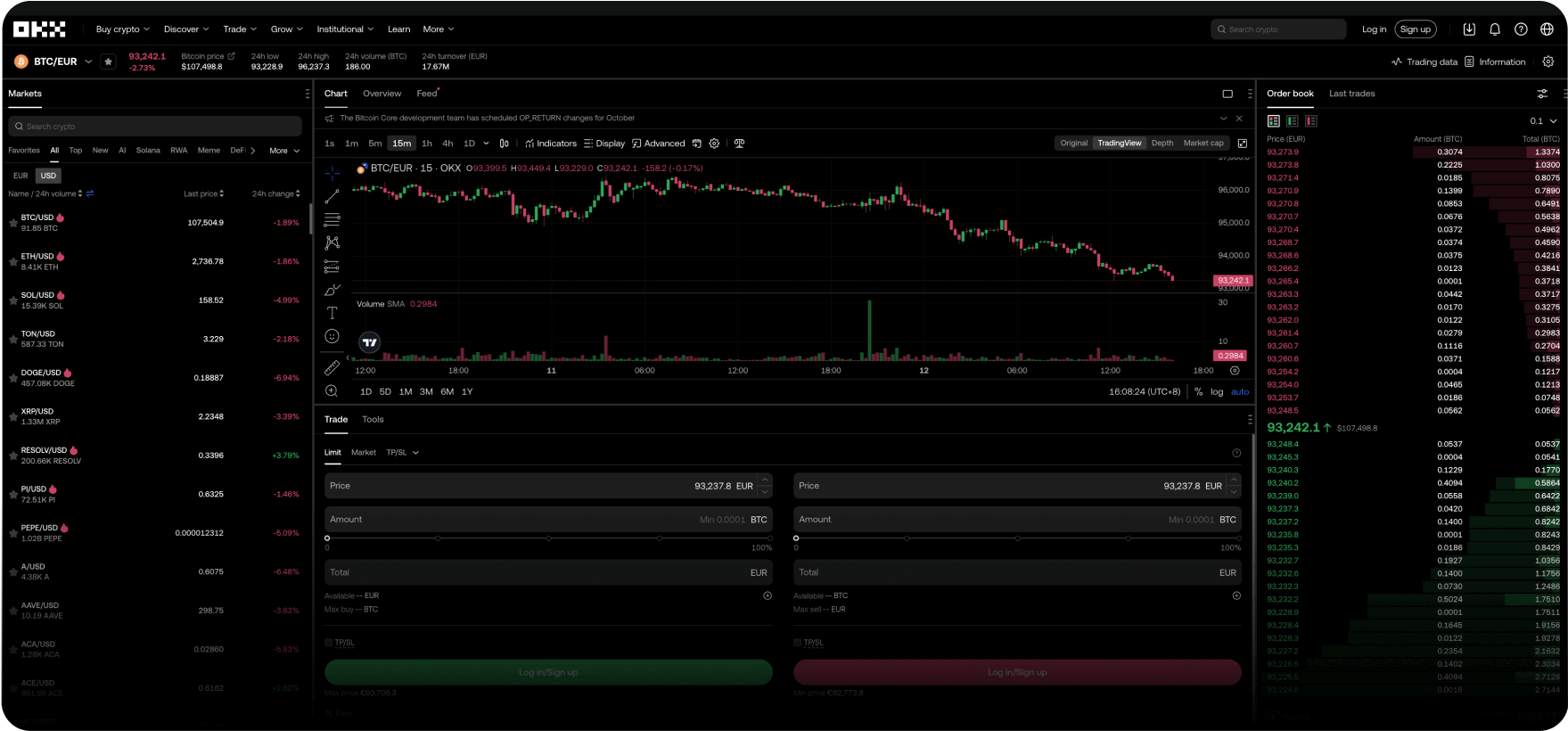

Handle som en proff

Få de laveste gebyrene, raske transaksjoner, kraftige API-er og mer.

Med deg hele veien

Fra å foreta din første kryptohandel til å bli en erfaren trader er vi der for å veilede deg gjennom prosessen. Ingen spørsmål er for små. Ingen søvnløse netter. Ha tillit til kryptoen din.

Treneren Pep Guardiola

Forklarer en utrolig fotballstrategi

Omskriv systemet

Velkommen til Web3

Snowboarderen Scotty James

Inviterer hele familien med

Har du spørsmål? Vi har svarene.

Hvilke produkter leverer OKX?

Hvordan kjøper jeg Bitcoin og annen kryptovaluta på OKX?

Hvor holder OKX til?

Kan innbyggere i EU bruke OKX?