While others focus on transaction fees, he's building a bridge of trust: Is Justin Sun leading the way again?

Initially, people thought this was just an ordinary collaboration... Not long ago, TRON officially announced that it would integrate Chainlink's decentralized oracle as a standard data source. This isn't the first time TRON has mentioned oracles, nor is it the first time they've worked on a price feed system. But this time is different—it brings a true upgrade in trust!

Why Chainlink?

Anyone familiar with TRON knows that the team previously promoted their own WINkLink as a data source. However, given today's ecosystem scale—USDD, JustLend, SunSwap, RWA, and the upcoming USD1—the more assets on-chain and the more complex the use cases, the higher the requirements for the price feed system.

Chainlink is currently the most mature decentralized oracle system in the industry. Its data isn't reliant on single points or custodians, making it resistant to manipulation and downtime. More importantly, it has become the industry standard adopted by most mainstream DeFi platforms. TRON's move aligns with mainstream practices and the core trust logic of DeFi.

In other words, from now on, TRON's lending, stablecoins, and LP market-making systems will have a robust data assurance system validated by the market.

130 billion TRX absorbed in six days—funds are voting

The first wave of feedback from this technical upgrade is the reaction of funds.

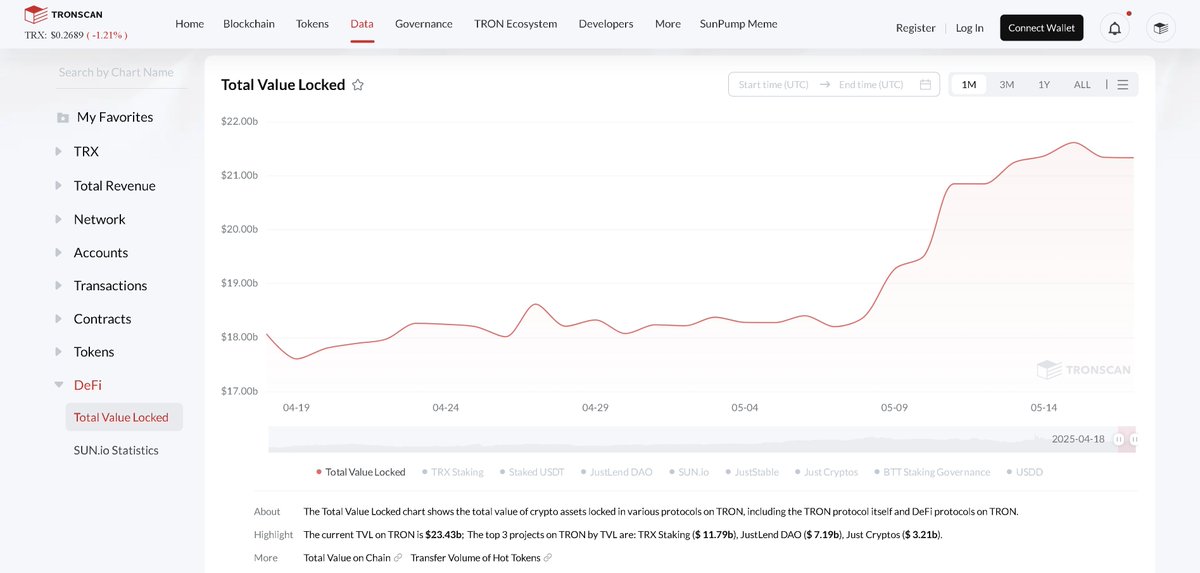

According to Tronscan data, TRON's TVL surged from approximately $18 billion to $21.6 billion between May 8 and May 15, a seven-day increase of $3.6 billion. Based on TRX's price at the time, this equates to a net inflow of over 130 billion TRX.

This isn't speculation; it's a long-term lock-in of real capital. Users are willing to lock their funds in JustLend and Sun.io because they trust that the system won't suddenly collapse due to data errors or price feed issues. Chainlink addresses this fundamental trust problem.

This wave of capital inflow isn't just liquidity; it's a vote of confidence.

From stablecoins to RWA, TRON is refining the bridge between on-chain and real-world assets

This integration also has a hidden effect: it opens the door for TRON to enter the RWA (Real World Assets) market.

The biggest hurdle for RWA isn't issuing tokens or launching chains; it's how to reliably map real-world prices, states, and security onto the blockchain.

Chainlink is currently the world's leading infrastructure for RWA data transmission. Tokenized U.S. Treasury bonds, tokenized real estate, and tokenized gold mostly rely on Chainlink for price and state updates.

So, TRON's adoption of Chainlink means that running tokenized U.S. Treasury bonds or tokenized real estate in the future is no longer just theoretical—it’s technically ready to go.

A low-key but critical infrastructure upgrade

In this era where DeFi is increasingly converging with the real world, TRON's move may have a more profound impact than issuing more USDT or conducting a marketing airdrop. For TRON to become the main hub for real-world assets on-chain, user volume and high-frequency trading alone aren't enough. Integrating Chainlink is a key step in completing the trust puzzle.

It must be said that Justin Sun's vision remains ahead of most. While others are still competing over transaction fees and TVL, he's already laying the foundation for the next generation of trust in on-chain finance.

You might not watch TRX's candlestick charts,

but the direction he's betting on

is definitely worth everyone's attention!

@justinsuntron @trondaoCN #TRONEcoStar

Show original

31.52K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.