 3 demand stages: coordination plane for BSNs, integration with BSNs, and its own DeFi ecosystem.

The $BABY flywheel will become fluid when the demand for Bitcoin staking keeps rising. That would happen when staking yield keeps flowing, which would happen when more BSNs join the network. And if more BSNs join the network, it would create staking demand for $BABY, as $BABY stakers could earn protocol rewards from both Babylon Genesis and other BSNs too.

7/ Bitcoin holders aren't against earning yield. They're against unnecessary risks for mediocre returns.

Babylon offers Bitcoin native yield without compromising the core value proposition I.e trustless, censorship resistant money.

8/ The real test isn't TVL growth (though that matters).

It's whether major Bitcoin holders, the ones with conviction, not just speculation.

Start participating.

9/ BTCFi isn't about making Bitcoin more productive.

It's about letting Bitcoin's security secure more of the financial system.

@babylonlabs_io gets this & that's why it might actually work.

Thanks for reading. If this thread was helpful👇

1️⃣ Share to help others learn

2️⃣ Bookmark for reference

3️⃣ Follow @YashasEdu for more such educative

19

6.67K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.