The momentum behind tokenized assets is now impossible to ignore, prompting the US Treasury to weigh in.

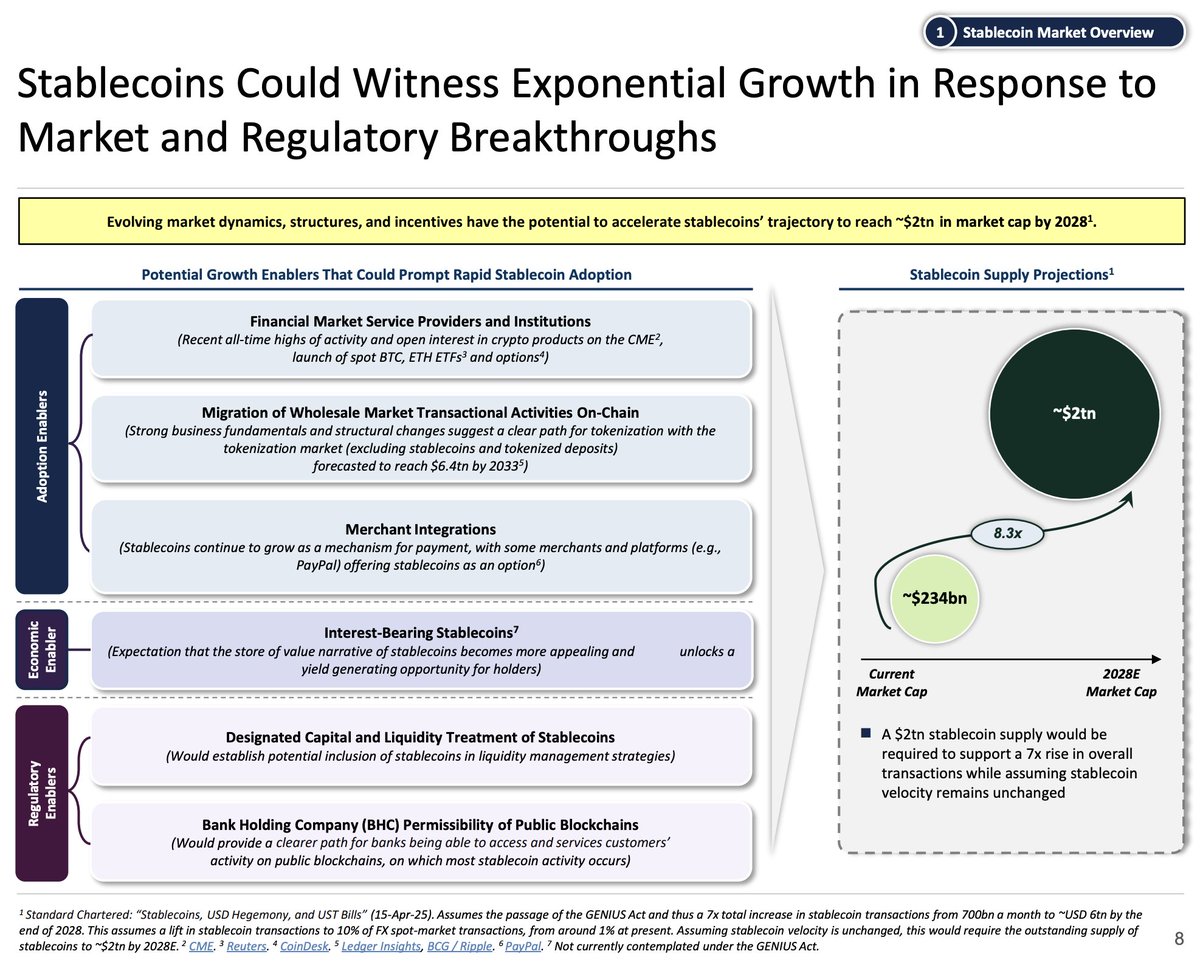

In its latest report, the department outlined how stablecoins could:

→ 8x to $2T by 2028

→ Reshape global demand for short-term Treasuries

→ Replatform payments, liquidity, and cross-border finance

Beyond stablecoins, the US Treasury observed that tokenized government securities have “swiftly proved a market-fit—catering for investors’ yield-seeking behavior in the Digital Assets ecosystem and the ability to optimize their cost of capital with instant settlement.”

Ondo is pioneering this category—having launched OUSG, the first tokenized security to achieve material adoption, with market-leading instant liquidity and diversified exposure to short-duration Treasuries—and USDY, the most widely held tokenized Treasuries product.

We are also proud to be building a broader suite of infrastructure to accelerate the transition of global capital markets onchain, including:

→ Ondo Bridge (Iive): The first institutional-grade cross-chain bridge for tokenized securities

→ Ondo Chain (coming): A purpose-built L1 blockchain for tokenized securities

→ Ondo Global Markets (coming): A platform that unlocks access to a wider universe of tokenized US securities such as stocks & ETFs, at scale

We welcome the growing interest from US government agencies and regulators—including our recent meeting with the SEC Crypto Task Force—and look forward to continued collaboration on shaping a thoughtful, forward-looking framework for tokenized assets.

📄 Read the report:

30.2K

572

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.