Smart Portfolio

1. What is Smart Portfolio?

The Smart Portfolio bot is an automatic strategy for dynamically rebalancing the position of user-selected crypto pairs. Dynamic rebalancing will assist in keeping a consistent proportion of each crypto in the user's portfolio. Users can select from two triggering modes of position rebalancing, one is based on a scheduled interval and the other one is based on a rebalancing threshold on the proportion ratio deviation of each crypto.

This bot takes the gains from exchange rate fluctuations to earn and stock crypto.

2. Use cases of Smart Portfolio

In the crypto market, prices of different crypto pairs may fluctuate at a different pace, so quite often investors may see the price of some crypto pairs falling while others are surging. If investors just hold the crypto, they may miss the profit when there is a large correction happening in the market. Whereas, if the user proceeds with the Smart Portfolio bot, it will help the user to sell crypto gradually when the price is increasing and re-invest those funds into pairs that have temporarily lagged behind but may have a high potential later. In this case, Smart Portfolio locks in the profit while increasing the position of high potential cryptos when the price is relatively low, and continuously earns extra returns over the long run.

3. Create a Smart Portfolio bot, Set the parameters and Examples

3.1 Create a Smart Portfolio bot

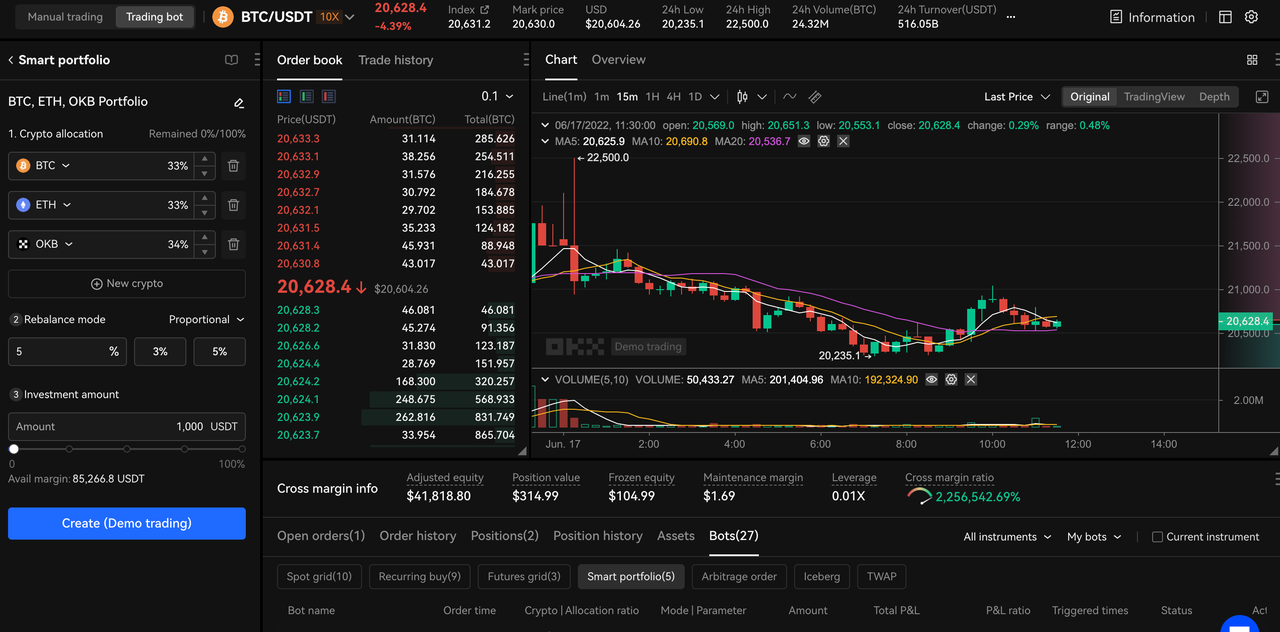

(1) After you enter OKX Web or App, select "Trading bot" on the "Trade" page (In the upper left corner of Web, and the upper right corner of App), then select Smart portfolio.

(2) Input the parameters on the order placement page, set the investment amount, and then a Smart portfolio will be created. (The assets invested in the Smart portfolio will be isolated from the manual trading account)

(3) Once created, you can view and manage bots in "Bots" at the bottom of the trading page.

3.2 Terms and parameters

Crypto allocation: You can choose the crypto portfolio for dynamic rebalancing, and then decide the market cap ratio of each crypto. During the bot is running, the position will be rebalanced with the preset ratio as the goal (up to 10 crypto selections, and available in USDT quoted pairs only)

Rebalance mode: There're two modes, Proportional and Scheduled

Proportional: The rebalancing is triggered according to the changed ratio of the market cap of the crypto. When more than 1 crypto was found to deviate from the preset ratio and exceeds the preset threshold, the rebalancing is triggered. (In order to avoid an extremely frequent position rebalancing, the next ratio-testing will be triggered every 5 minutes after the last rebalancing)

Scheduled: Monitor the degree of deviation and the rebalancing is triggered based on a fixed time period. After setting an interval, the bot will monitor whether the market value ratio of one or more crypto deviates from the preset ratio and exceeds the threshold, and if so, the balance will be triggered. (In order to avoid an extremely frequent position rebalancing, rebalancing will be triggered when the deviation ratio exceeds 3%)

Investment amount: The amount of funds invested in Smart Portfolio. After being invested, the funds will be traded into the crypto in the portfolio.

3.3 Examples

Example 1 - Proportional

Parameter settings

Crypto allocation: BTC | 50%; ETH | 30%; SOL | 20%

Rebalance mode: Proportional | 10%

Investment amount: 10,000 USDT

Running bot

Phase 1 - Exchanged into target crypto. The invested amount was traded into 5 BTC worth 5,000 USDT (assume the price of BTC is ₮1,000), 6 ETH worth 3,000 USDT (assume the price of ETH is ₮500), 20 SOL worth 2,000 USDT (assume the price of SOL is ₮100).

Phase 2 - Trigger rebalancing. Assume the price of BTC increases and reach 1,500 USDT, and prices of ETH and SOL are unchanged. Now the market cap proportion of each crypto are 60% : 24% : 16%. The BTC deviation rate ≥ 10%, rebalancing is triggered, so the Smart Portfolio bot will automated sell 0.83334 BTC, buy 2.5 ETH and 5 SOL, to remain the proportion unchanged. After this rebalancing, you will hold 4.16666 BTC (market cap 6,250 USDT), 7.5 ETH (market cap 3,750 USDT),25 SOL (market cap 2,500 USDT), which the ratio is same as initial BTC | 50%; ETH | 30%; SOL | 20%.

Example 2 - Scheduled

Parameter settings

Crypto allocation: BTC | 50%; ETH | 30%; SOL | 20%

Rebalance mode: Scheduled | 4 hours

Investment amount: 10,000 USDT

Running bot

Phase 1 - Exchanged into target crypto. The invested amount was traded into 5 BTC worth 5,000 USDT (assume the price of BTC is ₮1,000), 6 ETH worth 3,000 USDT (assume the price of ETH is ₮500), 20 SOL worth 2,000 USDT (assume the price of SOL is ₮100).

Phase 2 - Trigger rebalancing. Assume after 4 hours of bot creation, the price of BTC increases and reach 1,500 USDT, and prices of ETH and SOL are unchanged. Now the market cap proportion of each crypto are 60% : 24% : 16%. The BTC deviation rate ≥ 3%, rebalancing is triggered, so the Smart Portfolio bot will automated sell 0.83334 BTC, buy 2.5 ETH and 5 SOL, to remain the proportion unchanged. After this rebalancing, you will hold 4.16666 BTC (market cap 6,250 USDT), 7.5 ETH (market cap 3,750 USDT),25 SOL (market cap 2,500 USDT), which the ratio is same as initial BTC | 50%; ETH | 30%; SOL | 20%.

4. Risk reminder and notes:

4.1. After the Smart portfolio is created, the assets invested in Smart Portfolio will be isolated from the manual trading account. Please pay attention to the position risk of manual trading.

4.2 During the running of the Smart Portfolio bot, if the asset encounters unpredictable circumstances such as suspension or delisting, the bor will be automatically suspended.