Recently, I've been seriously looking into Orderly's staking mechanism and found that changing to issuing esORDER is quite a clever design.

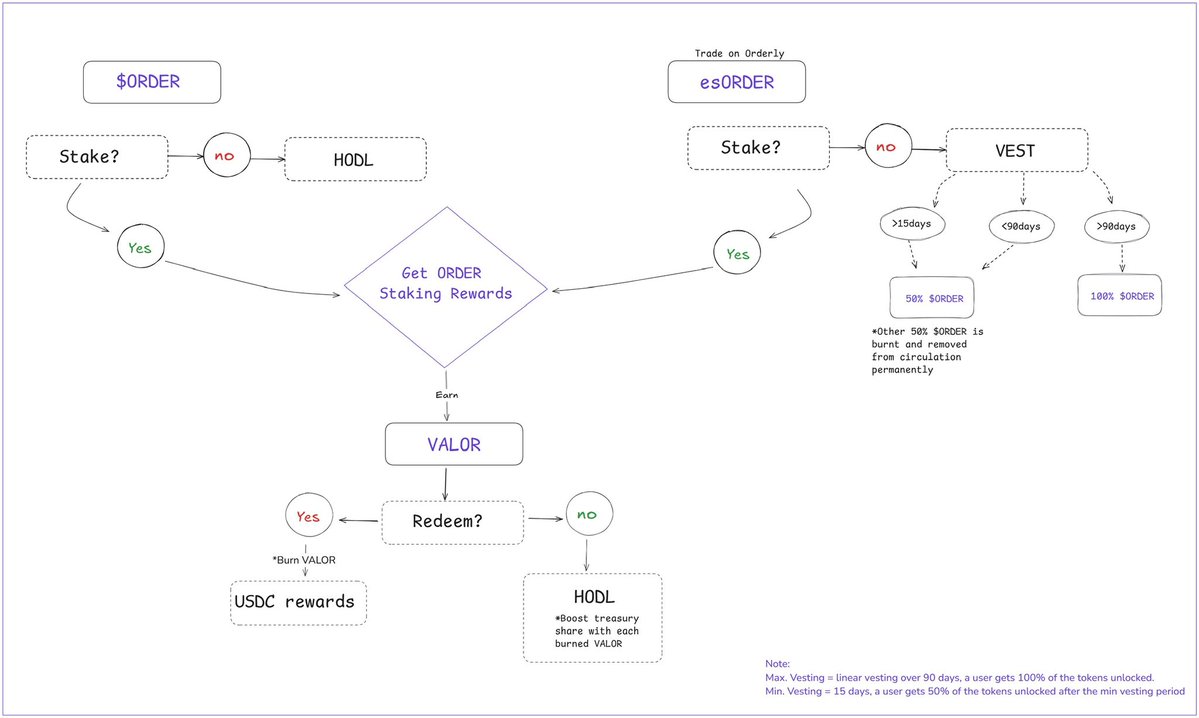

In simple terms, what used to be received from trading or market-making was $ORDER, but now it has changed to issuing esORDER. With this esORDER, you can:

※ Stake it to earn VALOR (which is the yield indicator of the protocol's USDC reserves)

※ Or choose to vest (50% after 15 days, 100% after 90 days, and if you don't, half will be burned)

This design is quite well-balanced; short-term arbitrage can't directly dump the price, while long-term participants can earn more rewards and benefit from the buybacks and the supply reduction from burns!

Moreover, the VALOR earned from staking is not just air; it can be exchanged for USDC, settled every two weeks. Each time you exchange, the system will burn the corresponding VALOR, making what others hold even rarer!

The most amazing part is that this is genuinely based on the protocol's revenue, not relying on emissions, and it doesn't require competing on who can issue more~

You can stake $ORDER, or you can stake esORDER, or even choose to vest and burn; in short, every choice points towards gaining a bit more share of the protocol, not just pure free-riding!

I will continue to follow this area; structurally, I think it's very good!

Show original

14.99K

176

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.