TRON Open Real Estate Tokenization Prototype Tutorial: The First Step in RWA Implementation Has Begun

Two days ago, I wrote a tweet proposing a judgment: although TRON is not the main narrative network for RWA currently, it has natural advantages in stablecoin circulation and transaction frequency.

Unexpectedly, yesterday, the official TRON DAO released a prototype system for real estate tokenization, fully demonstrating how to achieve asset splitting, trading, dividends, and circulation on TRON using Mock-USDT. This is no longer just a concept but a deployable, reproducible development tutorial.

This means:

TRON has officially pushed RWA from trend judgment to tool-based implementation.

☀️ What is Mock-USDT?

This is a TRC20 token used for development testing, simulating the behavior of USDT, and supporting transactions, purchases, and dividend processes in the tutorial. However, the real key is not the token itself but its service scenario: the tokenization of real estate assets. The entire tutorial fully restores the possible structure of an RWA project.

• Purchase property shares with USDT (divisible)

• Receive tokens representing ownership

• Rental income or dividends flow back proportionally

• Freely buy, sell, or exit

☀️ Why is this tutorial important?

1/ It's not a concept; it's a runnable prototype

With code, scenarios, and toolchain (TronBox + Nile testnet)

2/ Lowers the threshold for RWA entrepreneurship

This tutorial is almost a tokenization example from 0 to 1, suitable for developers who want to work on on-chain real estate, artwork, or installment assets. Compared to many chains still in the financing and narrative stage, TRON provides a template that can be directly implemented.

3/ Mature tools, solid foundation

TRON's development tools are complete, coupled with stablecoin liquidity and high-frequency trading foundation, making it one of the few chains capable of actually carrying RWA.

This tutorial also confirms my previous judgment: if Ethereum represents institutional narratives, then TRON is closer to real circulation scenarios. For RWA to land, the competition is whether the assets can truly be transferred.

This tutorial is just a prototype, but it means that the possibility of RWA on TRON is no longer theoretical speculation but a practical path that can be constructed, tested, and expanded. Will there be a truly implemented project taking the first step from this framework in the future?

Europe and the United States are both very friendly to Crypto, and TRON has a large user base in Asia, making all three great landing points. Can Brother Sun take it down! 🤔

@justinsuntron @sunyuchentron

@trondaoCN #TRONEcoStar

TRON: The Low-Key Runway for RWA Implementation

Real World Assets (RWA) have been a hot topic this year. From bonds and credit certificates to gold and real estate, everyone is discussing mapping real-world assets onto the blockchain, making crypto more than just speculation and enabling it to truly connect with traditional finance. However, most projects are still in the pilot stage. Implementation remains a big question mark.

1/ ETH has many projects, but as user numbers grow, Gas fees become excessively high.

2/ Solana, Polygon, and L2 each have their solutions, but users hardly notice the difference.

In summary: Projects can launch, but they’re not practical for everyday use.

In contrast, TRON has quietly been running real-world payment scenarios on-chain.

TRON may lack the endorsement of traditional financial institutions and doesn’t rely on regulatory support to build trust, but its resource mobilization capabilities, financial strength, and industry ecosystem form a complete financial system in themselves.

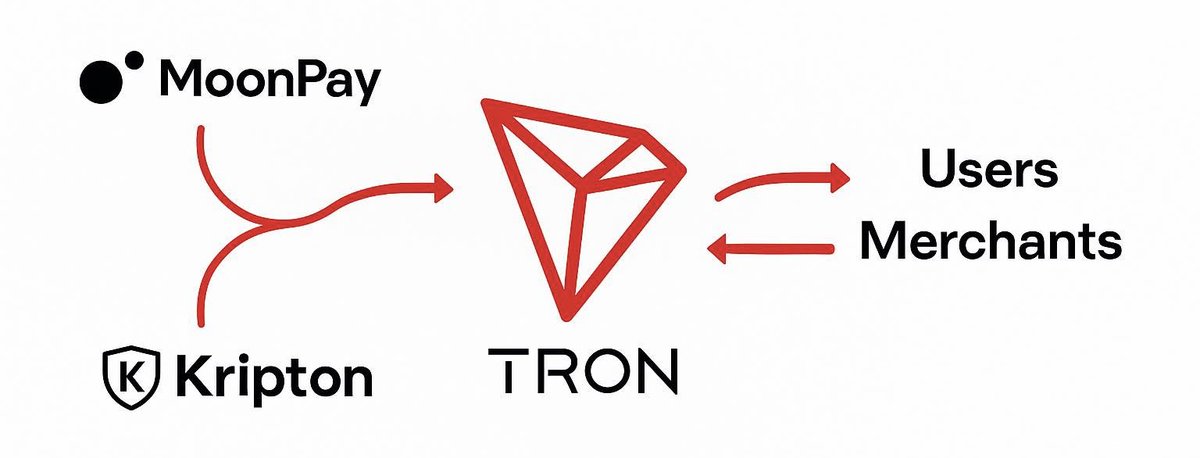

1/ Kripton + USDT have enabled daily consumption using on-chain stablecoins in high-inflation regions like Argentina.

2/ MoonPay + TRX provide fiat on-ramp services for U.S. users.

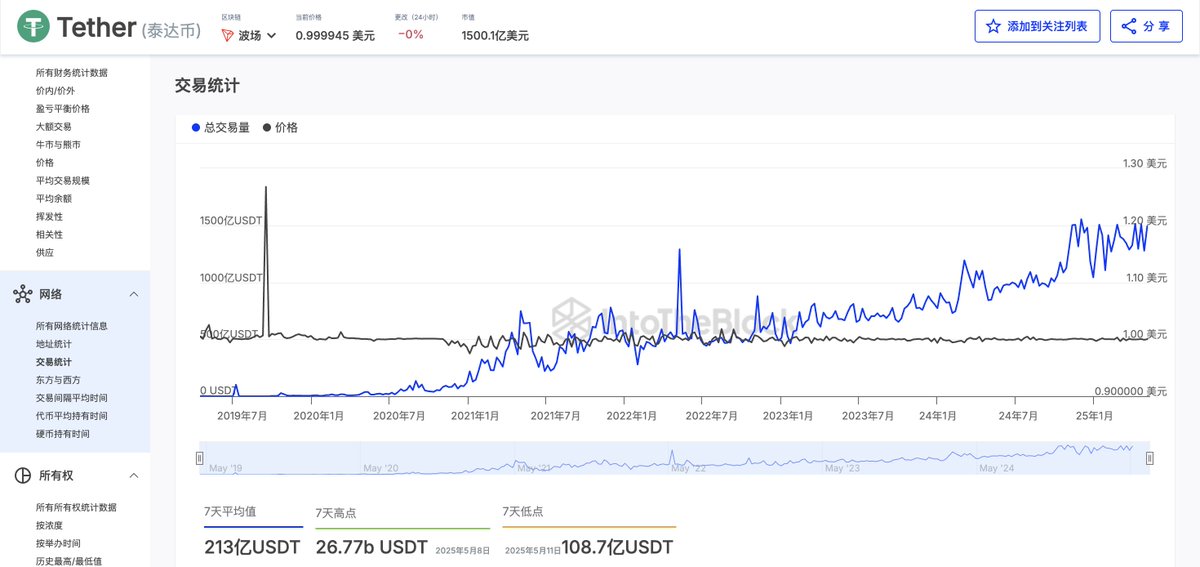

3/ TRC20-USDT processes over 2 million transactions daily, with an average transaction volume of $20 billion.

If RWA is truly going to be implemented, could TRON be the overlooked runway?

Imagine a future where RWA is no longer just a bill system designed for institutions but truly moves to the user side, such as:

1/ Tokenized bonds + USDT for automatic redemption

2/ Stable assets pegged to gold for hedging against exchange rate fluctuations

3/ Lightweight assets like leasing, installment payments, and cross-border settlements directly on-chain

The most suitable blockchain for these scenarios wouldn’t be the slow mainstream chains. Instead, it would be a chain like TRON, which already has payment infrastructure and widespread stablecoin coverage. It might not issue bonds or represent regulatory credit, but it’s currently the most suitable place for RWA implementation.

Will TRON join the RWA race?

TRON isn’t on the list of popular chains for RWA, but it has already captured the global flow of stablecoins. Who will be the next platform capable of running cash flow and implementing real-world assets? It’s hard to say.

It all depends on whether @justinsuntron has the intention to develop in this direction 🤔

@trondaoCN #TRONEcoStar

27.87K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.