I spent last weekend reading the new #MEV research from @Sei_Labs, and it completely resets how I think about L1 design.

MEV has already stripped more than $1.3B from Ethereum users, and #SEI GIGA is a good one to fix it.🧵

1/ To understand why #SEI’s approach is different, we need to look at where MEV actually appears.

MEV bots scan it, detect profitable opportunities, inject frontrun/backrun bundles, and manipulate ordering.

A single proposer then builds the block, reorders transactions, sandwiches, or steals value.

MEV gets extracted, and the user loses money.

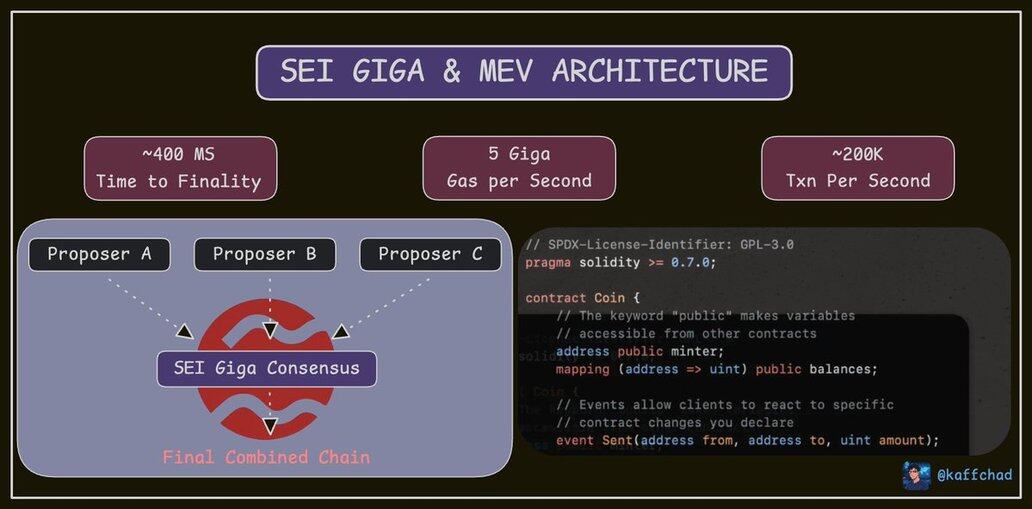

#Sei Giga flips the old model with #MCP (Multiple Concurrent Proposers).

Instead of one proposer controlling the entire block, several proposers publish blocks in the same tick.

Here’s what that looks like in practice:

User transactions flow to

→ proposer A, Proposer B, Proposer C

→ each proposer builds its own block (Block A, Block B, Block C)

→ SEI Giga’s consensus merges them into a single final chain.

A parallel block pipeline replaces the single choke point that created classic MEV.

MCP introduces new MEV dynamics, tx stealing, proposer timing games, proposer-to-proposer auctions.

here’s the breakthrough:

Sei Labs formalized them and showed they are bounded.

Predictable MEV is fundamentally safer for users and markets.

Bounded MEV is exactly what high-volume systems need: perps, options, RWAs, credit markets, arbitrage engines.

You can’t build real financial infrastructure on top of unbounded extraction.

If Sei succeeds, the beneficiaries are the traders, the liquidity providers, and every user who interacts with real onchain markets.

MEV becomes contained instead of weaponized.

Market moves faster on $SEI. ($/acc)

1.79万

174

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。