Why I am optimistic about on-chain institutionalization as the next Alpha, starting with the upgrade of @LorenzoProtocol $BANK 🧐🧐

TL;DR

1) Why on-chain institutionalization?

Trading and returns are the two core demands of blockchain. Capital seeks the path of least resistance to expand globally, which aligns perfectly with the characteristics of blockchain.

2) Why Lorenzo?

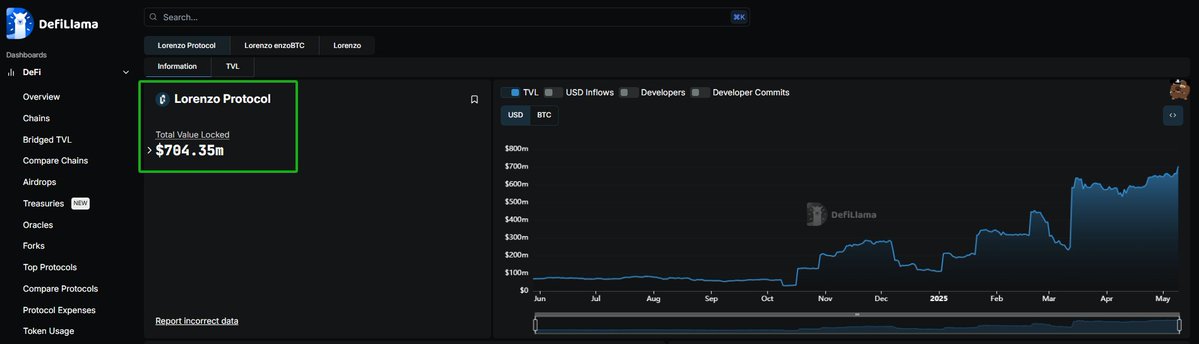

Accumulated $642 million TVL is an objective fact; the financial abstraction layer connects the strategy end and the capital end. Additionally, modularity allows other protocols to serve as distribution channels for Lorenzo's strategies.

3) How to reconstruct valuation logic?

veToken model, income buyback. Becoming an institutional-grade on-chain asset management infrastructure will allow Lorenzo to have more protocol income, and even fundamentals, which can better feed back into $BANK itself.

————————————————————————————————

Here is the main text:

The core argument is actually not complicated. Capital naturally seeks opportunities for disorderly expansion (i.e., does not want to be restricted by geography, regulation, etc.), which fits very well with the permissionless, decentralized nature of blockchain.

Capital flow will choose the path of least resistance. On-chain is this way.

The development of blockchain is accompanied by the continuous falsification of concepts, always answering one question, "What can blockchain do, and what can't it do?" Currently, trading and returns are the two main scenarios.

On-chain institutionalization refers to providing native trading or return services with decentralized, permissionless characteristics on-chain for institutional clients (including investment institutions, funds, project parties, and other B-end users).

In the past, services for institutions in the blockchain industry were mainly conducted in a centralized Web2 manner, such as custody, wallet multi-signature, structured derivatives, etc.

But now, it is clearly felt that with the emergence of modularity and re-staking, the security of new L1 and L2 can be built on Bitcoin and Ethereum.

Moreover, the scale of crypto asset funds, hedging methods, and trading depth are continuously improving, and the acceptance of crypto assets by traditional companies and sovereign funds is increasing.

The way institutions participate on-chain has expanded from old DeFi yields like @aave @Uniswap @CurveFinance to $BTC $ETH Resting re-staking (such as @eigenlayer), and then to new RWA chains. Institutional participation funds on-chain are continuously overflowing from the Ethereum mainnet.

————————————————————————————————

What is Lorenzo, and what has Lorenzo upgraded?

Lorenzo has upgraded from a BTC staking protocol to an institutional-grade on-chain asset management infrastructure, providing native real return strategies for institutions, asset ends, and ordinary users.

This not only means a change in narrative but also a change in fundamentals and valuation logic.

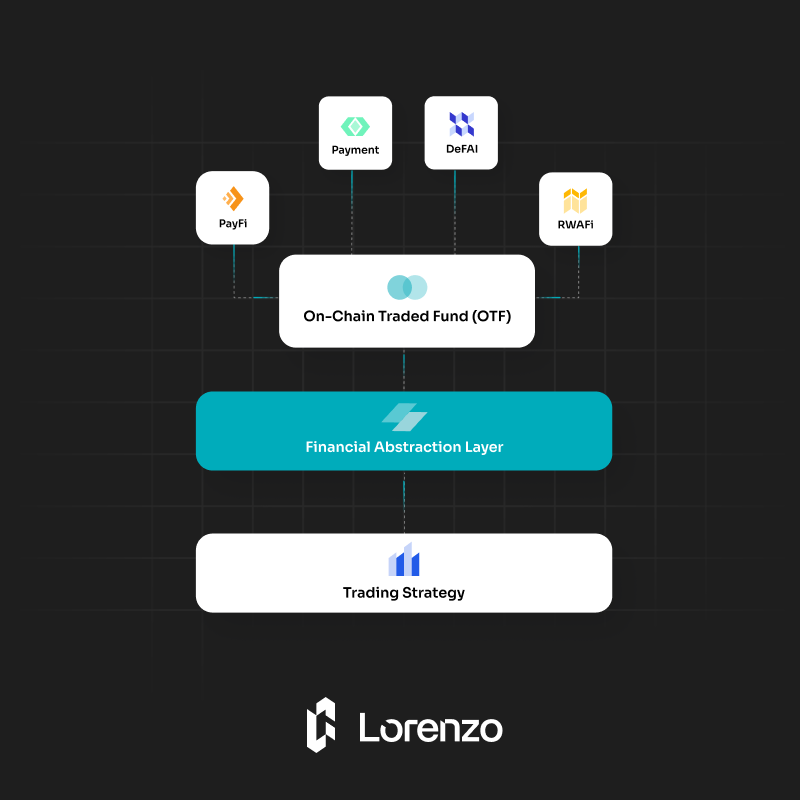

Lorenzo has built a universal financial abstraction layer, providing composable, verifiable modular return modules for institutions, PayFi, RWA, DeFAI, and other projects.

Simply put, as shown in the figure below, Lorenzo has built an intermediate layer connecting the three parties of return strategies, asset ends, and users.

1⃣ Return strategy providers encapsulate return strategies (such as fixed income, principal protection, and dynamic leverage) into Token tokens. When users purchase, they mint the corresponding Token, equivalent to purchasing the return strategy.

Their return strategies can be based on real assets, such as RWA assets, quantitative funds, or CeFi strategies, such as exchange arbitrage, quantification, etc.

Originally, only professional institutions had trading strategies, but now Lorenzo can provide these strategies on-chain and achieve on-chain fundraising—off-chain execution—on-chain settlement. Lorenzo calls this an on-chain trading fund (OTF).

In short, return strategy providers provide return strategies based on Lorenzo and tokenize the strategies.

2⃣ Asset ends and users are the buyers of strategies, depositing assets to obtain strategy returns. Where do buyers come from?

Wallets, U card issuers, PayFi project parties, DeFi pools, CEX pools, etc., have funds accumulated, seeking safe and stable returns.

Due to the tokenization of strategy returns, in addition to making it easy for users to operate and directly choose products based on returns, strategies can also be encapsulated and provided to other protocols, such as RWA protocol Plume, etc.

Summarizing again with the diagram,

Return strategy providers provide strategies to Lorenzo's financial abstraction layer.

Strategies are tokenized into OTF (On-Chain Traded Fund), with different strategies corresponding to different Tokens.

Institutions, PayFi, RWA, DeFAI, and other projects can use their own pools to purchase strategy tokens or act as distributors to provide these strategy tokens to their users.

————————————————————————————————

The question is, why do institutions want to put money in Lorenzo?

1⃣ First, Lorenzo currently has $704 million TVL. This is an established objective fact.

2⃣ Secondly, Lorenzo's return scenarios are native, introducing CeFi or DeFi return strategies into Lorenzo on-chain, meaning these strategies cannot be participated in elsewhere, or there is a certain threshold to participate in these strategies.

Users entrust assets, co-managed by Lorenzo and PayFi, RWAFi partners, mapped to exchanges.

Professional return strategies, combined with on-chain interest-bearing services, provide returns for users. In terms of security, Lorenzo provides risk control and compensation mechanisms.

3⃣ Third, Lorenzo's strategy return tokenization means strategies have scalability and can be deployed as Tokens on other chains.

For example,

1) A professional team as a strategy provider provides strategies to Lorenzo on-chain, then tokenizes the strategies and provides them to the RWA chain @plumenetwork.

Users can purchase the token on the Plume chain, equivalent to holding the return strategy.

2) Another example, assuming the option platform @DeribitOfficial's Green Leaf Loan or Silver Fern USDT volatility strategy as a strategy provider.

Institutions can purchase in a decentralized manner on Lorenzo chain, mapping funds to centralized trading platform strategies. Equivalent to enjoying professional institutional strategy returns from centralized exchanges on-chain.

————————————————————————————————

Team, financing situation, and token model

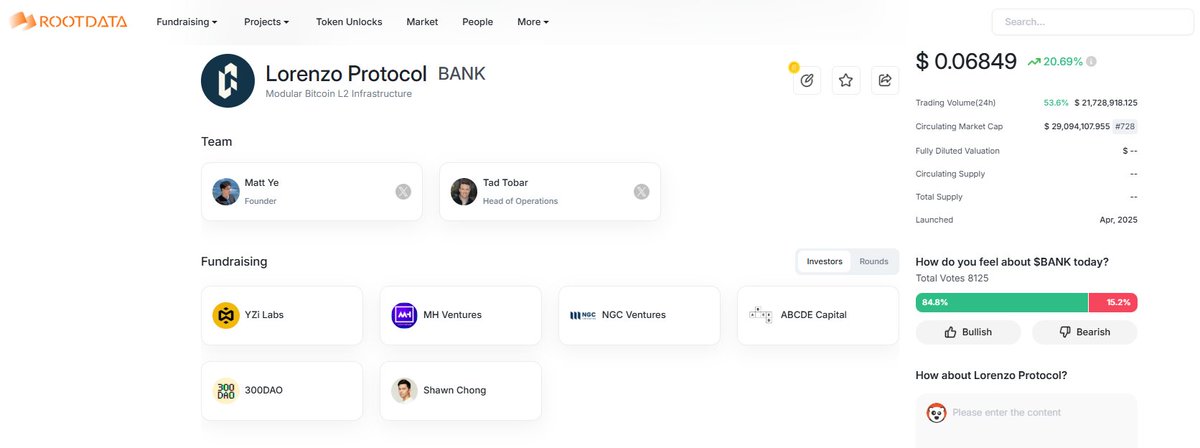

Lorenzo's investors include @yzilabs (Binance Labs) @animocabrands @GumiCryptos @PortalVentures, etc. Founder @MattYe_MEP, COO @TadTobar.

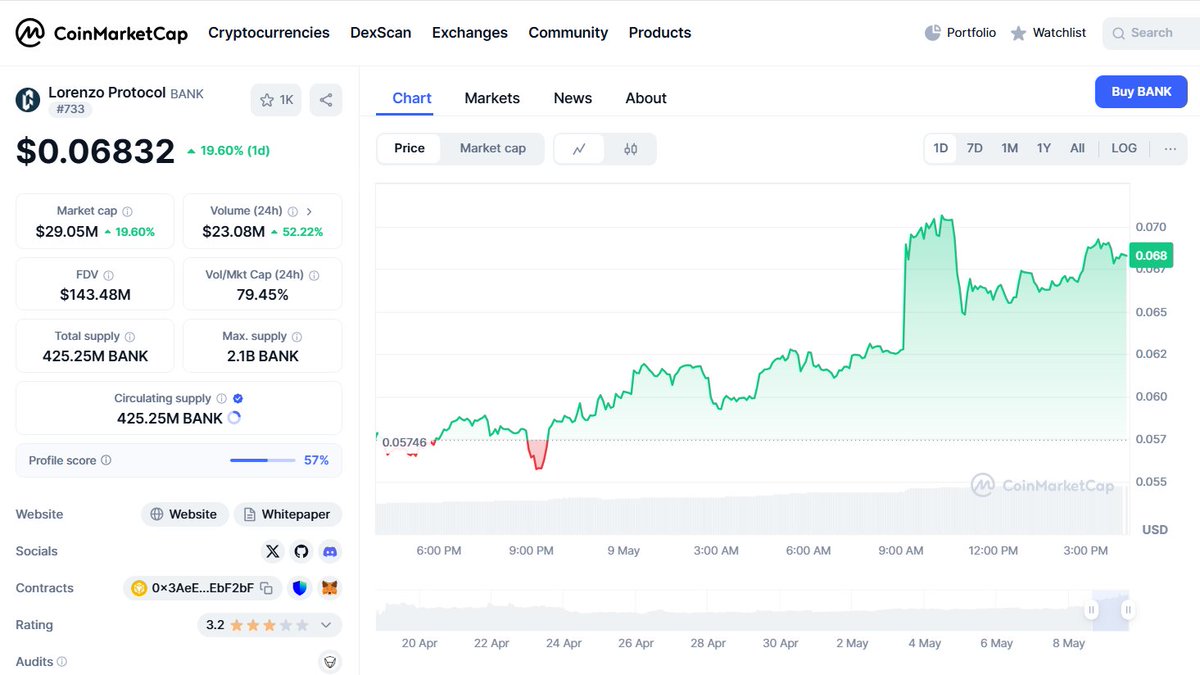

Token $BANK, current market cap only $29.05 million, FDV $143 million.

$BANK total supply 2.1 billion, initial circulation 20.25%. Adopts VE token model, i.e., users lock positions to obtain veBANK, representing voting rights and protocol income rights.

At the same time, the protocol will use income to buy back $BANK tokens. (Key point)

————————————————————————————————

Changes in $BANK fundamentals and valuation logic

The core of $BANK fundamentals lies in the veToken model and income buyback.

1⃣ About veToken

The veToken economic model represents the project @CurveFinance and its token $CRV. Users lock Token to obtain veToken.

The longer the lock-up time, the more veToken obtained. veToken cannot be sold, has no liquidity, but can obtain protocol income.

At the same time, holding veToken can vote to choose which trading pool to direct $CRV rewards to.

This is also the source of $CRV buying. Projects that build pools on Curve buy $CRV to lock positions and vote for themselves to direct $CRV emissions to their pool to attract liquidity.

At the same time, large holders also vote for their participating LP pools to obtain more rewards.

Thus, the $CRV War (CRV battle) was born, and protocols like Convex use the illiquidity of veCRV to guide users to lock $CRV on their platform, providing liquid cvxCRV.

Back to $BANK.

The ve model lock-up mechanism will reduce the market circulation, further reducing the already limited $14 million circulation market cap.

Moreover, perhaps strategy providers or large holders participating in a certain strategy may buy $BANK to lock positions and vote for themselves to guide $BANK reward emissions.

Of course, whether there is $BANK reward emissions has not been announced by Lorenzo.

2⃣ Income buyback

There are very few projects in the crypto space with fundamentals, i.e., continuous buying.

Once liquidity is poor, the market turns bearish, and without fundamental buying support, the price will fall more severely. In a bull market, buying will bring "price-income" flywheel cycle.

And fundamentals, a very important point is continuous income.

First, Lorenzo provides return scenarios, and they are original real returns, which are just needed. Secondly, whether it is trading, fee rates, or strategy return extraction, they will bring continuous income to Lorenzo, which will also feed back to $BANK.

In short, @LorenzoProtocol $BANK represents a new attempt at on-chain institutionalization, worthy of long-term attention.

🧐🧐

1/ After our @BinanceWallet IDO, we didn’t pause — we leveled up.

Lorenzo has evolved into an institutional-grade on-chain asset management platform, focused on tokenizing CeFi financial products and integrating them with DeFi.

At the heart of this evolution: The Financial Abstraction Layer!

6.06K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.