$BTC

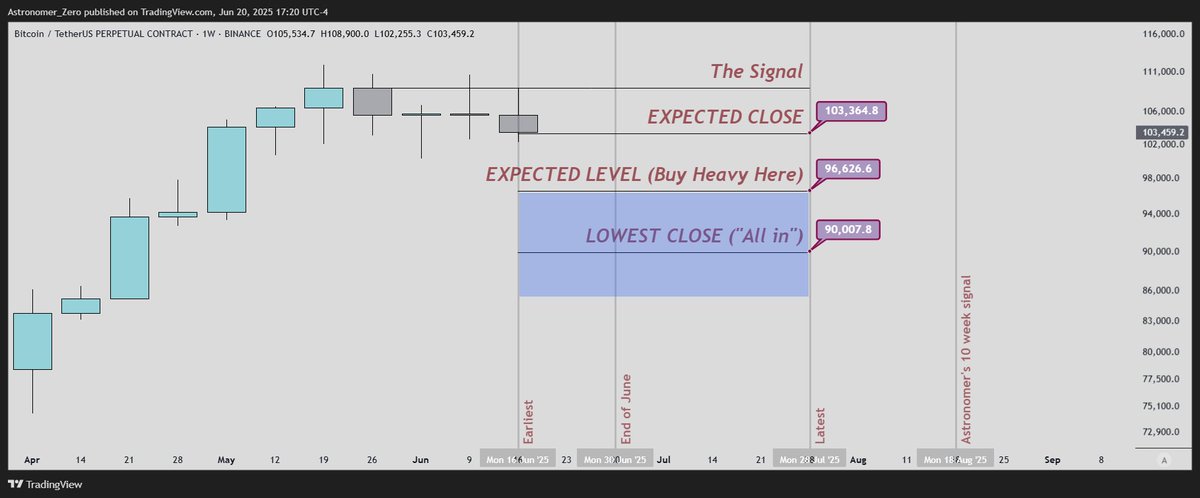

Plano de ação de mergulho final - 103k alcançados ✅

Tudo bem, $BTC indo um pouco mais baixo agora para o território de 103k.

Isso nos coloca no fechamento esperado (o nível em que se espera que o semanal feche antes de subir mais alto e chegar a 170 mil) de nosso plano de jogo de ação de mergulho final que criamos.

Como mencionado, é aí que eu começaria a me envolver (NFA) em $BTC (veja o tweet citado).

Ainda não estou comprando alts para esta queda e, pessoalmente, também esperando finalmente aumentar as posições iniciais de desafio de altcoin até que $BTC faça sua corrida, também conforme o plano abaixo.

Estamos agora a 2 semanas de julho, que é a primeira data em que permito que o preço suba, como você sabe. E o último ponto está a 6 semanas de distância.

Chegando mais perto, então é um ótimo momento para começar a comprar. (NFA).

O sentimento também está começando a se alinhar, com os ursos comemorando pequenos movimentos de 1 a 5%, enquanto o movimento maior provavelmente será de 170 mil, que é um movimento de 60% +, daí este plano de ação.

Desfrutar.

$BTC data analysis

170k is coming. And here is what I would do if I was sidelined.

So, aside from the overall plan we have for $BTC and #Alts of...

➡️Expecting 170k+

➡️Expecting it after June 30th

➡️Alts to follow after $BTC's move

➡️Therefore holding positional longs from 95k

➡️Therefore holding high timeframe alt positions

Those positions have been taken a while ago and despite my endless bull posting at that time, many missed out because others on X told you the opposite which is to be careful.

So decided to write a post here to help you out in case you are still completely, or too sidelined for comfort. I designed this post in a user friendly, easy to follow way. So you don't have to sit on the charts all day and can just structure your buys (NFA as always).

For the traders out there (like myself), this post also helps you to shape your bias. Which, surprise surprise, is still bullish.

Because this post is indeed on the backbone of our overall bull market masterplan, running from 18k (we flipped at 18k in 2023, to "up-only" on the weekly timeframe), and still expecting price to continue that way, no top being in yet, until we reach at least 170k+.

So planning to buy now into $BTC, is expected to net you a move of over 70% in a short period of time, or in alts, even more IMO (with higher drawdown tolerances). Good information if you want to make money even if you're sidelined, are holding, or want to top up your bags.

The timeline is bearish, the order books start to rotate towards green into spot, red into perps (aggressive shorts, aggressive spot buys, simply visible with the increasing spot premiums). And, we have the hash ribbon signal on the weekly. One that never failed.

Astronomer is bullish.

So where to buy?

While the aim of this post is not to give exact levels and perform 24/7 monitoring, as always, I aim to give actionable guidelines here. Because you know I think that's lacking on this platform. (Too much talk, too little action).

So ending the rant here, here's the analysis + plan.

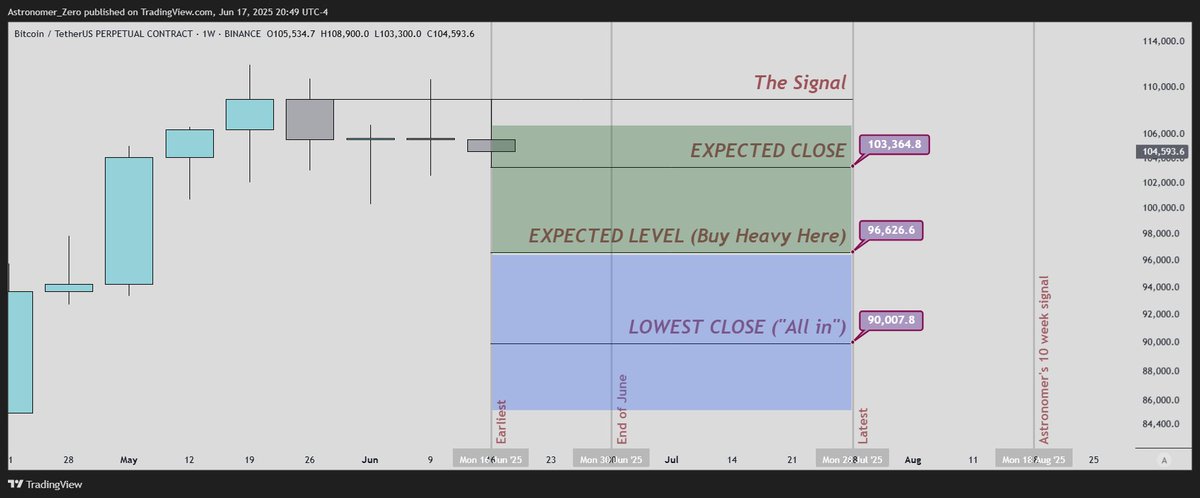

Upon statistical analysis, the expected close before going up only is around 103k. So, probably a good level to start getting involved. i.e. take a partial position, 25% of dry powder, 30% of dry powder, whatever you like.

The expected level to be reached based on all prior signals (lowest wick) is 96k. Probably a good level to buy heavy if given, 60%, 70% alloc.

And finally, the expected lowest close is 90k. Probably a good level to allocate (almost) all your dry powder.

So do you buy alts or $BTC? Good question. Typically, $BTC moves first, then alts. But in later stages, they more likely move simultaneously so if you want alt exposure and have a higher drawdown tolerance for more reward (more risk, to get more reward), they are your way to go. But what if you want the best of both worlds?

Well we haven't looked at the time yet. You know my style of always looking at price as either trading the range or trading the breakout/breakdown, never getting stuck in one or the other. It lead to my most recent 95k breakout trade and the many in the past.

When will we break out this time? I explained why it's not before 30th of June, seems to still play out. I also addressed it's around 10 weeks with some variance.

So using this timing, and knowing $BTC moves first as one of the most ancient crypto mechanics (also true in commodities and stock pairs by the way), buying alts $BTC breaks out (alts are lagging, ready to catch up) is smarter than trying to knife catch them (to eliminate the drawdown, and reap the upside rewards). And the exact timing can be used to time the $BTC breakout.

Align this timing and plan of buying with the sentiment, where likely lots of horns will be tooted again with a little deeper drawdown from here, and as time goes on, the cynicism likely increases again, all things you want to see.

Summary

To summarize, if I was sidelined, I'd look to buy below 103k and as much as possible as close to 90k as possible, and the closer we get to those 10 weeks, confirmed with price action, the closer $BTC is to breaking out, rotate to alts if they haven't moved yet (most likely, they won't at that time yet).

If the price doesn't go as deep into the 90's (which I don't think is very likely, I expect June to close between 95-110k, and not go much lower), then I'd buy more and more the closer we get to those 10 weeks regardless of the price (time is more important than price).

For my trading, that means I keep my bullish bias (long aggressively, short passively, hold longs long, hold shorts shortly), for similar reasons and look for levels with the typical confluences and analysis I usually.

That is the plan. Of course to be refined with other confluences and data. But here a good example and certainly 80% of the way towards my high standards and certainty explaining a lot of the process.

Enjoy.

138,54 mil

510

O conteúdo desta página é fornecido por terceiros. A menos que especificado de outra forma, a OKX não é a autora dos artigos mencionados e não reivindica direitos autorais sobre os materiais apresentados. O conteúdo tem um propósito meramente informativo e não representa as opiniões da OKX. Ele não deve ser interpretado como um endosso ou aconselhamento de investimento de qualquer tipo, nem como uma recomendação para compra ou venda de ativos digitais. Quando a IA generativa é utilizada para criar resumos ou outras informações, o conteúdo gerado pode apresentar imprecisões ou incoerências. Leia o artigo vinculado para mais detalhes e informações. A OKX não se responsabiliza pelo conteúdo hospedado em sites de terceiros. Possuir ativos digitais, como stablecoins e NFTs, envolve um risco elevado e pode apresentar flutuações significativas. Você deve ponderar com cuidado se negociar ou manter ativos digitais é adequado para sua condição financeira.