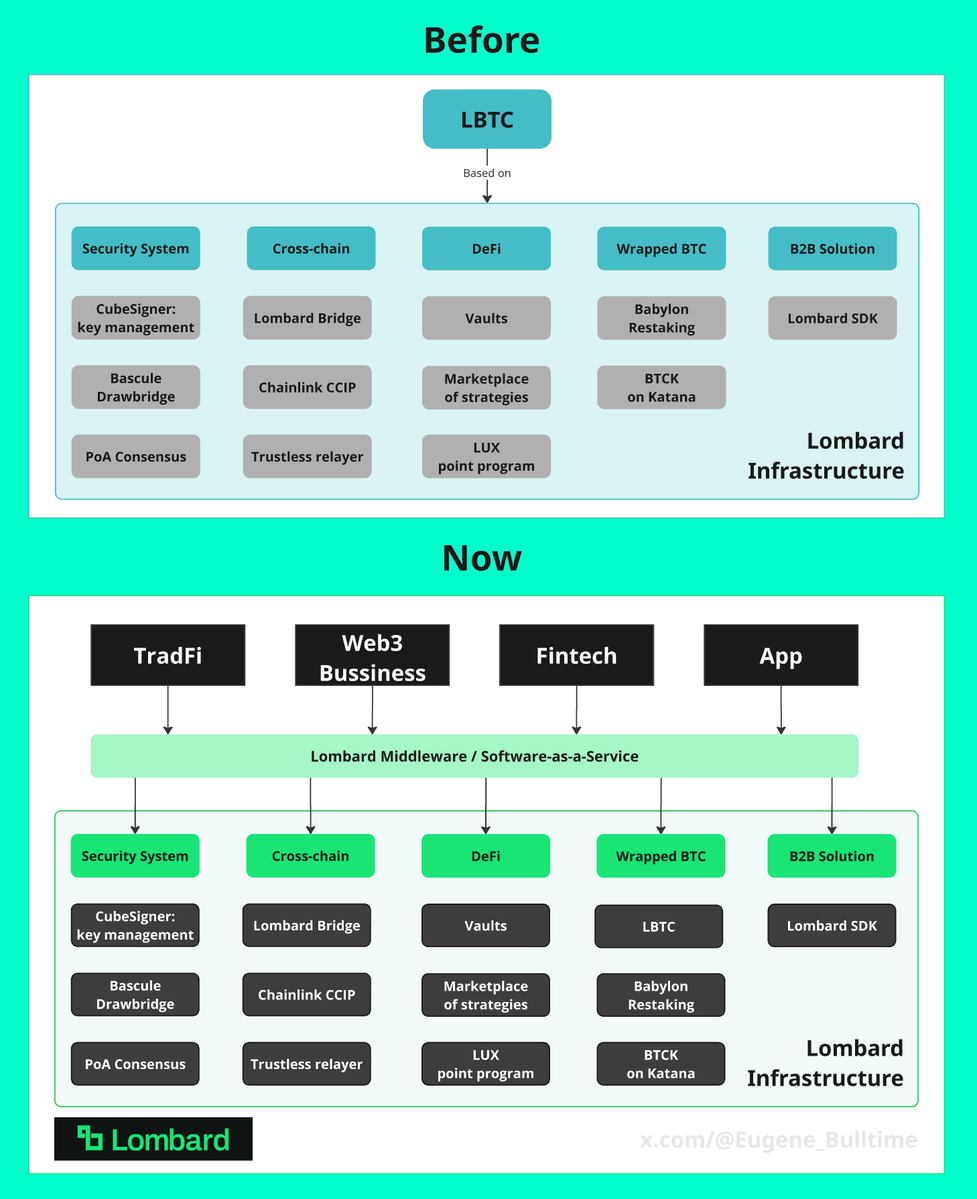

Look closely at the new concept

There are 2 things. Heavier and lighter.

1 thing - product.

This is the heavy part — the product evolution.

Originally, the entire infrastructure was built to support the growth of LBTC and BTCfi.

But now, @Lombard_Finance is shifting toward SaaS for B2B — and that’s a massive change in direction.

For months, I’ve said that Lombard’s long-term vision is to serve TradFi.

This is the moment that vision becomes real.

Many companies want to start working with Bitcoin, but they can't. This requires high expertise and a lot of resources. So now, they can delegate all this work to Lombard.

This turns Lombard into a Bitcoin middleware solution — a foundational layer for institutions and Web2 companies to build on BTC without touching its complexity.

The implications of this pivot are huge:

1. Market size expands by 100x

2. Lombard becomes independent of Babylon

3. No longer “just a protocol” — it’s a service provider

4. Project valuation and utility increase drastically

5. Strong positioning to become the core infrastructure of the BTC ecosystem

Before: “We build native DeFi products for Web3.”

Now: “We offer Bitcoin infrastructure and services for Web2 + TradFi.”

2 thing - Design

The picture clearly shows how the design has changed.

At first, I did not like the new design, but when I combined the old and new designs in one picture, I realized that the new one looks much cooler.

Of course, this is a subjective assessment

And what do you think about the new design and branding?

===========================

Also look to opinions of Lombard Ambassadors:

@theadvisorbtc

@0xCheeezzyyyy

@ProofOfTravis

@Jonasoeth

@dudu_bitcoin

@0xKaveh

@GemBooster

@marvellousdefi_

@BQYouTube

@0x_xifeng

@KazumaxCrypto

@sherrylab_

@10000BRC

@nas_dotcom

5.83K

90

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.