Cardano Price Faced Resistance Near $0.99 As Shorts Risked $164 Mln

Key Insights:

- Cardano price faces key resistance at $0.99, breaking which could trigger a massive rally.

- Analysts said more than $164 million in shorts were exposed.

- Derivatives data showed liquidation risk across Binance, OKX, and Bybit.

Cardano price moved toward a key resistance area in late August 2025. Analysts said this level carried added importance as a large cluster of short positions risked liquidation if broken.

Could the breach of $0.99 trigger forced buying in the ADA market?

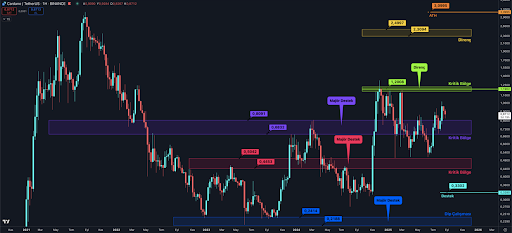

Cardano Price Tested Critical Resistance Levels

Cardano price moved steadily higher and traded near $0.83 at press time. The asset approached the $0.99 level, described by analysts as a short-term resistance threshold.

Analyst Berke Oktay identified $1.19 as the next major barrier if ADA surpassed $0.99. He said that a successful breakout could leave little resistance before the prior peak near $3.09, which marked the all-time high in 2021.

Technical traders described resistance as a price area where selling pressure historically capped further gains. When an asset broke through resistance, buying often accelerated as confidence grew.

Cardano’s pattern showed consolidation near these levels, suggesting that traders were positioned for further moves.

The ADA chart demonstrated resilience after multiple retests of support. Its stability above recent floors indicated structural demand remained in place.

Analysts said this base-building process created a foundation for potential continuation if momentum persisted.

Short Positions on Cardano Faced Heavy Risk

The derivatives market carried significant exposure to the ADA price. According to Mintern data, more than $109 million in leveraged short positions faced liquidation risk near $0.99.

Total short exposure across Binance, OKX, and Bybit reached around $164.5 million. Short positions represented trades betting that ADA would decline.

In leveraged trading, a move against the position forced closure when the margin was insufficient.

If Cardano price crossed the $0.99 line, short sellers would be required to buy back tokens at higher prices. Analysts said this dynamic, known as a short squeeze, often amplifies rallies. The forced buying added to organic demand, creating a feedback loop of upward price action.

Liquidation risk increased when clustering of short contracts aligned near the same strike zone. Market participants said that large-scale liquidations could create sudden volatility spikes. ADA’s approach toward $0.99 set the stage for such conditions.

The concentration of shorts in a narrow range showed bearish traders were confident in defending the barrier. Yet the risk remained that even a modest breakout could unwind their positions.

At press time, ADA recorded a 24-hour trading volume above $1.28 billion. The ADA price rose 0.8% in the same period.

It was also down about 9% for the week but up more than 5% for the month. Market sentiment remained mixed as the asset held above some support.

Trading volume reflected the level of participation in the market. Higher turnover often indicates conviction in the ongoing trend. Analysts said the combination of liquidity and resilience strengthened the case for continued observation of ADA.

Cardano’s underlying network continued to show consistent activity during 2025. Staking and decentralized application usage remained stable, although such fundamentals were not the primary driver of short-term price moves. Instead, technical positioning and derivatives flows dictated near-term direction.

The price action showed that ADA held above important supports despite market fluctuations. If Cardano price surpassed $0.99, it could confirm the upward structure in the charts.

A sustained consolidation above that zone would shift attention toward the $1.19 resistance level.

Analysts remained cautious in interpreting the moves but acknowledged that technical factors pointed to upward potential if momentum carried forward.

Outlook for Cardano Price in the Near Term

Cardano’s position near resistance drew attention to derivatives exposure. The short liquidation risk around $0.99 created a potential catalyst for rapid movement.

If ADA maintained volume strength and broke through resistance, liquidations could accelerate price gains. Conversely, failure to clear the barrier might keep the token in consolidation.

The Cardano price structure, combined with concentrated short exposure, ensured that the $0.99 level remained the most important marker for traders watching the market in the days ahead.

The post Cardano Price Faced Resistance Near $0.99 As Shorts Risked $164 Mln appeared first on The Coin Republic.