OKX Institutions recap - January 2023

Welcome to our monthly OKX Institutions recap, going over our latest product launches and metrics. You'll see, on both fronts, the year has started on a roll for us. Let's dive in.

In summary

- We've had a major launch with the Liquid Marketplace, our state of the art on-demand liquidity network

- We've launched a very competitive VIP Loan program

- Our metrics show crypto traders are in flight to safety mode and flocking to our platform amidst market stress

Latest products

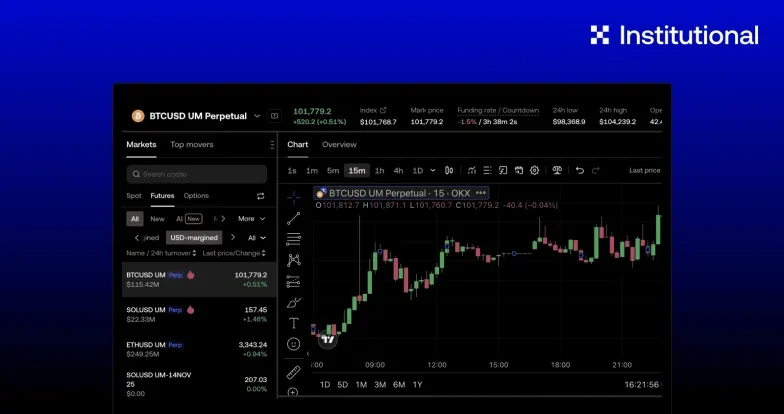

Liquid Marketplace

In December we've launched our on-demand liquidity network, the OKX Liquid Marketplace. It provides traders with access to deep liquidity, through an execution layer that automates trades and settlements instantly and off the order book:

- Learn what the Liquid Marketplace offers for pro and institutional traders

- Learn how to leverage the Liquid Marketplace for futures spread trading

- Learn how to trade crypto options on the Liquid Marketplace

Interested?

Reach out

VIP Loans

We've also launched the VIP Loan Pool, a program for eligible VIP clients to:

- Improve capital efficiency

- Reduce risk

- Access dedicated margin

- Benefit from competitive rates

Learn more

Latest metrics

Flight to safety

The challenges faced by some other platforms has inspired traders a flight to safety. As the only major exchange to have had zero exposure to 2022's negative events, we've seen trade volumes pick up consistently amidst market stress. Liquid Marketplace - our OTC trading platform did over $340m of trading volume in Jan 2023.

Key highlights

- 📈 $28.4M highest volume day (Jan 9th)

- 💸 $11.4M largest single trade

- ✅ 2411 successfully executed RFQs

- 🏋🏻 $140k average trade size

- 📊 Top traded strategies: ETH Quarterly Futures Rolls

What's next

- Spread Orderbooks: Linear delta one spread order books across all spot, perpetual, and dated futures are coming soon. One-click trading and API for multi-leg combo spreads will support futures rolls, funding rate arbitrage, calendar spreads and more.

Explore our solutions

THIS BLOG IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. IT IS NOT INTENDED TO PROVIDE ANY INVESTMENT, TAX, OR LEGAL ADVICE, NOR SHOULD IT BE CONSIDERED AN OFFER TO PURCHASE, SELL, OR HOLD DIGITAL ASSETS. DIGITAL ASSETS, INCLUDING STABLECOINS, INVOLVE A HIGH DEGREE OF RISK, CAN FLUCTUATE GREATLY, AND CAN EVEN BECOME WORTHLESS. YOU SHOULD CAREFULLY CONSIDER WHETHER TRADING OR HOLDING DIGITAL ASSETS IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. PLEASE CONSULT YOUR LEGAL/TAX/INVESTMENT PROFESSIONAL FOR QUESTIONS ABOUT YOUR SPECIFIC CIRCUMSTANCES.

© 2025 OKX. Denne artikkelen kan reproduseres eller distribueres i sin helhet, eller utdrag på 100 ord eller mindre av denne artikkelen kan brukes, forutsatt at slik bruk er ikke-kommersiell. Enhver reproduksjon eller distribusjon av hele artikkelen må også på en tydelig måte vise: «Denne artikkelen er © 2025 OKX og brukes med tillatelse.» Tillatte utdrag må henvise til navnet på artikkelen og inkludere tilskrivelse, for eksempel «Artikkelnavn, [forfatternavn hvis aktuelt], © 2025 OKX.» Noe innhold kan være generert eller støttet av verktøy for kunstig intelligens (AI/KI). Ingen derivatverk eller annen bruk av denne artikkelen er tillatt.