"Banks issue dollars; non-banks issue claims to dollars."

This difference explains why many #stablecoin issuers are seeking bank charters in the U.S.

🚨But be careful, bc not all banks are actually banks.

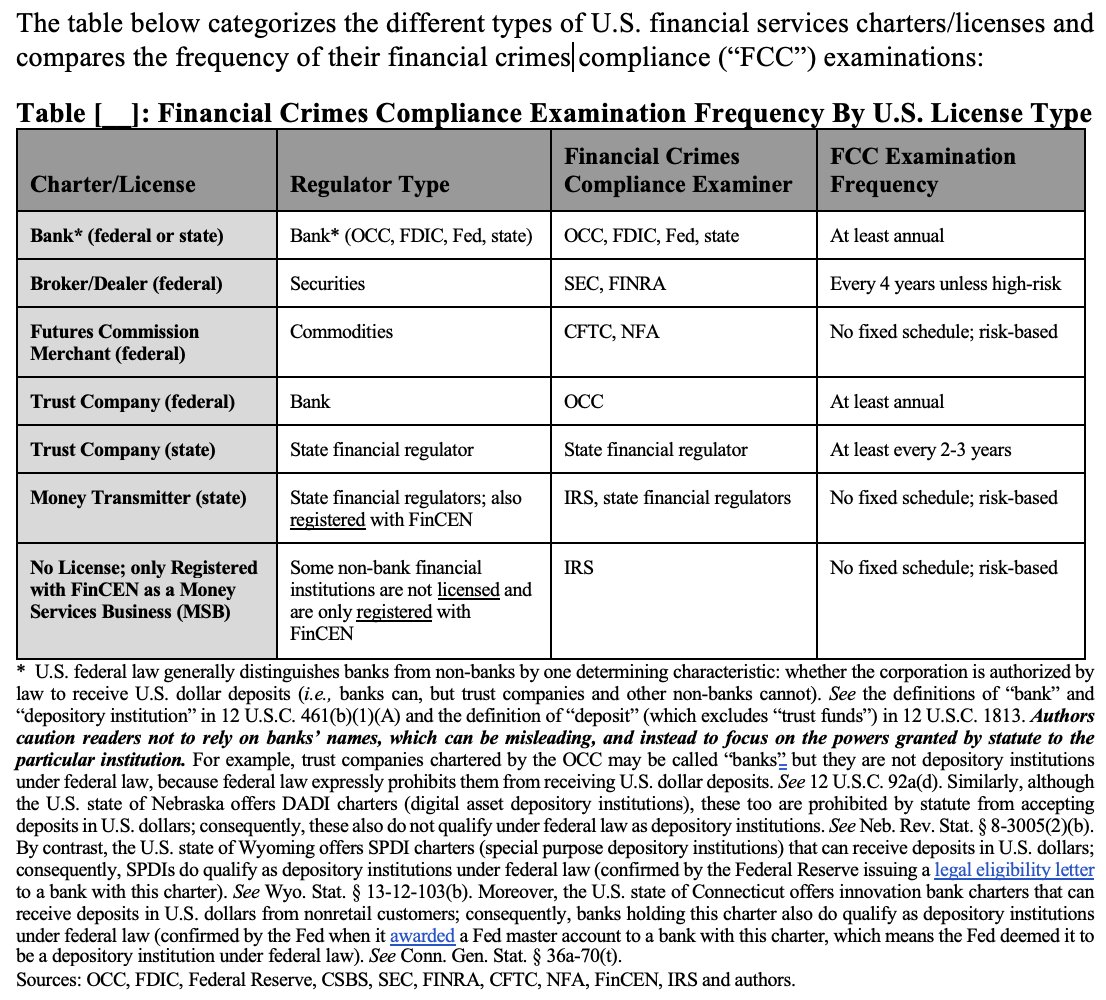

It's critical to look at the statutory powers of the particular institution, even if "bank" is in the institution's name. U.S. federal law generally distinguishes banks from non-banks by one determining characteristic: whether the corporation is authorized by law to receive U.S. dollar deposits (i.e., banks can, but trust companies and other non-banks cannot). More in this handy chart below (from a soon-to-be-published #stablecoin paper). Among crypto-native companies in operation, only two (@krakenfx Bank & @custodiabank) are authorized by statute to receive U.S. dollar deposits.

Depository institutions issue dollars; non-depository institutions issue claims to dollars.💡

318

98.99K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.