Midnight tokenomics are similar to those of $EOS, which was once dubbed the "Ethereum killer." However, EOS ultimately failed precisely because of those tokenomics.

While EOS allowed users to access resources for free by staking tokens, this approach backfired as the network became more active. Competition for limited resources (CPU, NET) led to price surges that priced out small users, and the structure requiring users to manage these complex resources themselves created a terrible UX.

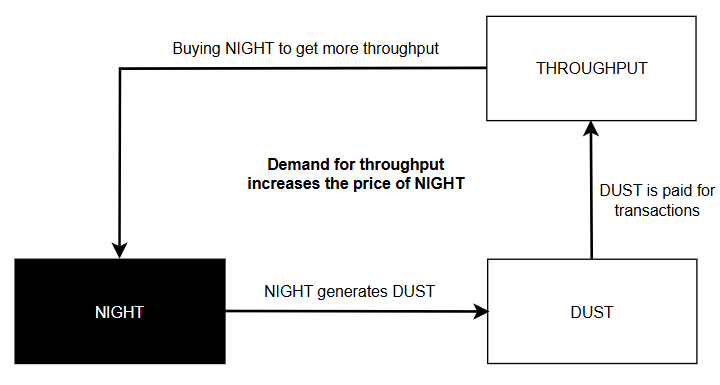

In contrast, @MidnightNtwrk directly addresses these problems. It eliminates the complex resource competition, resolving the issue with an intuitive relationship between 'NIGHT' and 'DUST'. As demand for the network increases, so does the need for DUST, which in turn naturally creates an incentive to hold NIGHT tokens, thus proving its clear utility.

Of course, unforeseen challenges may arise in the future. Reflecting on the history of EOS, it will be crucial to improve the model quickly if similar problems emerge. This agility will be key to ensuring that Midnight's model remains truly intuitive and sustainable.

Midnight has great tokenomics:

▪️NIGHT generates DUST

▪️You need DUST to pay fees

▪️You use the network for free, you don't spend NIGHT

▪️To use Midnight more, you need to buy more NIGHT to generate DUST faster

▪️The demand for using Midnight increases the demand for NIGHT

4.66K

59

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.