In-depth analysis of the RealtyX project: innovative practice and future prospects of the real estate RWA track

1. Overview of the RealtyX project: an innovative blueprint for real estate tokenization The

core mission of RealtyX is to transform traditional real estate into programmable crypto digital assets, solving the challenges of high capital thresholds, low liquidity, and compliance through blockchain technology. It is positioned as a bridge connecting traditional finance (TradFi) and the crypto economy, with the goal of lowering investment thresholds and promoting RWA financialization (RWAfi&DeFi).

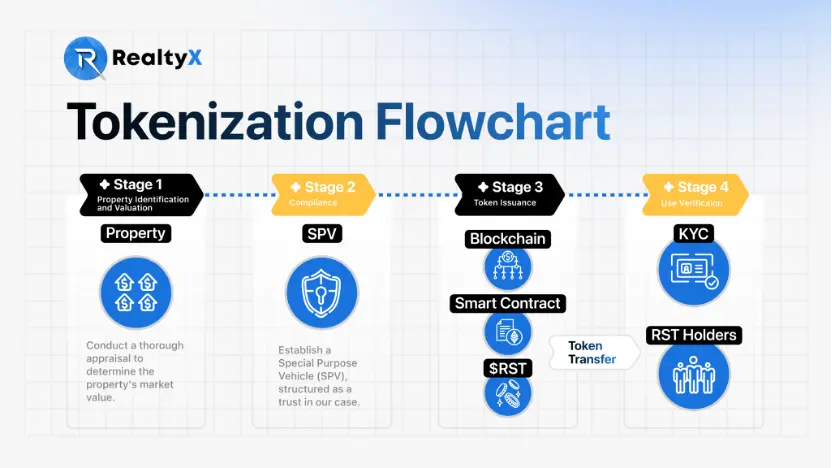

1.1 Technical architecture: three-layer design to solve industry pain points

RealtyX's technical architecture is divided into asset layer, protocol layer and application layer, addressing the three major challenges of real estate tokenization: asset confirmation, liquidity release and compliance closed loop.

asset layer: the actual value is anchored

property-token mapping: Physical property rights are split to ERC-20 Each token corresponds to $50, which is the actual value of the property, and also represents the holder's property income rights and governance rights. Property rights, appraisals, and insurance information are recorded on-chain, and the dynamic metadata module updates property maintenance records in real time.

scientific pricing mechanism: Regularly conduct authoritative valuations of assets, by RWA token holders vote on whether to sell assets to achieve dividend redemption

protocol layer: compliance engine

CaaS middleware: built-in KYC/AML verification, Realize whitelist management and risk rating.

legal adaptation: Each asset interest is transparently structured in the trust.

Application layer: The three scenarios

fractionalised investment: $5 starting at RWA token, automatic monthly rental income distribution, and the rental return of the first Dubai asset is 8% annualised.

Mortgage Lending: Dynamic LTV (50-75%) adjusts according to the type of property and region.

Utility Valut: In addition to collateralising and lending stablecoins to achieve liquidity, you can also participate in various functions such as pledge mining, contracts, options, and preferential check-in.

1.2 Dual Token Economy: RST and RX synergistically drive

RST (RWA).token):

anchored: linked to the real property value.

scenario: rental income denominated in stablecoins, corresponding to real estate decision-making rights, free trading in the secondary market, mortgage lending, etc.

RX (governance token):

Functions: community incentives, in-ecosystem payment tools, governance participation.

deflationary mechanism: regular repurchase and destruction, expense deduction destruction, etc.

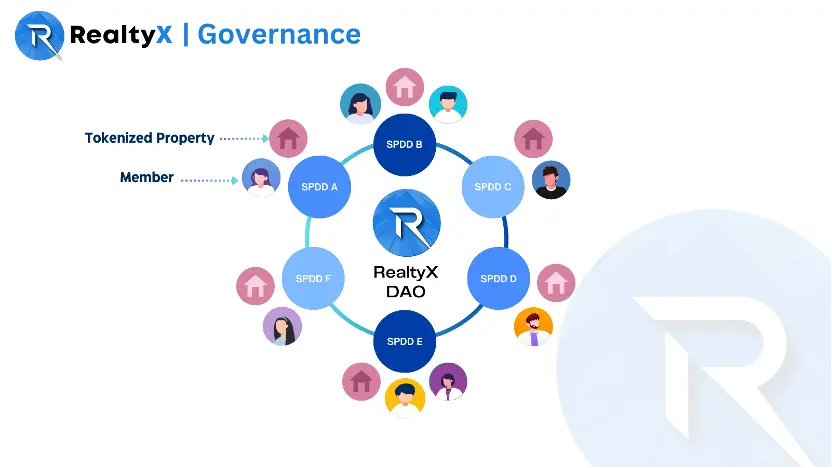

1.3 Operating mechanism: DAO and SPDD's decentralised governance

RealtyX DAO: Supervise platform governance, community decides contract upgrades, Asset selection and reward distribution.

SPDD (dedicated decentralised organisation): Each property is owned by an independent SPDD Regulated, RST holders participate in decision-making and share in rental yields (expected yield of 7-10%).

participants: Property owners tokenise assets through a trust fund, RST holders need KYC verification, the platform charges a 2% service fee.

2. RWA Industry Background: Market Outbreak and Structural Transformation

2.1 Overview of Market Size and Growth

Data (As of the end of 2024.) ,RWA.xyz):

on-chain RWA market (excluding stablecoins): 154 billion dollars, an increase of 80% year-on-year (8.6 billion in 2023).

U.S. Treasury bond: $3.96 billion (up 415%), Private credit: 9.83 billion (up 48%), other assets: 1.537 billion (up 32.6%).

Comparison: The global real estate market is $326.5 trillion ( CoinGecko), with a total market capitalisation of $2.5 trillion in the crypto market (CoinMarketCap estimate, March 2025), and RWAs account for only 1.28%, which is a huge potential.

Prediction:

BCG: Tokenized assets by 2030 $16 trillion.

ScienceSoft:2030 Annual tokenised real estate amounts to $3 trillion, accounting for 15% of assets under management.

2.2 Market structure: dual pillars and diversification

twin pillars: U.S. Treasury bonds and private credit account for more than 85% of the share.

Diversification frontiers: real estate (CAGR 19-21%), ESG Assets, artworks, supply chain finance, etc. are accelerating.

Catalytic trend:

liquidity reshaping: Blockchain reduces transaction costs by 30-90%, and round-the-clock trading increases participation.

Institutional Expansion: Blackstone BUIDL Fund (2024.) AUM exceeds 500 million), JPMorgan Chase & Co.'s Onyx platform tokenization fund.

Technical support: Chainlink is 70% on-chain RWAs offer pricing, and Layer 1s like Plume optimise tokenization.

2.3 Growth engine

institutional adoption: Blackstone, Fidelity, JPMorgan Chase entered, and BlackRock cooperated with Securitize to achieve USDC 1:1 redemption.

Technological breakthrough:

compliance: ERC-3643 reduced by 90% Cost of compliance (BlocHome).

Cross-chain: Chainlink CCIP, Wormhole NTT enables seamless asset transfers.

dedicated chain: Plume supports 180+ protocols, Mantra tokenises 1 billion Dubai properties.

Regulatory Developments: EU MiCA and Hong Kong Sandbox Promote Compliance Innovation.

3. RealtyX's Strategic Highlights: Innovation Barriers and Ecological Layout

3.1 Legal Engineering

asset rights and interests are guaranteed by trust structure, and KYC and AML are adoptedThe policy ensures that participants, RWA token holders, and the platform are compliant.

3.2 Liquidity activation

get stablecoins by staking RWA tokens

secondary market: Users can trade freely through the on-chain order book

4. RealtyX DAO's latest progress

4.1 Honors and recognitions

WOW Summit 2025: Finalist in the startup competition.

Cyberport Support: Endorsed by Hong Kong Incubator, Provide funding and resources.

Consensus Hong Kong 2025: Participate in global conferences to drive institutional RWA adoption.

SpringX & Aptos Accelerator: 10The only RWA project among the selected projects.

4.2 Ecosystem dynamics

Plume Network Collaboration: Will be as Plume One of the first core projects deployed on the mainnet.

Product Update: More properties are planned to be launched, Lending Agreement 2.0 and more Utility Vault Partner Expansion.

Community Events: Ambassador programs, a series of community events, and RWA popularisation talks have been launched.

5. Comparison of RWA industry competitors

Ondo Finance:OUSG Tokenized Treasury bonds, up 782% in 2023 with a market cap of 931 million (CoinGecko), in partnership with Blackstone.

Centrifuge:Credit value 4.46 billion (2024, CoinGecko), with MakerDAO for 220 million.

RealT: $50 to invest in U.S. real estate, Expansion into Europe in 2025.

RealtyX Advantage: RWA It is deeply integrated with DeFi, while paying equal attention to DAO governance and compliance.

6. Opportunities and Challenges

6.1 Opportunities

market potential: real estate tokenization is only the tip of the iceberg of the 326.5 trillion market, The Security Token Market predicts $1.4 trillion by 2025.

Policy support: Singapore MAS Sandbox, Hong Kong regulatory framework.

institutional demand: BlackRock predicts more than 4% tokenised real estate by 2030 Trillion.

6.2 Challenge

regulatory uncertainty: The position of the U.S. SEC is unclear, and cross-border laws are ambiguous.

Liquidity Stratification: Real estate liquidity is lower than Treasury bonds (RWA Market Report).

technical bottleneck: high Ethereum gas fees (Galaxy )。

7. Future Outlook and Strategic Planning

7.1 Three Trends

asset revolution: the integration of real estate and DeFi to truly unlock the value of underlying assets.

Technology Shift: Zero-Knowledge Proofs (ZKPs) and Modular Blockchains Enhance Privacy and Interoperability.

regulatory restructuring: The United States may introduce supporting regulations, and international frameworks are emerging.

7.2 Strategic planning

short-term (2025): Focus on the UAE and Hong Kong, with more assets on the chain and STO licenses.

Medium-term (2026-2027): Expand globally and develop third-party access to Utility Vault functions.

Long-term (2028-2030): Explore metaverse real estate and urban tokenization governance.

8. RealtyX (RX) Airdrop

Campaign

To provide more high-quality asset options, JuCoin will list RealtyX (RX) and launch an airdrop event at the same time!

total airdrop: 100,000 RX

airdrop qualification: Users who hold ≥100 JU during the snapshotperiod snapshot time: March 17, 2025Day 19:00 (UTC+8) to March 20, 2025 19:00 (UTC+8)

Release time: March 21, 2025Sun 12:00 (UTC+8)

Distribution Rules: After the snapshot ends, the total snapshot will be taken based on the number of JUs held by the user The weight of the amount of JU is used for RX token distribution.

Make sure to hold enough JU during the snapshot to participate in this RealtyX (RX) airdrop!

9. Conclusion

RealtyX transforms real estate from "brick cement" into encrypted digital assets through technological innovation and DAO governance Unique in the RWA industry. As the market moves from 15.4 billion to 50 billion (Bitwise predicts the end of 2025), RealtyX is expected to become a key hub connecting crypto and traditional markets, writing a new chapter in capital flows.