Margin trading guide

Margin trading is a trading method that traders can borrow assets from an exchange such as OKX and leverage their margin in multiples to amplify potential profit and risk. You can either Buy (Long) a token or Sell (Short) a token to gain profits depending on the price that goes up or falls. When using margin trading, it's important to be aware of the risk, the maximum leverage is 10 times the initial principal, meaning that both profits and losses can be multiplied by up to 10 times.

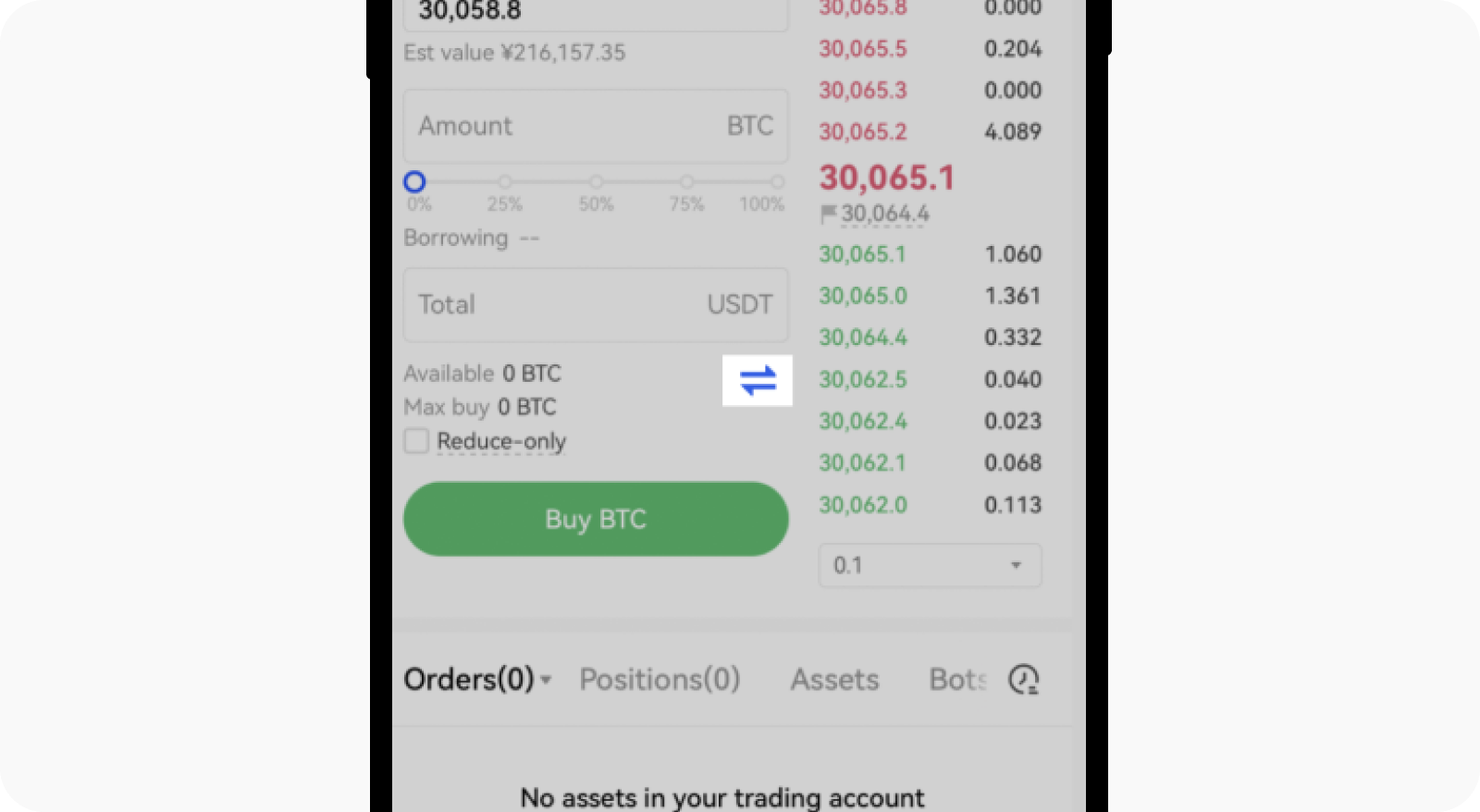

Before using margin trading, you'll need to ensure you have assets in your trading account, or you can make a transfer from funding account to trading account.

- On the web: Login to OKX website > Assets > My Assets > Transfer

- On the app: Open you OKX App > Assets > Transfer

- Or you can also transfer on Margin trading page

How do I Buy (Long) / Sell (Short) a token?

In Margin trading, "Buy (Long)" refers to buying at a low price and then selling at a higher price; "Sell (Short)" refers to selling at a high price then buying at a lower price. By doing this, you can earn a profit from the price difference.

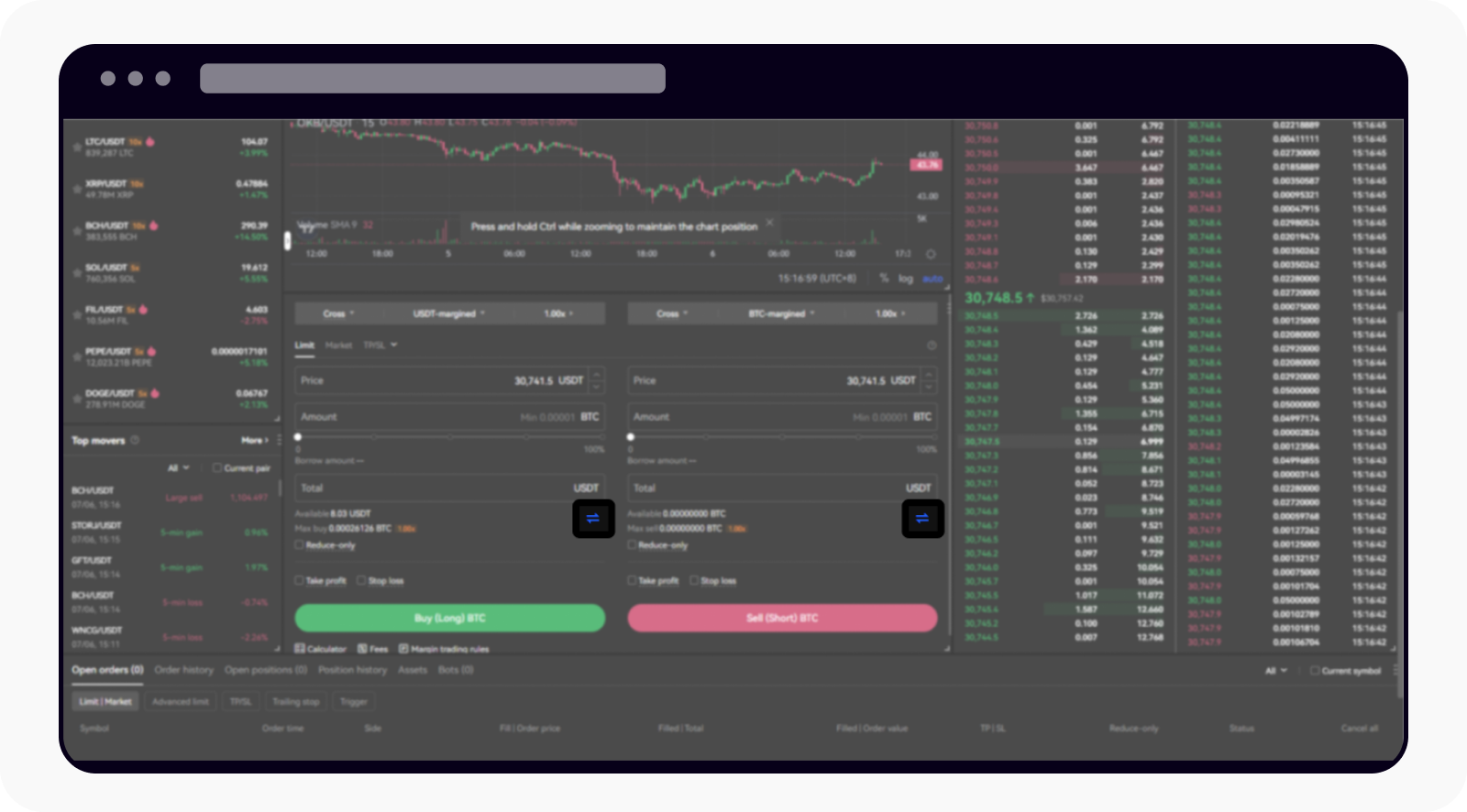

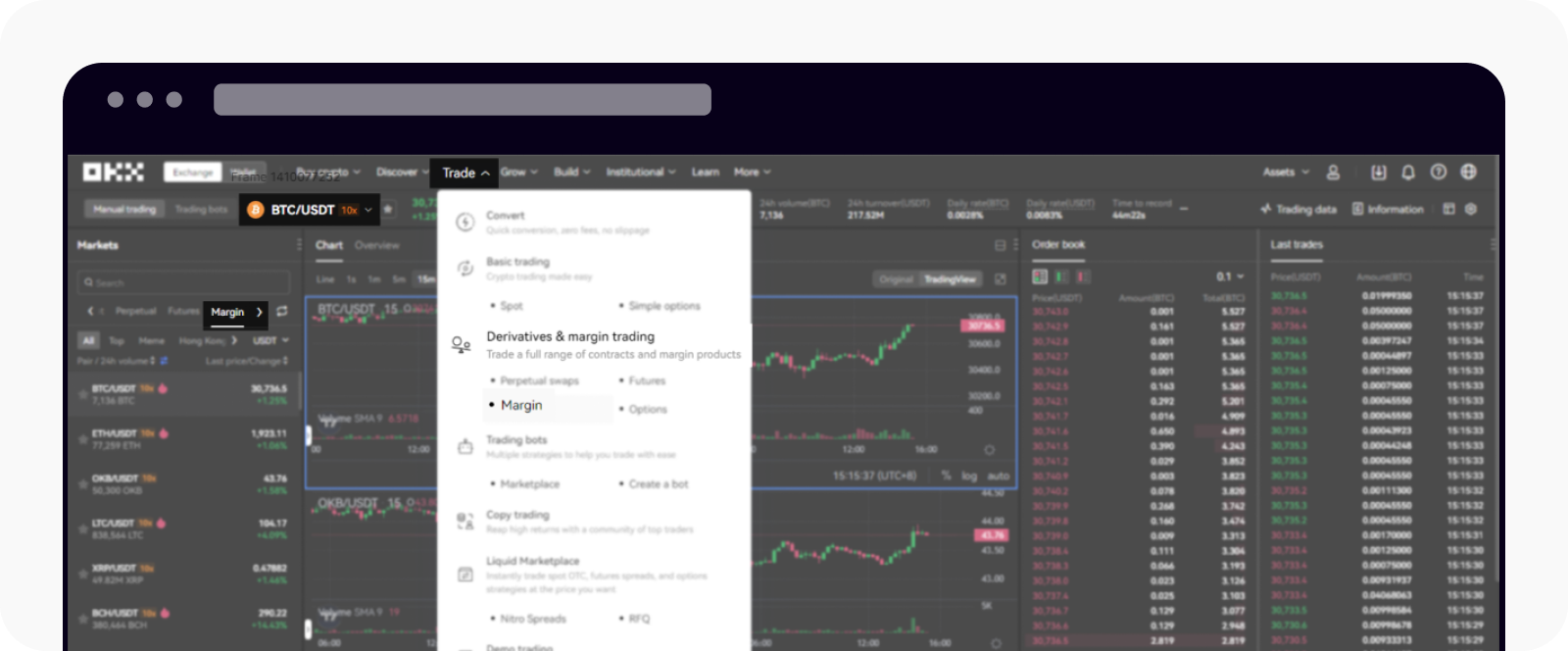

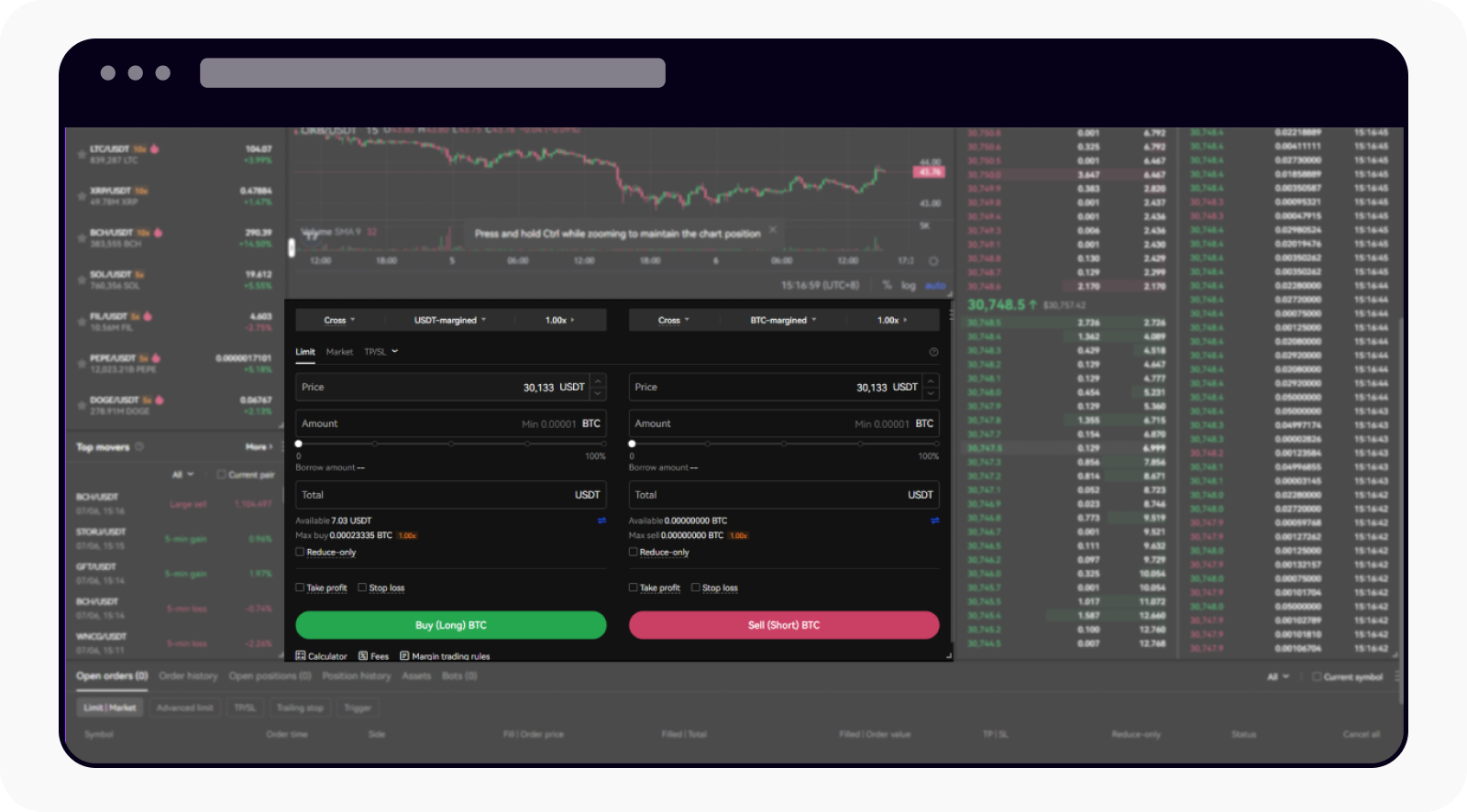

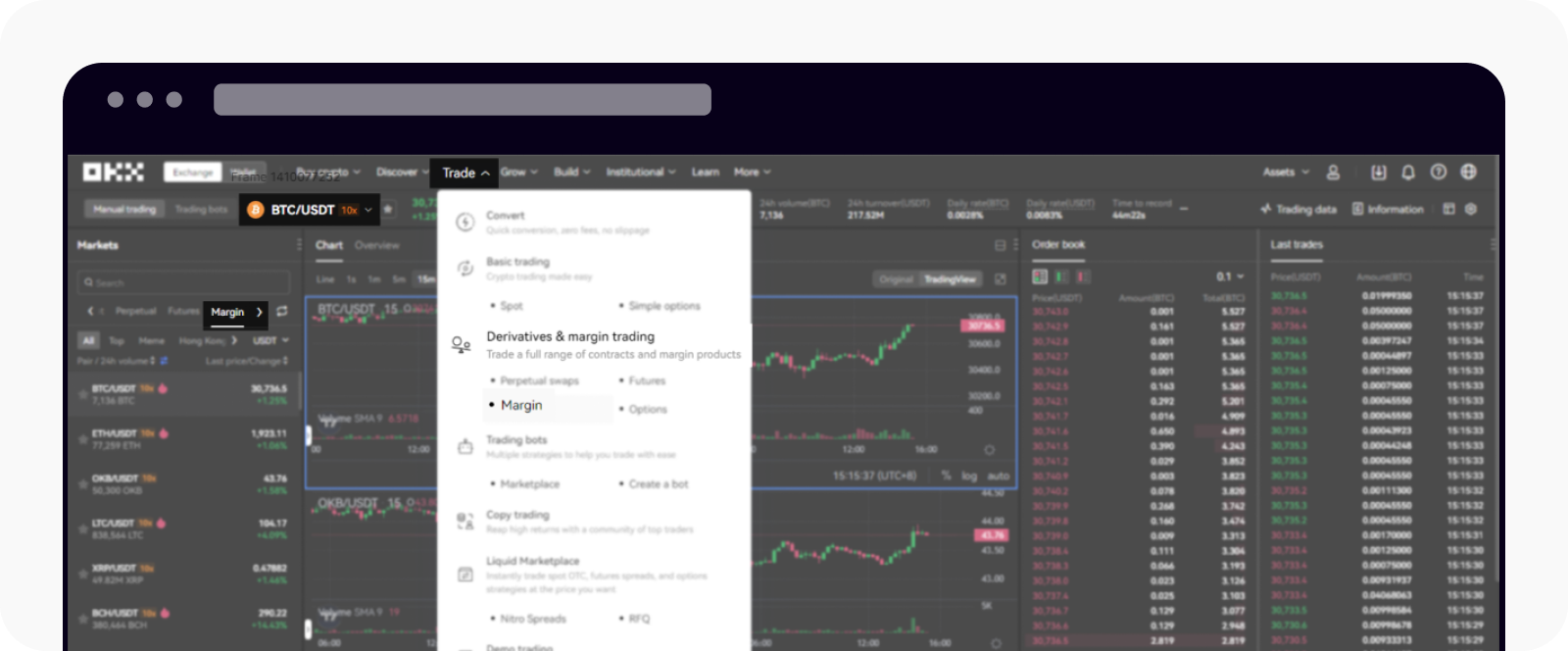

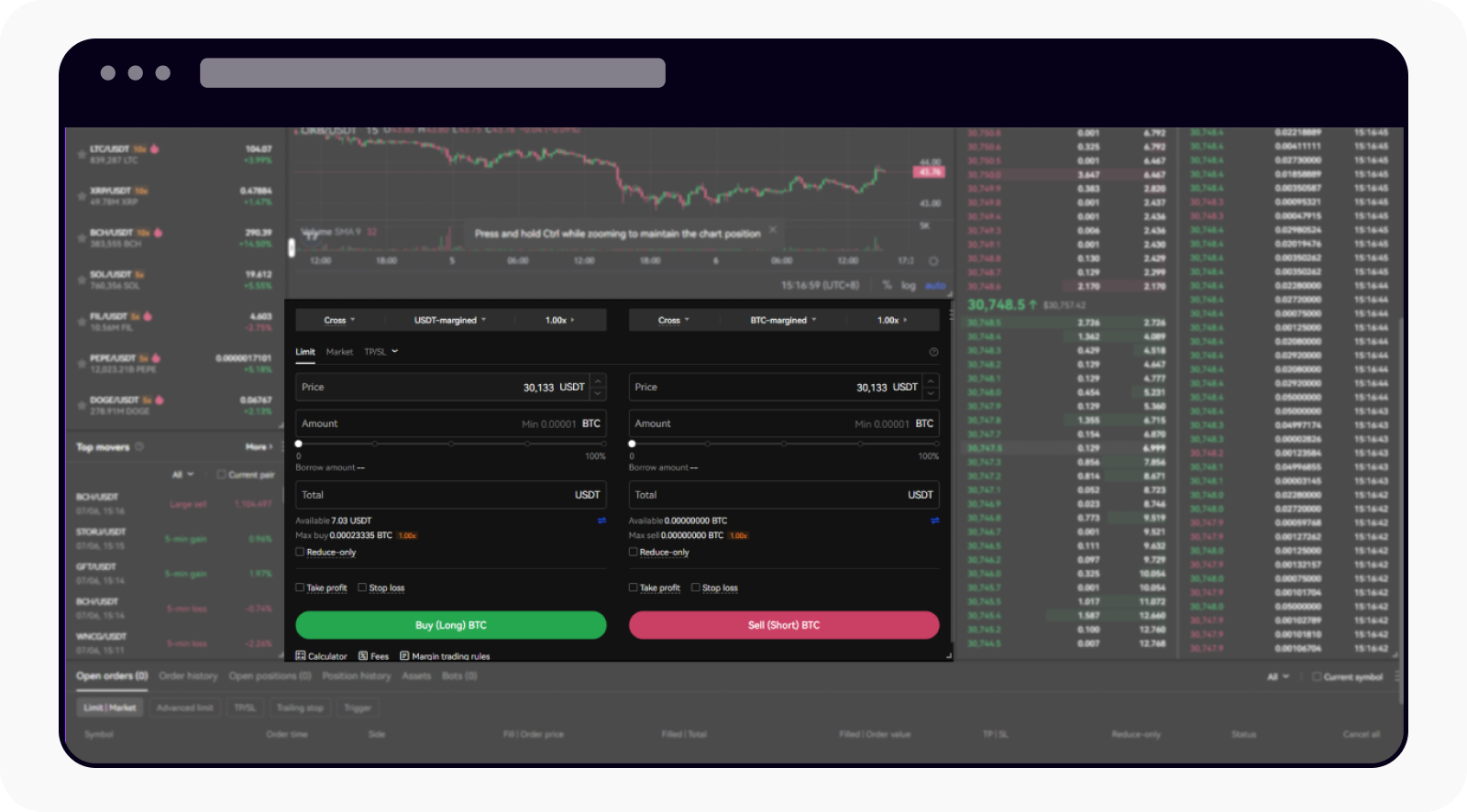

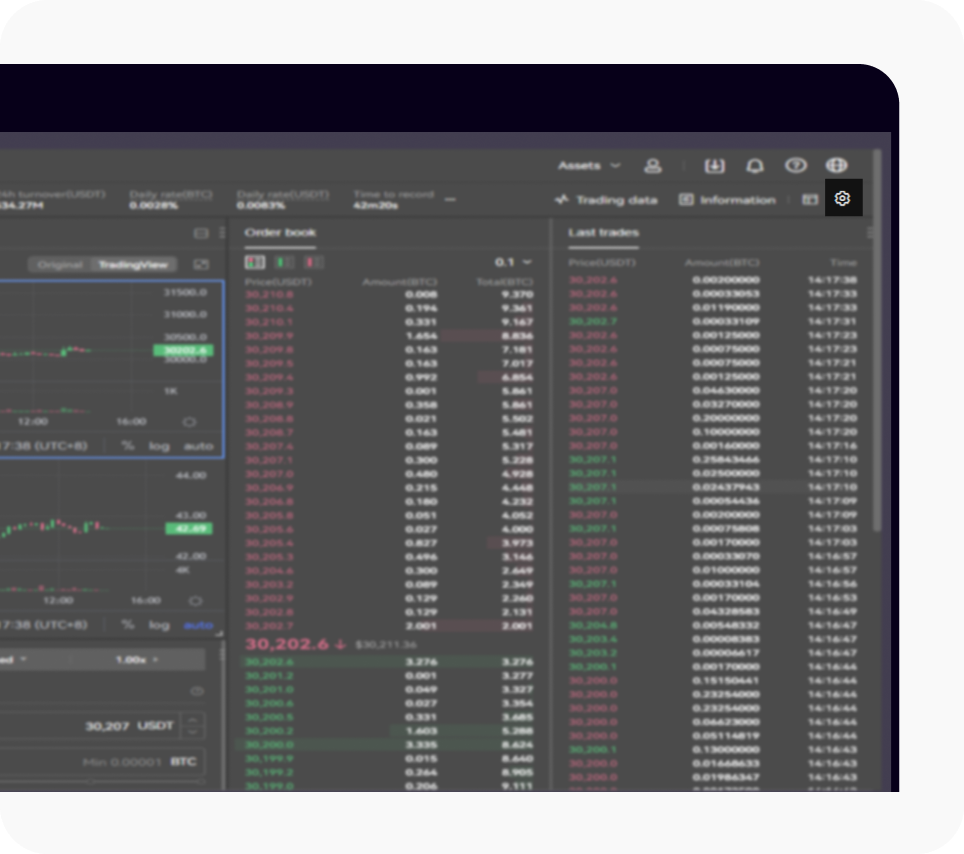

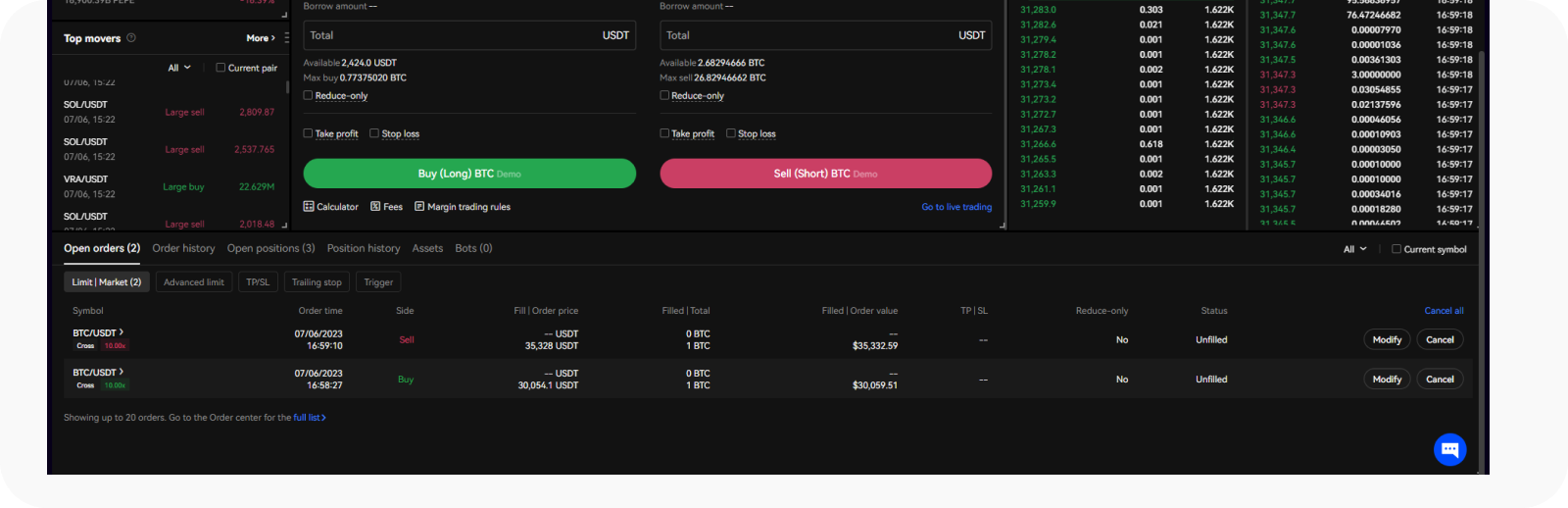

On the web

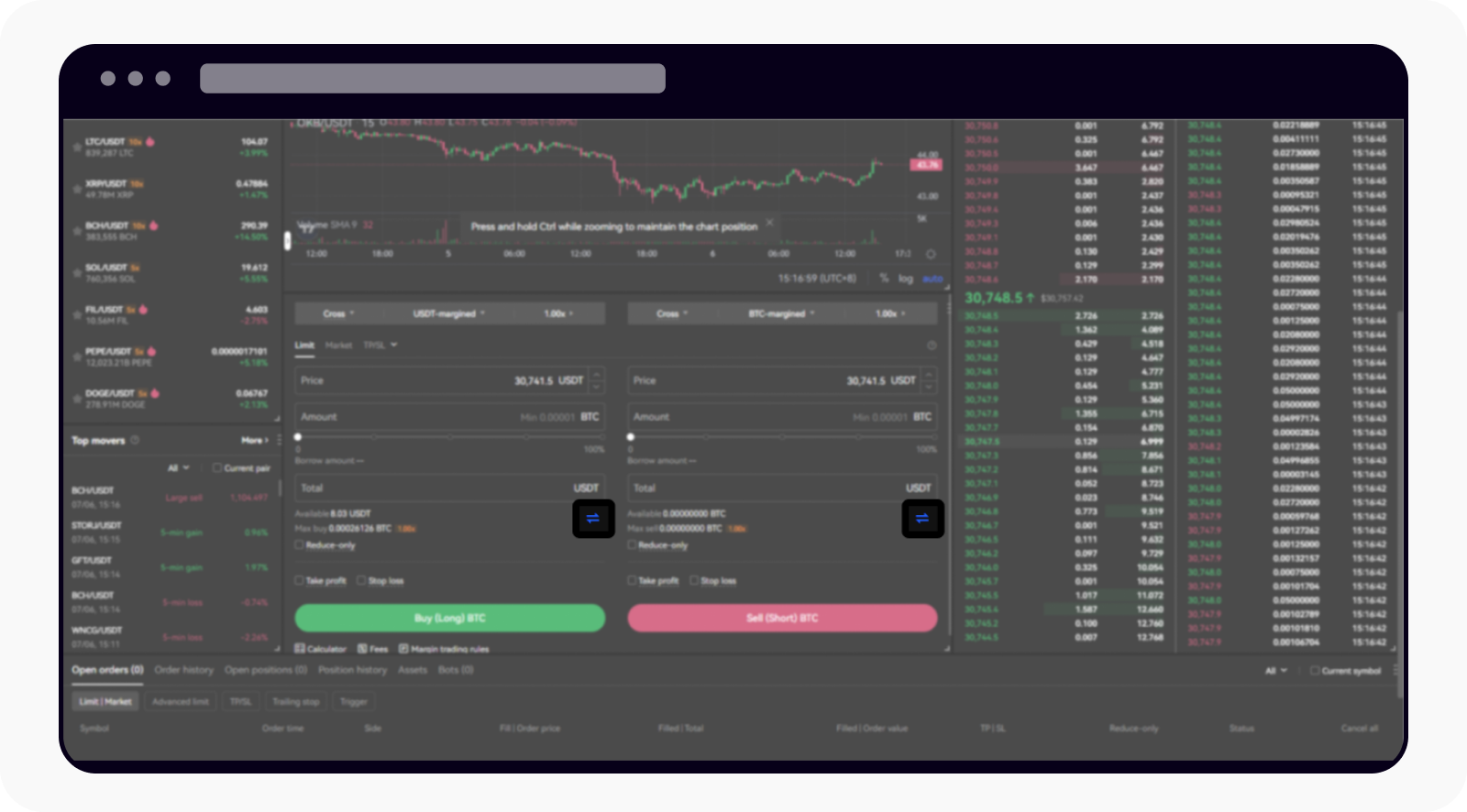

- Login to OKX website > Trade > Derivatives&margin trading > Margin

- Select the trading pair (e.g. BTC/USDT) you would like to trade and ensure you selected Margin under Markets

- Select Cross/Isolated margin mode and leverage that you would like to trade

- Select Limit / Market / TP/SL to enter your expected price and amount according to your need

- Select Buy (Long) / Sell (Short) Token to confirm your order

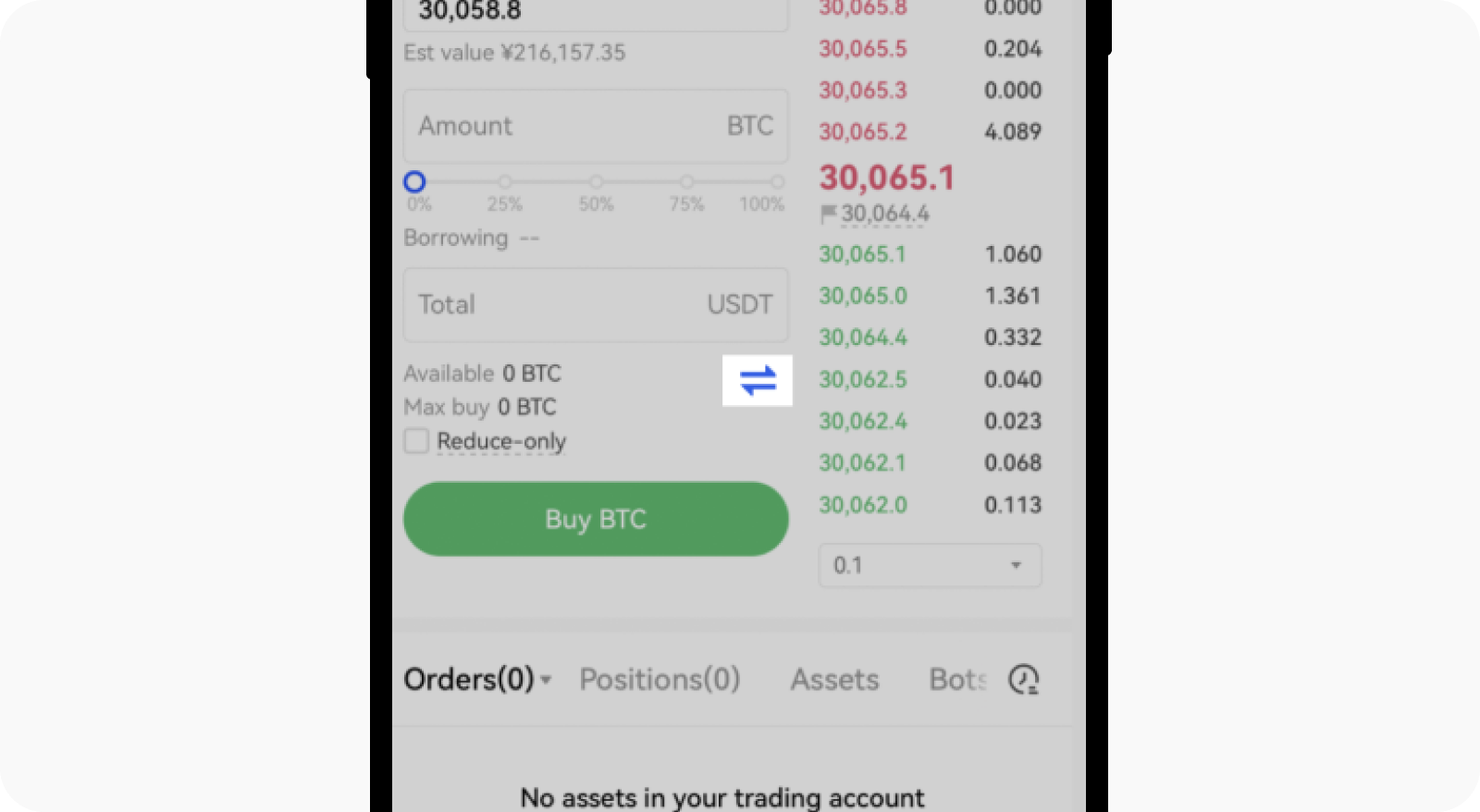

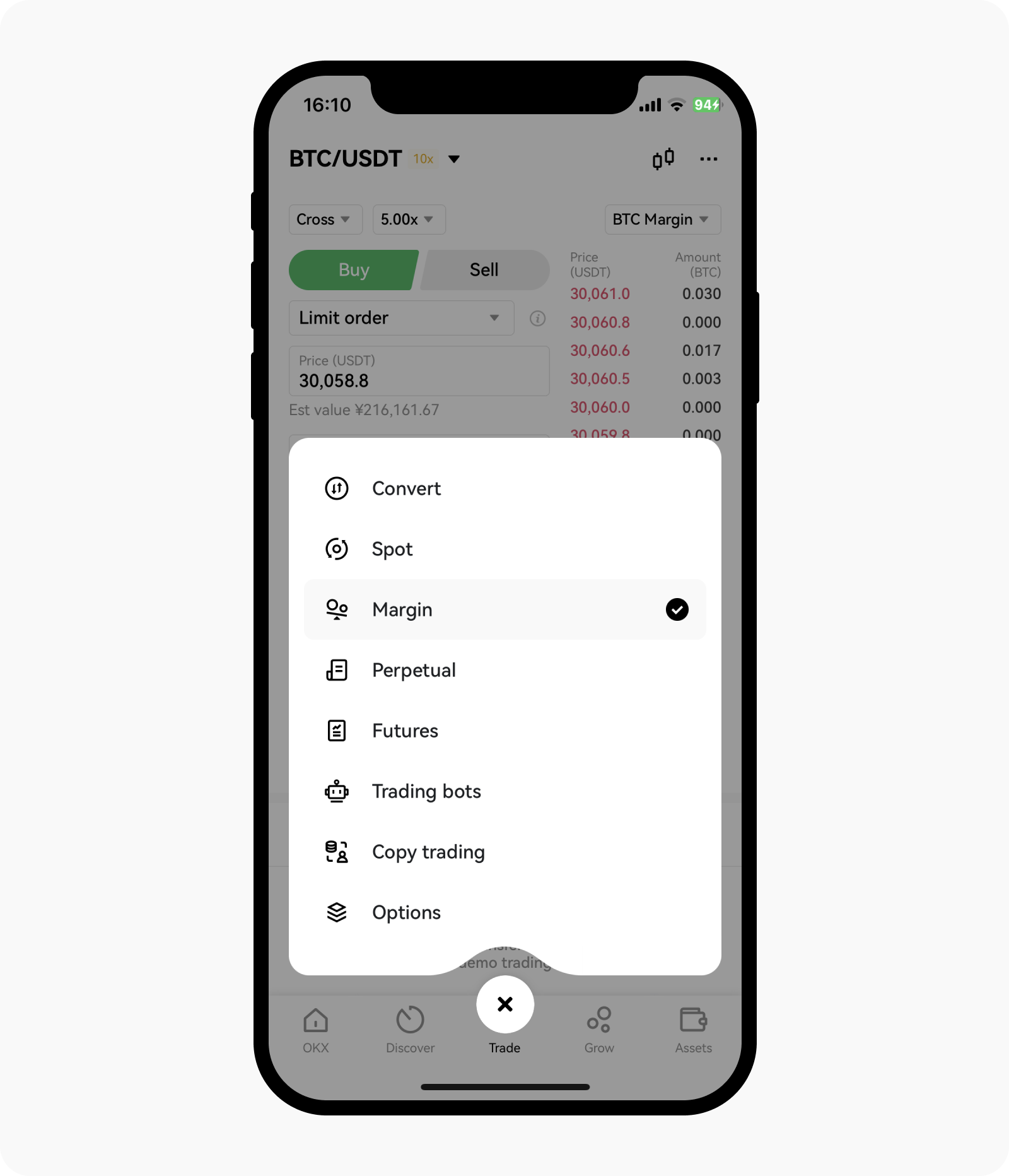

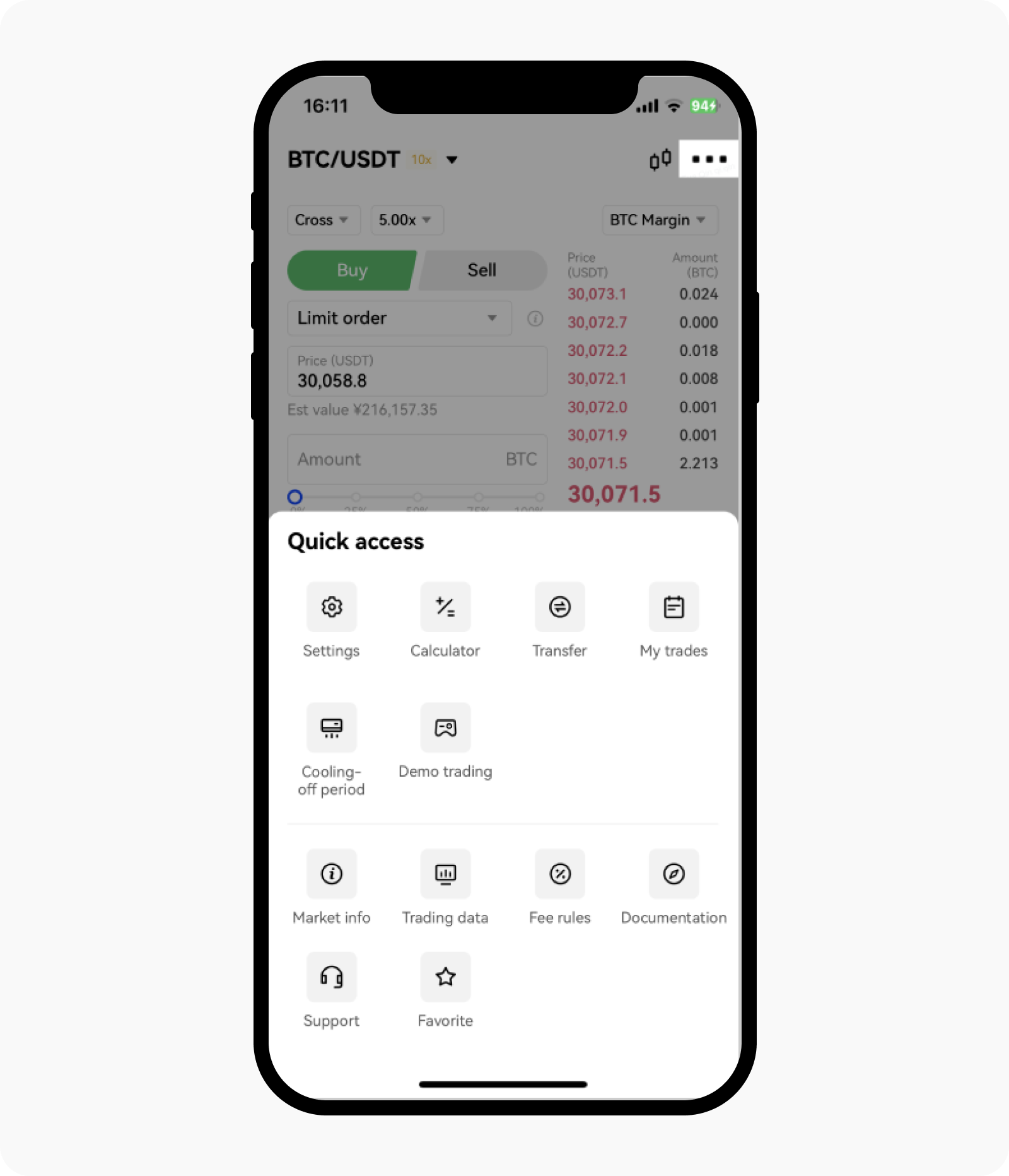

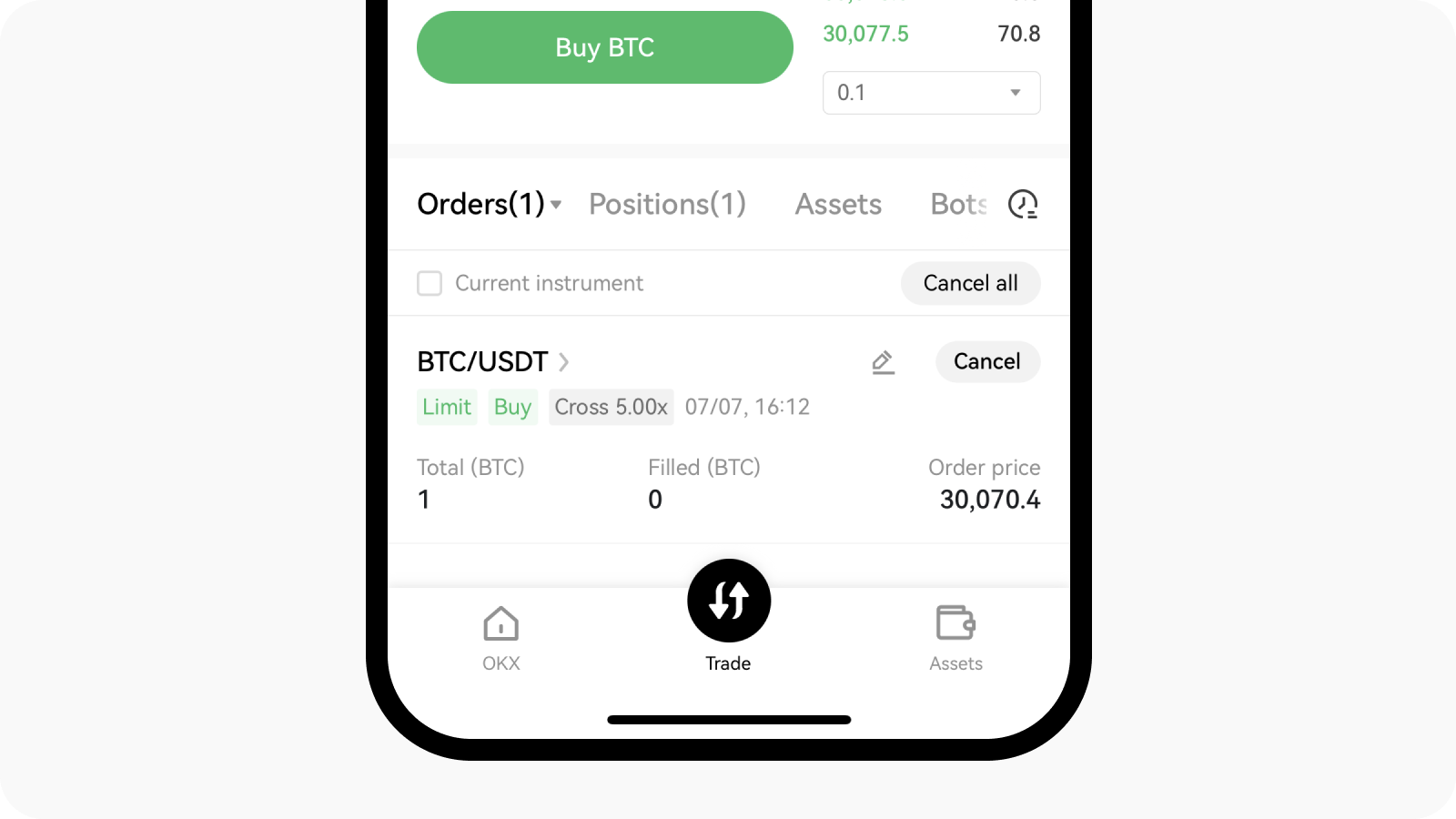

On the app

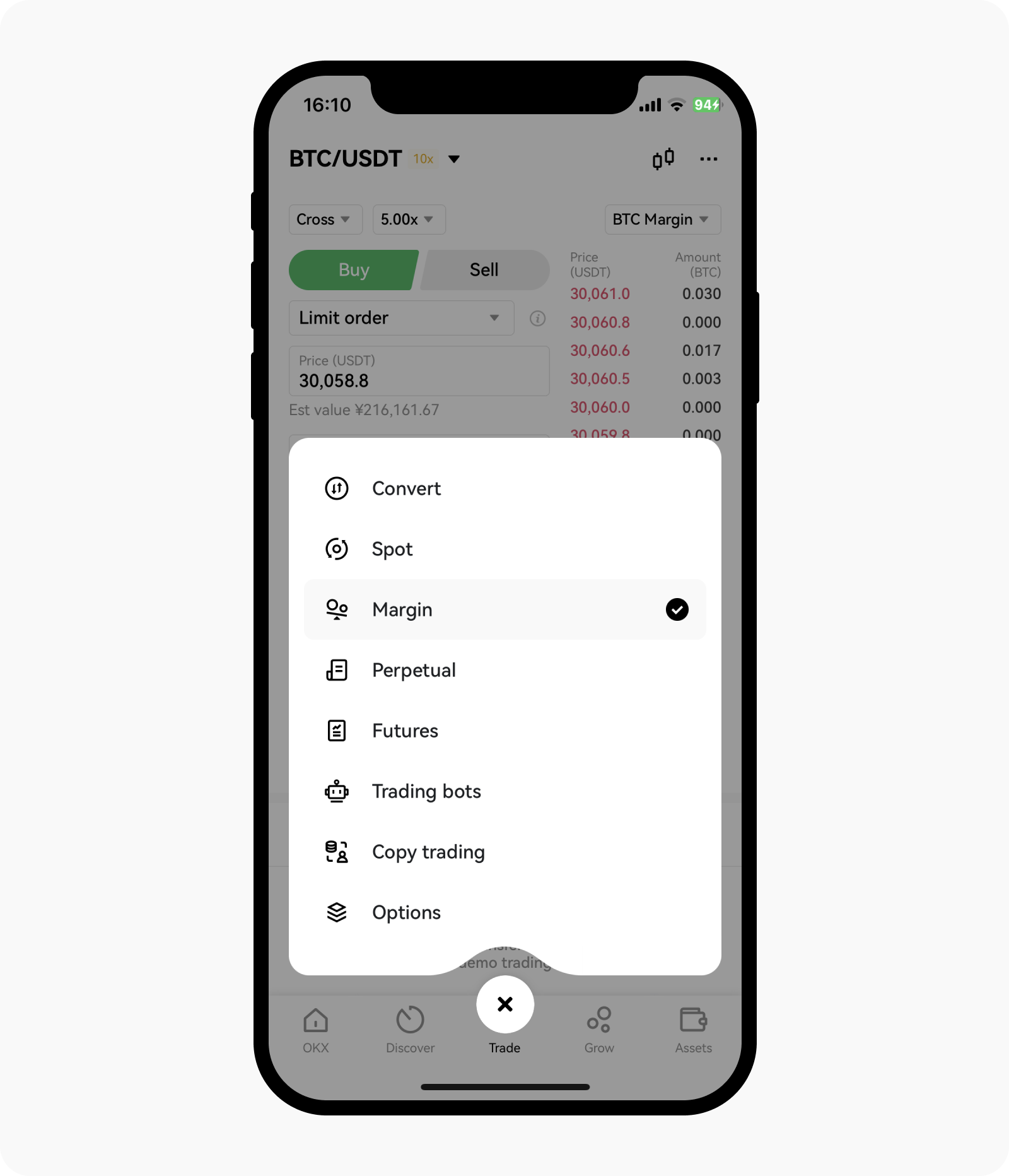

- Open your OKX App > Trade, and select a trading pair that you would like to trade

- Select Cross/Isolated margin mode and leverage that you would like to trade

- Select Limit / Market / TP|SL to enter your expected price and amount according to your need

- Select Buy / Sell Token to confirm your order

How do I change account settings?

Select Settings on Trade > Margin page, you can set your Account mode, Isolated margin transfers.

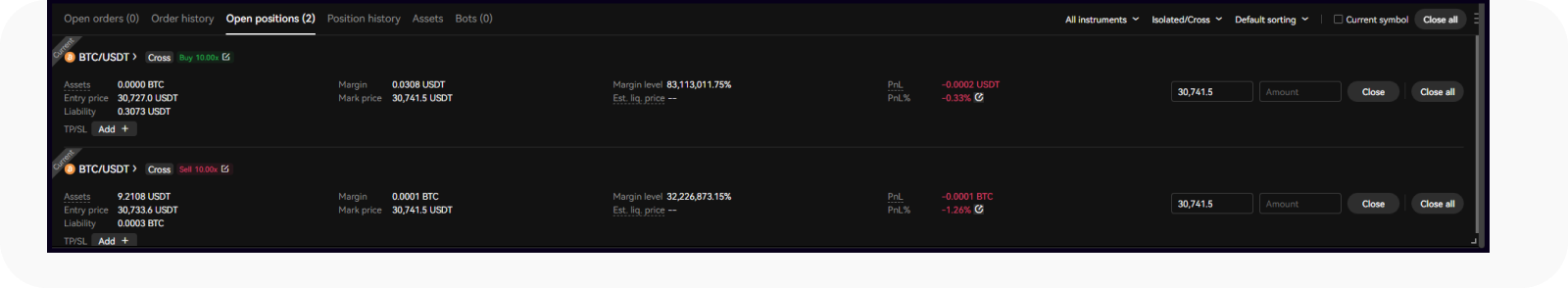

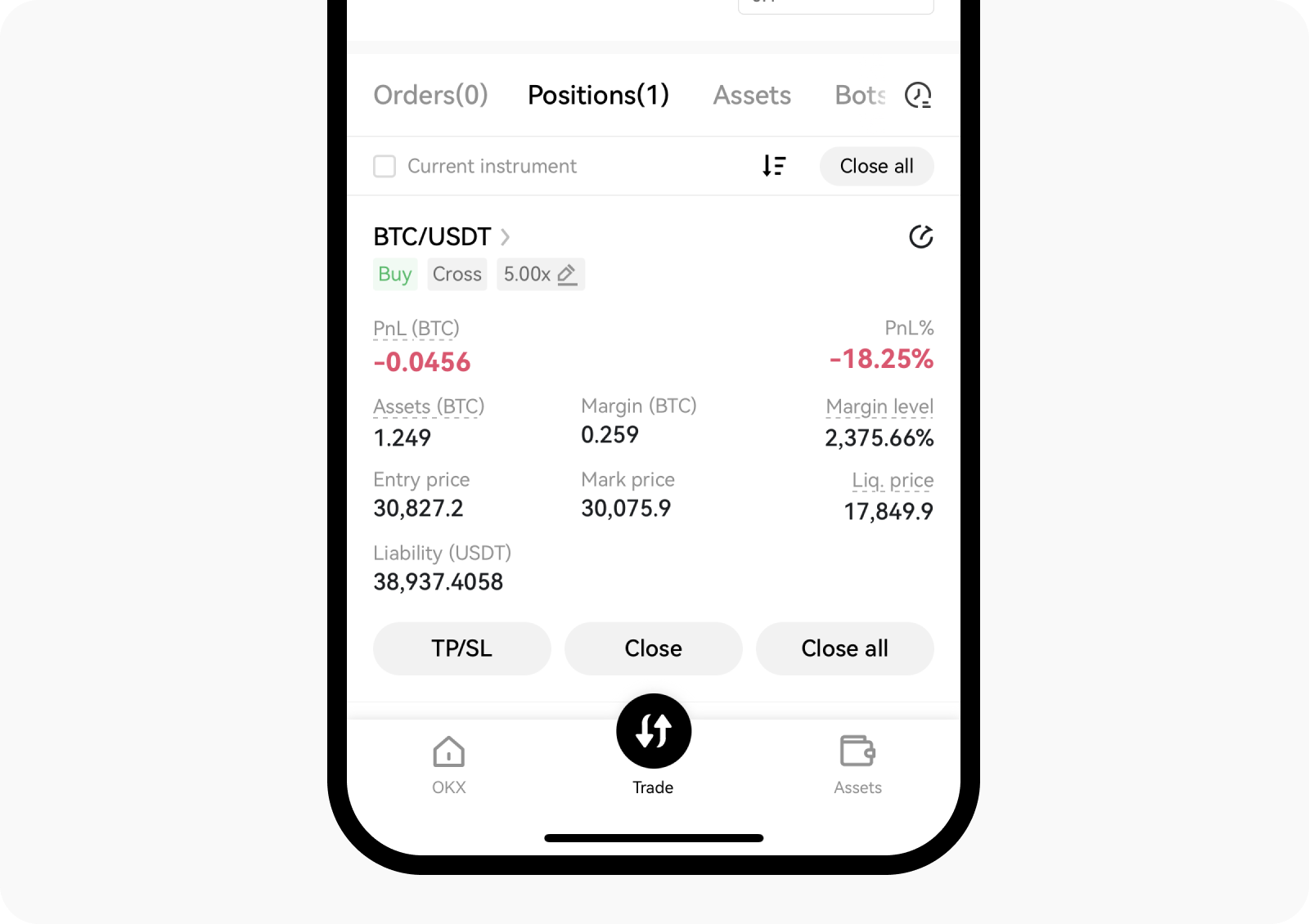

How do I close positions?

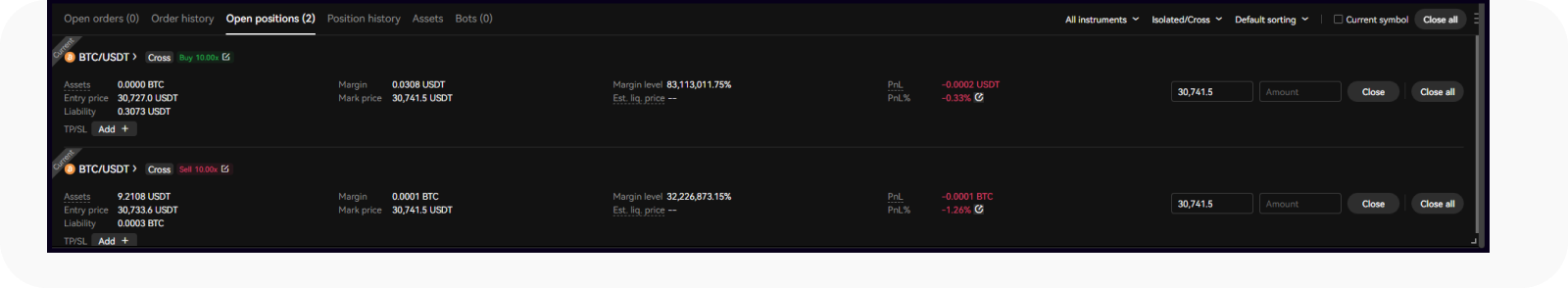

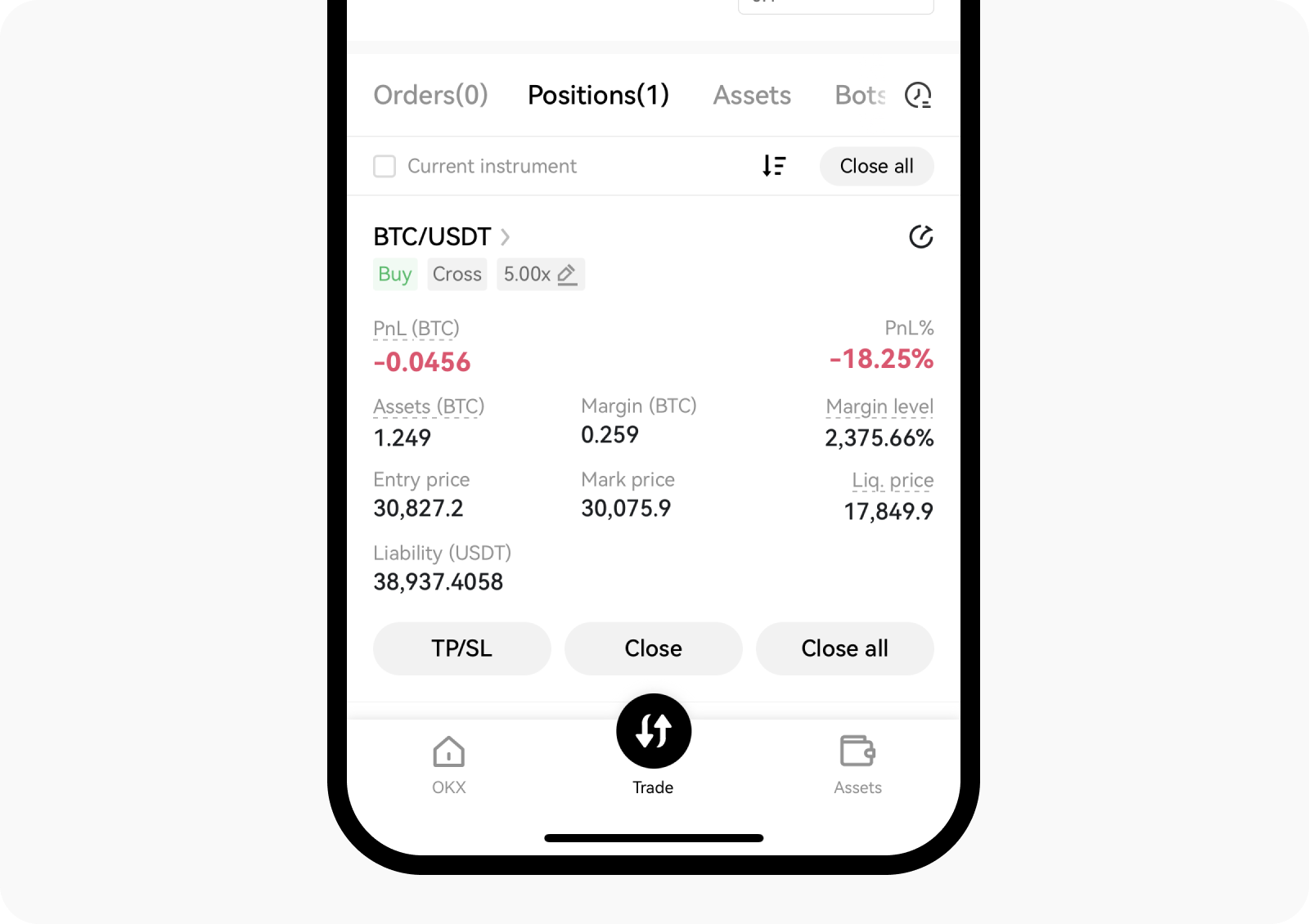

- Select Open positions and find the position you would like to close

- Enter the Price and Amount to Close the position

You can also Close all to quickly close all the positions or add TP|SL to take profit or stop loss in time.

Note: if there is a market fluctuation happening, orders might remain unfilled.

How do I check open orders?

You can select Open orders to check current unfilled orders, and you can also Modify or Cancel it.

Notes

- Under the Cross and Isolated margin mode, interest will be incurred when there are liabilities generated.

- The liabilities incurred under cross/isolated margin mode will be accrued and deducted separately.

- Interest is accumulated and recorded on the hour. It'll take 5 minutes to record accrued interest. Any liabilities that are incurred during this period will be recorded as well. For example: when the user borrows crypto at 22:55, the interest will not be recorded. At 23:00, the interest is calculated through interest-bearing debt, and at 23:00, the interest is deducted. If the user returns the debt at 22:57, no interest will be generated.