🐓Tokens Benefiting from ETH Price Increase🐓

When ETH price rises -> Layer 2 -> DeFi -> liquid staking tokens and other tokens dependent on Ethereum infrastructure—often benefit from increased network activity.

1. Layer 2 (L2) Tokens

The Pectra upgrade improves Layer 2 scalability, particularly through EIP-7691, doubling the number of data blobs per block from 3 to 6, reducing transaction costs for rollups. This makes Layer 2 solutions more efficient, potentially driving adoption and the value of native tokens.

🐦Arbitrum (ARB): Highly correlated with ETH (0.94), it is one of the Layer 2 tokens likely to move in sync with ETH price.

🐦Polygon (POL): Strongly correlated with Arbitrum (0.97) and Optimism (0.93), indicating it moves closely with other L2 tokens and ETH.

🐦Optimism (OP): Another major Layer 2 solution for Ethereum, likely to see increased usage due to lower costs and improved scalability after Pectra, potentially boosting demand for OP.

2. Liquid Staking Tokens

The Pectra upgrade includes EIP-7251, increasing the maximum validator balance from 32 ETH to 2,048 ETH, simplifying staking for large investors and improving staking efficiency. This makes staking on Ethereum more attractive, especially for institutional investors, potentially driving demand for liquid staking protocols.

🦆Lido DAO (LDO): Highly correlated with ETH (≥ 0.81) and the leading liquid staking protocol. As staking becomes more efficient, demand for LDO may rise due to increased ETH staking activity.

🦆Rocket Pool (RPL): Also strongly correlated with ETH (≥ 0.81) and benefits from increased staking participation.

🦆ETHFI: A newer liquid staking token, highly correlated with ETH. It is a strong candidate to benefit from ETH price increases.

🦆Pendle (PENDLE): Focused on yield tokenization.

3. DeFi Tokens

Ethereum dominates the DeFi sector with over 52% of the industry's total value locked (TVL).

🐥Uniswap

🐥Ethena (ENA)

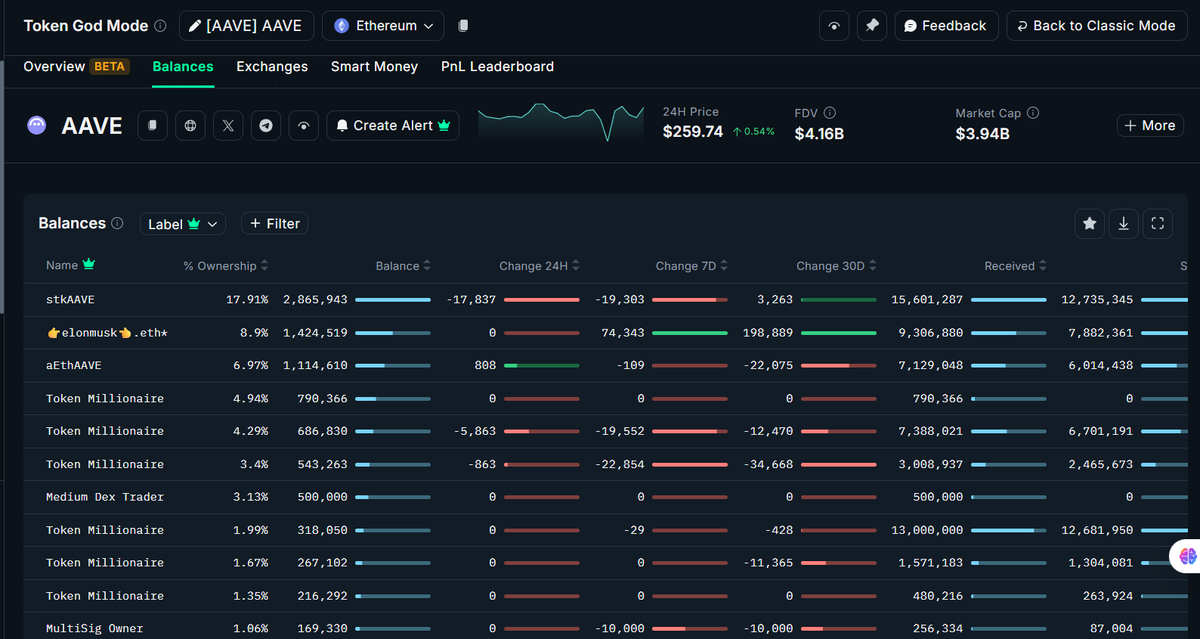

🐥Aave (AAVE): A leading DeFi lending protocol.

🐥Maker (MKR): MakerDAO, supporting the DAI stablecoin, may see increased demand as the Ethereum ecosystem grows, especially with institutional adoption.

Personal

From an investment perspective, Alan is interested in AAVE and ETHFI at this stage. They have good price models and are strong players in two benefiting sectors.

Based on observations from Nansen, there are signs of accumulation over the past two weeks. Worth paying attention to, especially if it holds at this price range along with BTC dominance trending downward.

#onchain #degen

Show original

4

23.8K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.