Lido CSM is at capacity 🌐

Lido's Community Staking Module went permissionless yesterday, with its stake share limit doubled from 1% to 2% of all protocol stake.

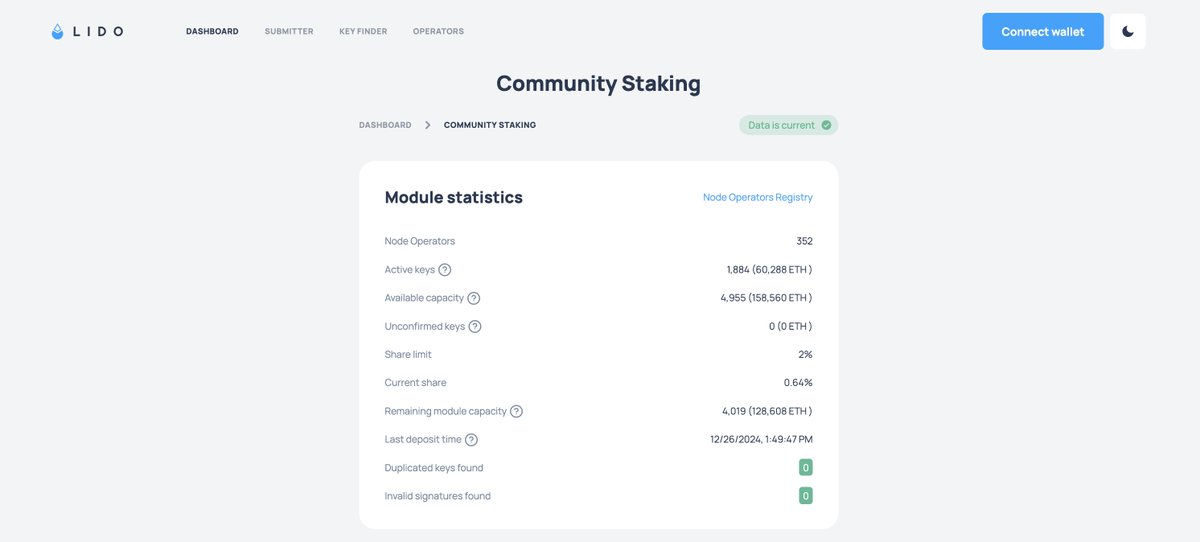

Within hours ~4,500 keys were submitted, surpassing the remaining capacity of 4,019 keys (i.e. how much stake would be needed for the module to reach its share limit) thanks to active Node Operator participation.

Module Limit & Queue Mechanics

Active keys are how many validators are active in the module. Available capacity is the number of keys in the deposit queue, while Remaining module capacity is the total number of capacity the module has left.

Given that Available capacity > Remaining module capacity, it's very possible that any newly submitted keys will not get deposited until one of the following occurs:

• CSM Node Operators exit some of their active validators;

• Keys are removed from the queue;

• The module share is increased via a DAO vote;

• The total ETH in the protocol increases enough such that the number of keys in terms of share limit increases.

📊 Track real-time stats here:

For Node Operators

As with most permissionless staking solutions, Node Operators may wait a long time (potentially indefinitely) for deposits. In other solutions, for instance, there may be a maximum queue size.

In the case of CSM, newly submitted keys, especially if surpassing the module’s capacity, may not receive deposits anytime soon. Operators can still upload keys, but if the module reaches its limit before these keys are deposited, the wait could be months or longer. However, submitted bonds still receive rebase rewards while keys await deposit.

Lastly, removal of keys from the deposit queue for any reason carries an additional charge of 0.05 ETH per key to prevent spam.

Why not raise the module share limit? 🤔

The 2% cap is based on CSM’s risk profile, limiting how much of the Lido protocol’s total stake can be allocated to it.

While quickly increasing the limit may sound appealing, it requires careful risk and protocol impact assessments, including understanding of how to accommodate and integrate upcoming changes to Ethereum staking in Pectra, and ultimately must follow the DAO governance process.

20.21K

174

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.