Crypto Derivatives 24 April 2025

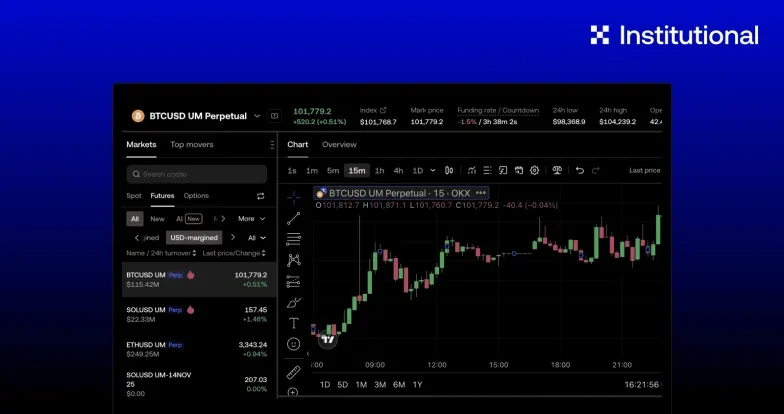

Keep up with the latest in crypto market commentary as we share the insights from our institutional research partners.

In this edition, we share the latest crypto derivatives weekly from Block Scholes.

The recent turmoil in financial markets amounted to a relief rally as President Trump showed a willingness to negotiate a trade deal with China. That ignited a further spark in BTC’s spot price that had already been rallying even before that, pushing it past $90K. Derivatives markets have not supported the rally, however. BTC funding rates have changed wind, registering two negative spikes after positive readings for most of the month. BTC’s term structure of volatility did not invert either. ETH, which rallied harder, saw stronger support in derivative markets with short-tenor volatility smile skews spiking dramatically higher before paring back slightly.

ATM Implied Volatility, 1-Month Tenor

BTC Options

BTC SVI ATM Implied Volatility

BTC’s term structure did not invert, and now trades far steeper than ETH’s.

BTC 25-Delta Risk Reversal

Short-tenor calls see a sharp recovery in demand despite smiles across the term structure since reverting to netural.

ETH Options

ETH SVI ATM Implied Volatility

A far smaller inversion of the term structure has resolved with a fall in short-tenor volatility.

ETH 25-Delta Risk Reversal

Short-tenor volatility smile skews have spiked dramatically higher during the rally in spot prices.

Market Composite Volatility Surface

Listed Expiry Volatility Smiles

Constant Maturity Volatility Smiles

The information provided in this document by Block Scholes Ltd is for informational purposes only and does not necessarily represent the views of OKX. Any additional disclaimers issued by these third parties are also applicable and should be considered as part of this document.

This report is not intended as financial advice, investment recommendation, or an endorsement of specific trading strategies. The contents of this report, including but not limited to any graphs, charts, and numerical data, are provided “as is” without warranty of any kind, express or implied. The warranties disclaimed include but are not limited to performance, merchantability, fitness for a particular purpose, accuracy, omissions, completeness, currentness, and delays.

The cryptocurrency markets are highly volatile and unpredictable, subject to substantial market risks including significant price fluctuations. The strategies, opinions, and analyses included are based on information available at the time of writing and may change without notice. They are also based on certain assumptions and historical data that may not be accurate or applicable in the future. Therefore, reliance on this report for the purpose of making investment decisions is at your own risk.

Past performance is not indicative of future results. While we strive to provide accurate and timely information, we cannot guarantee the accuracy or completeness of any data or information contained in this report. We are not responsible for any losses or damages arising from the use of this report, including but not limited to, lost profits or investment losses.

Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The inclusion of any specific cryptocurrencies or trading strategies does not constitute an endorsement or recommendation by OKX.

© 2025 OKX. تجوز إعادة إنتاج هذه المقالة أو توزيعها كاملةً، أو استخدام مقتطفات منها بما لا يتجاوز 100 كلمة، شريطة ألا يكون هذا الاستخدام لغرض تجاري. ويجب أيضًا في أي إعادة إنتاج أو توزيع للمقالة بكاملها أن يُذكر ما يلي بوضوح: "هذه المقالة تعود ملكيتها لصالح © 2025 OKX وتم الحصول على إذن لاستخدامها." ويجب أن تُشِير المقتطفات المسموح بها إلى اسم المقالة وتتضمَّن الإسناد المرجعي، على سبيل المثال: "اسم المقالة، [اسم المؤلف، إن وُجد]، © 2025 OKX." قد يتم إنشاء بعض المحتوى أو مساعدته بواسطة أدوات الذكاء الاصطناعي (AI). لا يجوز إنتاج أي أعمال مشتقة من هذه المقالة أو استخدامها بطريقة أخرى.