I spent last weekend reading the new #MEV research from @Sei_Labs, and it completely resets how I think about L1 design.

MEV has already stripped more than $1.3B from Ethereum users, and #SEI GIGA is a good one to fix it.🧵

1/ To understand why #SEI’s approach is different, we need to look at where MEV actually appears.

MEV bots scan it, detect profitable opportunities, inject frontrun/backrun bundles, and manipulate ordering.

A single proposer then builds the block, reorders transactions, sandwiches, or steals value.

MEV gets extracted, and the user loses money.

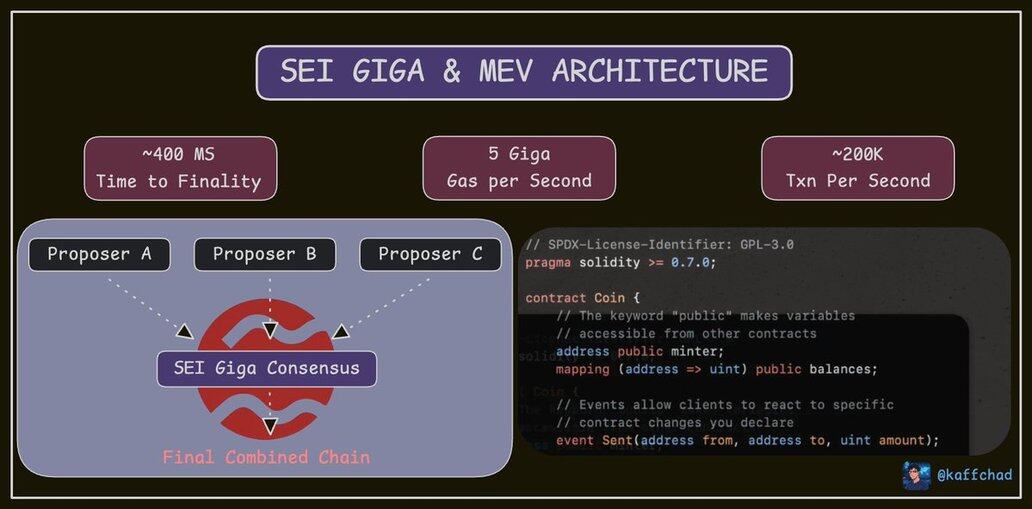

#Sei Giga flips the old model with #MCP (Multiple Concurrent Proposers).

Instead of one proposer controlling the entire block, several proposers publish blocks in the same tick.

Here’s what that looks like in practice:

User transactions flow to

→ proposer A, Proposer B, Proposer C

→ each proposer builds its own block (Block A, Block B, Block C)

→ SEI Giga’s consensus merges them into a single final chain.

A parallel block pipeline replaces the single choke point that created classic MEV.

MCP introduces new MEV dynamics, tx stealing, proposer timing games, proposer-to-proposer auctions.

here’s the breakthrough:

Sei Labs formalized them and showed they are bounded.

Predictable MEV is fundamentally safer for users and markets.

Bounded MEV is exactly what high-volume systems need: perps, options, RWAs, credit markets, arbitrage engines.

You can’t build real financial infrastructure on top of unbounded extraction.

If Sei succeeds, the beneficiaries are the traders, the liquidity providers, and every user who interacts with real onchain markets.

MEV becomes contained instead of weaponized.

Market moves faster on $SEI. ($/acc)

17,95 k

174

Le contenu de cette page est fourni par des tiers. Sauf indication contraire, OKX n’est pas l’auteur du ou des articles cités et ne revendique aucun droit d’auteur sur le contenu. Le contenu est fourni à titre d’information uniquement et ne représente pas les opinions d’OKX. Il ne s’agit pas d’une approbation de quelque nature que ce soit et ne doit pas être considéré comme un conseil en investissement ou une sollicitation d’achat ou de vente d’actifs numériques. Dans la mesure où l’IA générative est utilisée pour fournir des résumés ou d’autres informations, ce contenu généré par IA peut être inexact ou incohérent. Veuillez lire l’article associé pour obtenir davantage de détails et d’informations. OKX n’est pas responsable du contenu hébergé sur des sites tiers. La détention d’actifs numériques, y compris les stablecoins et les NFT, implique un niveau de risque élevé et leur valeur peut considérablement fluctuer. Examinez soigneusement votre situation financière pour déterminer si le trading ou la détention d’actifs numériques vous convient.