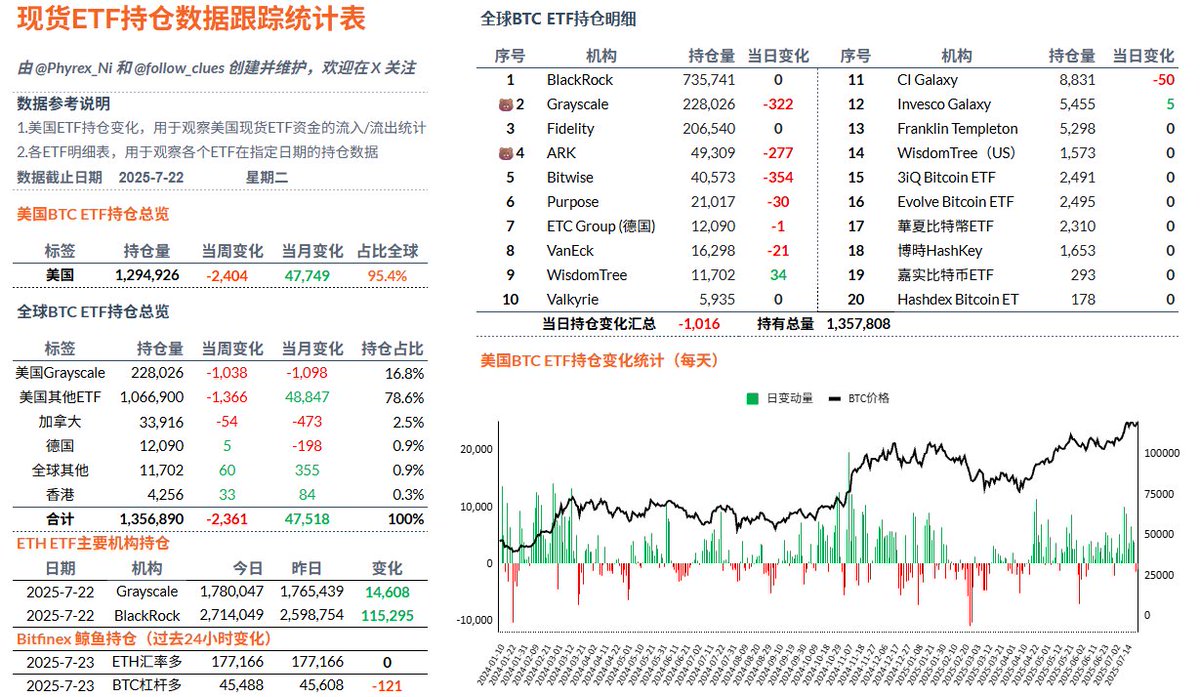

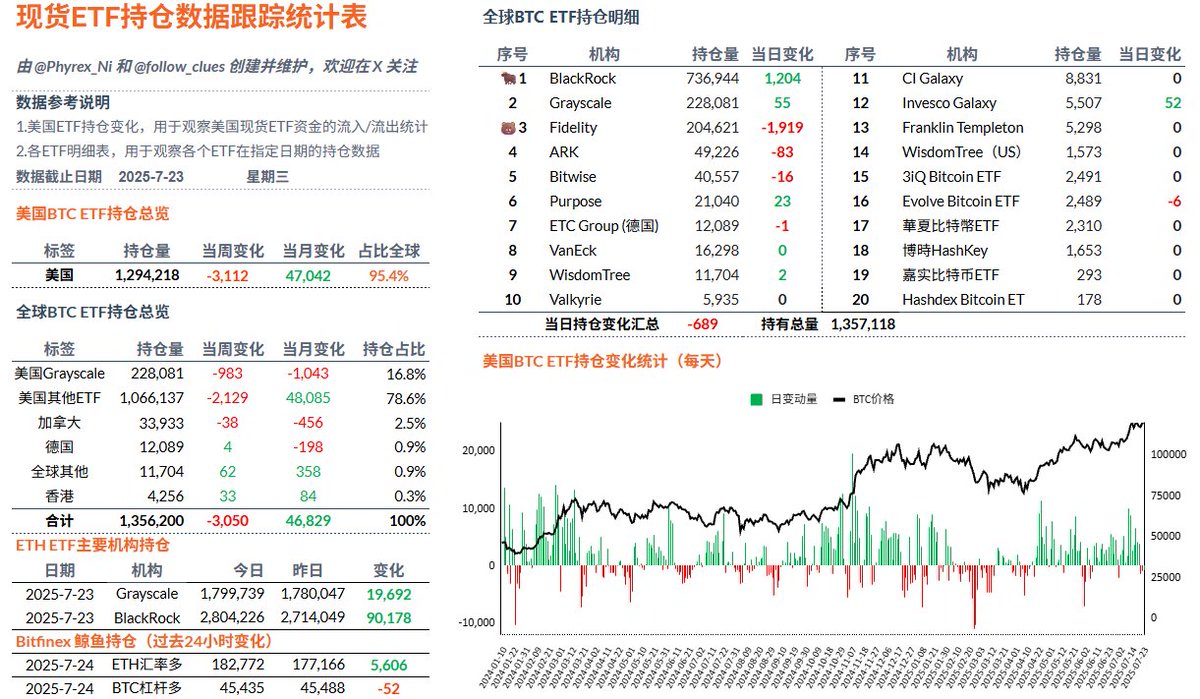

周三的 $BTC 现货 ETF 也不是很好,连续第三天出现了净流出的情况,即便贝莱德的投资者有了超过 1,200 枚 Bitcoin 的流入,也被富达将近 2,000 枚 BTC 的流出给打败了,当然除了富达的流出稍微多点,其它机构的数据也都可以忽略不记了。

最近两天虽然是流出,但流出量并不算多,应该是处于较为正常的水平,部分的投资者已经解除了 FOMO 状态,但并未出现大量抛售的情况,主要还是维持观望。

数据地址:

本文由 #Bitget | @Bitget_zh 赞助

76.93K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.