🚀 Block Scholes x D2X: How do stablecoin denominated options affect options pricing

💵 USD-denominated options that pay interest on collateral are more capital-efficient for short positions. In contrast, stablecoin-margined contracts (common on centralized exchanges) offer no yield, leading to higher premium demands.

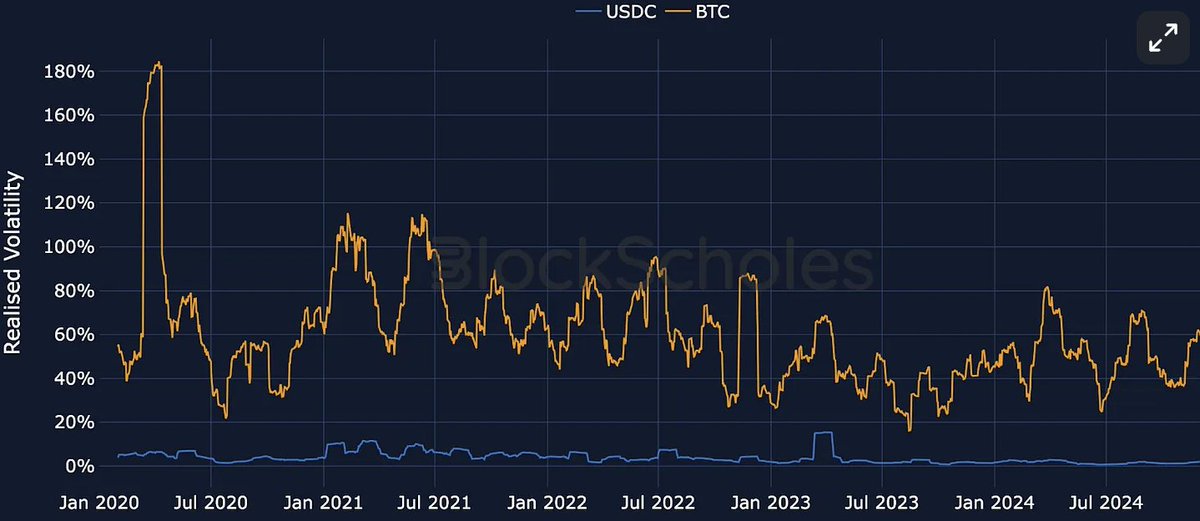

⚠️ Stablecoin settlement introduces FX risk. USDC/USD volatility (est. 4.71%) and BTC–USDC correlation (~8.7%) impact pricing - particularly during market stress.

🧮 Accurate pricing requires a quanto-adjusted model. A 1Y BTC call at $110K shows a 0.43% mispricing vs naive Black-Scholes. Correlation risk increases cost linearly.

🔗 Access the full article via the link:

0

4.69K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.