I took out $Meta Call last night, from -30% deep water to reverse profit of 18%, yesterday I really wanted to stop the loss, but it reversed unexpectedly, and the stock market was koi again

As of today, the overall performance of this round of U.S. stock earnings season is average, with good performance opening high and low and even falling in reverse, such as Netflix and TSMC, with average performance and unstoppable decline

There is only one reason, the current market position is too high, the capital expectation is also very high, and the continued rise requires better performance and profits, obviously in the context of the current macro environment, once there is no higher performance expectation, it is inevitable for funds to take profits and run away, so the expectations for this earnings season can be lowered.

After Intel's financial report came out, it was actually not that bad, data center and AI revenue both exceeded expectations, but the gross profit was a bit low, and the chip foundry business did not improve much.

The reason for the after-hours sharp decline is actually not so important, the original market expectation did not think that Intel's performance would improve, Intel's investment logic, mainly the reversal of the predicament, the current barely 1 times PB, this is obviously a bankruptcy valuation, is Intel bankrupt? Obviously not

My confidence in Intel comes from the background of Chen Liwu, I think Intel's foundry business will slowly get better, TSMC has absolute bargaining power in the foundry industry chain, which is not a very good thing for Broadcom and Nvidia, if Intel's technology can really approach TSMC's process, there will be no shortage of orders.

BTC has fallen below the 5-day line and the 10-day line, I think that like the logic of US stocks, the momentum demand for funds to take profits is very strong, and the data refers to @Murphychen888

The follow-up of BTC should be a volatile trend, and the pressure to continue to rise in the short term is very high, after all, the money-making effect of US stocks is also very low, and the funds have gone to Nvidia, Broadcom, and companies that sell shovels with greater certainty.

Last night's operation was also synchronized, the position was opened $UNH and $AEHR, currently in the trap, just looked at A-shares, Tianqi came out of the trend of shock upward, Goertek is still shocking, it is said that the industrial Fulian is at a record high, Goertizer is fighting for breath.

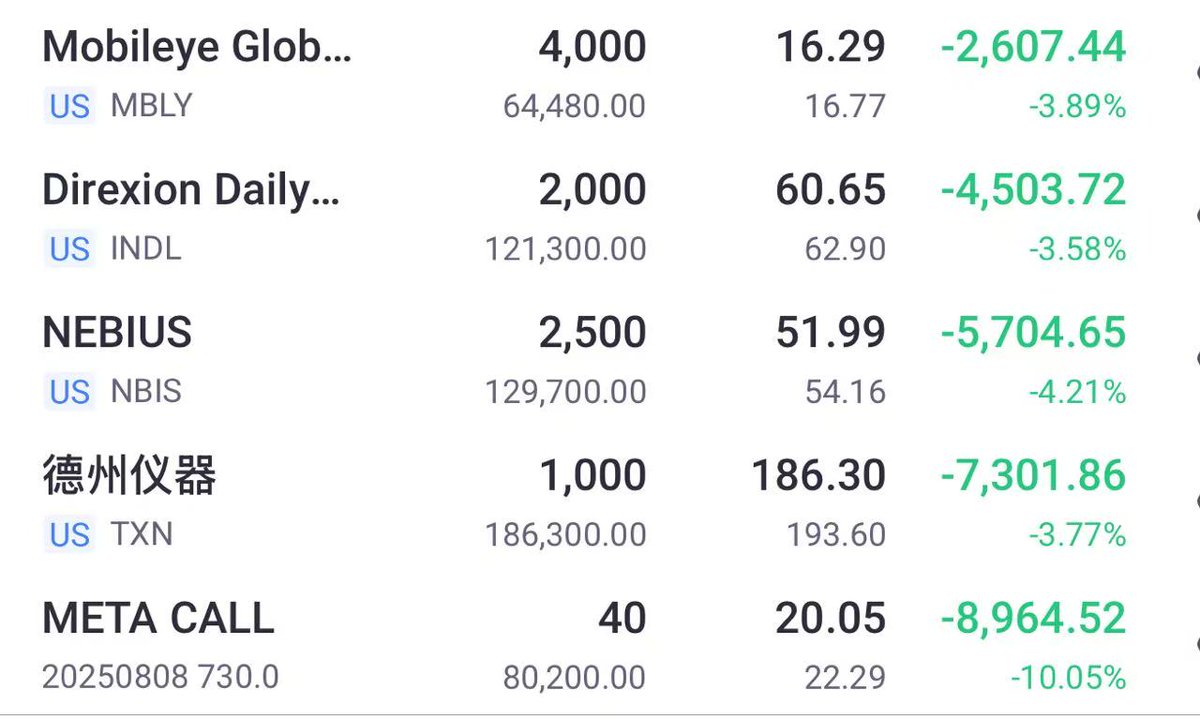

A brief review of the phased trading ideas, the positions are as follows: there are both profits and losses.

So far this year, the profit return on Pony.ai and Broadcom is the most, especially Broadcom, from 185 to 280 liquidation, in the year before the year, it was said that the expected target price for Broadcom was 300, but unfortunately it was not held.

Pony has made 4 trades this year, and each time I think it's not bad, until yesterday I saw a fan following me to be a pony, he was accurate every time, and I really admire those technical indicators.

The biggest loss is the following Meta Call, which once lost $20,000+, and now only wants to recover its capital

At present, the position is mainly long gold mine, intelligent driving (AI applications bet on this field), coal cycle, chips and Apple long, the small-cap strategy is used to defend, and the Indian index is betting on the United States and India to reach an agreement

After this earnings season, it will gradually reduce its position, and then move to medical care (UNH) to bet on the midterm elections and the revision of the Beauty Act in the field of medical insurance

Let's talk about yesterday's financial reports of Google and Tesla, Google's financial reports are very good, and the financial report information reveals a lot, in addition to revenue and profit exceeding expectations,

The capital expenditure forecast for 2025 was raised by $10 billion to $85 billion, and I think this information is the most important in Google's earnings report

It means that Google continues to choose to continue to increase investment, and Meta, Microsoft and even Apple have to follow up, which means that AI chips (Broadcom, AMD and Nvidia) are more certain, and it would be great if they could wait for a wave of big pullbacks.

Tesla's financial report, the performance is not much to say, there is nothing to say, it can only be said that it is getting worse and worse, and the current fundamentals are even worse than Tesla's stock price range of 200-250 a few months ago.

Musk said on the phone that Tesla is in an unusual period of transition and may face several difficult quarters. 330's stock price is largely priced in robotaxi and optimus, but now the pace of Robotaxi is not expected to be too fast, and the AI business will not have an immediate effect in the short term.

Tesla still has a sea of stars, but it would be more appropriate to treat it as an emotional stock now.

Finally, let's talk about Apple, I think the probability of Apple's earnings report exceeding expectations is very high, and Google's earnings report adds a little certainty to me. Apple's revenue is 90 billion yuan and net profit is 20 billion, so there should be no surprises.

Apple is similar to Google, with a strong ecological moat, Apple's AI business is indeed very slow and crotch-pulling, which has been expected by the market, and the stock price also reflects this expectation

My Apple stock price target is 240, and now it's 214, well, Broadcom's lesson can't happen.

25.67K

52

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.