Stablecoin Market Flashes Hard-To-Ignore Bullish Signal, What It Means

Stablecoins are supposed to be boring, but right now, they might be sending a big signal. In the past week alone, over $3 billion in the stablecoin market have left exchanges.

At first glance, this looks like money leaving crypto. But when you zoom out, the data tells a very different story.

Supply Is Growing Even As Stablecoin Reserves Drop

In the past 7 days, more than $3 billion worth of stablecoins have been pulled off centralized exchanges.

That means users are moving coins out of Binance, Coinbase, and other big platforms and putting them somewhere else.

Usually, when stablecoin leave exchanges, it’s seen as a sign that people are not planning to sell crypto soon.

Instead of keeping coins ready to trade, they’re moving to wallets or DeFi apps, or even withdrawing to cold storage.

This trend has now continued for six weeks in a row, one of the longest withdrawal streaks in 2025. But here’s the twist: while coins are leaving exchanges, the total supply of stablecoins is going up.

Right now, the total stablecoin supply is $268 billion, the highest it’s been all year. That’s a 5.2% increase in just 30 days.

So more coins are being minted or issued, even though fewer are staying on exchanges. It shows that people are still bringing money into crypto, just not leaving it idle on trading platforms.

Ethereum Still Dominates, but Capital Is Moving Across Chains

Ethereum remains the main home for stablecoins. In just the past 24 hours, $691 million worth of stablecoins were added to Ethereum.

That’s more than all other chains combined. This means users still trust Ethereum for DeFi, trading, and yield farming.

But it’s not just Ethereum.

Other chains like Aptos, Tron, and Arbitrum also saw stablecoin inflows. These networks are often cheaper and faster than Ethereum.

Many users are bridging coins to these chains to access low-fee trading, new token launches, or early DeFi opportunities.

For example:

- Aptos has become popular for fast swaps and new apps.

- Tron has long been used in Asia for low-cost USDT transfers, especially in peer-to-peer markets.

- Arbitrum, an Ethereum Layer 2, is used heavily for perpetuals and yield farming, thanks to platforms like GMX.

When stablecoins move into these chains, it usually means users are preparing to trade, earn yield, or rotate into risk assets. And that is bullish for the broader crypto market.

Yield-Bearing Stablecoins Are Winning the Liquidity Wars

One major reason stablecoin supply is rising is the growth of yield-bearing stablecoins. These are coins that pay you extra yield (like interest) just for holding them.

Right now, USDe is leading this trend. It has added $2.73 billion in supply since July 18. That’s more than USDT and USDC during the same period.

USDS and USDFalcon, two other yield-bearing coins, are also growing fast.

This is the first time in crypto history that yield-bearing stablecoins are growing faster than regular ones.

Why is this happening?

People want to earn passive income without moving into risky tokens. Holding USDe, for example, might pay 5–10% per year, way more than a savings account. It’s also easier than trading or staking.

This is the bullish shift: instead of selling crypto, traders are deploying capital more smartly, choosing stablecoins that work harder for them.

And with DeFi platforms like Pendle offering even higher yields on these coins, users now have many ways to earn without leaving the stablecoin world.

Big Picture: China Joins the Race, Stablecoin Market Outruns Visa

Outside of crypto, governments and big companies are also waking up to stablecoins.

China is testing its first stablecoin, launched through Hong Kong. The goal is to create a regulated, dollar-pegged token that can compete with US-led coins like USDT and USDC.

As Hong Kong sets up rules for stablecoin trading, China is clearly looking to expand into global digital finance.

This could change how capital moves in and out of Asia. It also shows that stablecoins are now seen as tools for economic power, not just crypto trading.

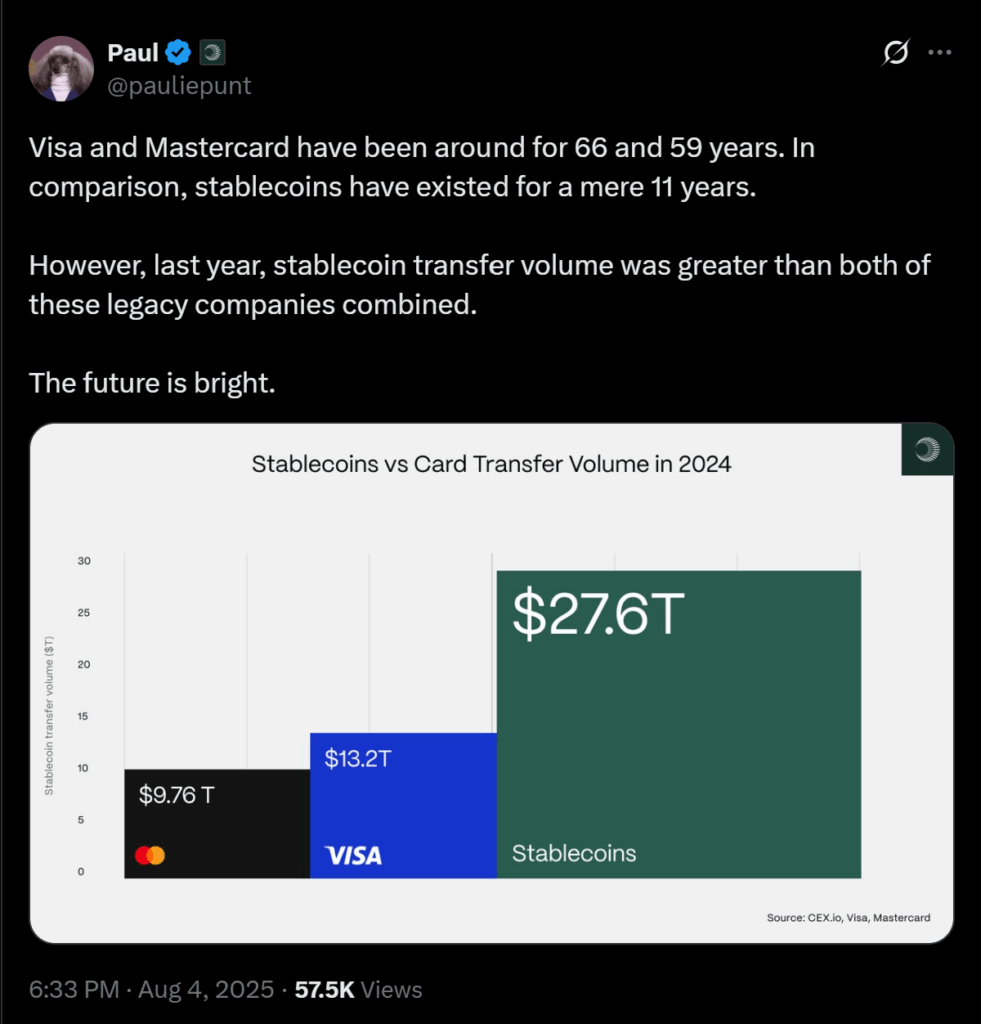

At the same time, stablecoins are outpacing traditional payment systems. In 2024, stablecoin transfer volume hit $27.6 trillion. That’s more than Visa ($13.2 trillion ) and Mastercard ($9.76 trillion) combined.

Stablecoins have only existed for 11 years, while Visa and Mastercard have been around for over 60 years. This proves one thing: stablecoins are growing much faster, and they’re here to stay.

Even as billions in stablecoins leave exchanges, it doesn’t mean the market is scared.

Instead, it shows a new kind of strategy: move coins to safer or higher-yield places, take advantage of on-chain opportunities, and wait for the right moment to act.

The post Stablecoin Market Flashes Hard-To-Ignore Bullish Signal, What It Means appeared first on The Coin Republic.