日报 | 币安 HODLer 空投上线 Bubblemaps (BMT);币安推出 Binance Alpha 2.0

Collation: Jerry, ChainCatcher

Important:

- Binance HODLer Airdrop Listing on Bubblemaps (BMT)

- Binance launches Binance Alpha 2.0

- Trump's Crypto Project WLFI Announces Completion of Token Sale Totaling $550 Million

- South Korean Financial Regulator Imposes 0.6% Regulatory Fee on Crypto Exchanges

- Cronos' proposal to restore the burned 70 billion CROs was voted on, and the voting process raised questions from the community Binance

- Alpha Launches TUT

- SlowMist: Four.meme Token Hackers Exploit Pre-Token Launch Vulnerability to Steal Liquidity

"What Important Events Have Happened in the Past 24 Hours"

Binance HODLer Airdrop Launches Bubblemaps (BMT

). According to the official announcement, Binance will list Bubblemaps (BMT) at 23:00 on March 18, 2025 (UTC+8), and open trading pairs for BMT/USDT, BMT/USDC, BMT/BNB, BMT/FDUSD, and BMT/TRY.

In addition, Binance HODLer airdropped and listed Bubblemaps (BMT). From 08:00, March 2, 2025 (UTC+8) to 07:59, March 7, 2025 (UTC+8), users who subscribe to CPI or On-Chain Earn products using BNB will receive airdrop allocations. The airdrop information is expected to be announced within 5 hours, and the new tokens will be distributed to users' spot wallets at least 1 hour before the start of trading.

Binance Launches Binance Alpha 2.0

According to the official announcement, Binance Alpha 2.0 expands Binance Alpha by integrating Binance Alpha directly into the Binance exchange, while still being available on the Binance wallet.

This innovative solution bridges the gap between centralized (CEX) and decentralized (DEX) transactions, improving liquidity, capital efficiency, and user accessibility.

Trump's crypto project WLFI has announced the completion of a token sale totaling $550 million

According to official sources, Trump's crypto project WLFI announced the completion of a token sale totaling $550 million, with more than 85,000 participants completing KYC verification. WLFI "Macro Strategy" also allocates a variety of digital assets in its Strategic Reserve Program, including BTC, ETH, TRX, LINK, SUI, and ONDO tokens.

The"macro strategy" may be used in part to support WLFI in funding innovative projects, fostering ecosystem growth, and creating new opportunities in the fast-growing DeFi space.

South Korea's financial regulator imposes a 0.6% regulatory fee on crypto exchanges

South Korea's Financial Supervisory Service (FSS) has required crypto exchanges to pay annual regulatory fees totaling 7.9 billion won (about $5.54 million), according to the Electronic Times. The fee was set at 0.6%, up from the initial projected 0.4%. These fees are due quarterly by the end of March, May, July and October each year. In addition to Korbit (whose operating income is less than 3 billion won, or about $2.08 million), the expenses are distributed as follows:

Upbit operator Dunamu will pay 6.7 billion won (about $4.64 million);

Bithumb paid 900 million won (about $624,000);

Coinone paid 150 million won (about $104,000);

Gopax paid about 21.35 million won (about $14,800).

The total fees of the four major exchanges are about 7.9 billion won (about $5.54 million).

Cronos' proposal to restore the burned 70 billion CROs was voted on, and the voting process raised questions from the community

Voting data on Mintscan shows that Cronos' vote on the proposal to restore the burned 70 billion CROs burned passed with 62.18% support, which proposes to restore the 70 billion CRO tokens burned in 2021 to build a Cronos strategic reserve, and will update the network parameters and token distribution in the Cronos POS V5 upgrade.

In addition, according to Un Chained, the said proposal had almost slightly more votes in favor than against by March 16, but at that time the quorum of 33.4% required for entry into force had not yet been reached. Towards the end of voting, 3.35 billion CRO tokens were added to the yes category, reaching a quorum and well above the maximum turnout.

According to the source, the votes in question came from large validators operated by Crypto.com (including Starship, Falcon Heavy, Electron, Antares, and Minotaur IV), which controls 70-80% of the total voting power. One token holder said on Telegram about the final result. "They (Crypto.com) voted almost at the last minute. Now they have created a precedent that other projects can follow. "

Binance Alpha Goes Live on TUT

According to the official announcement, Binance Alpha goes live on TUT.

SlowMist: Four.meme Token Hackers Exploit Pre-Token Launch Vulnerabilities to Steal LiquidityAccording

to SlowMist's monitoring, Four.meme Token has been used by attackers to exploit pre-launch vulnerabilities to steal liquidity.

An attacker uses Four.meme's 0x7f79f6df function to buy a small amount of tokens before they are released, and uses this feature to send tokens to an address of a PancakeSwap trading pair that has not yet been created.

This allows the attacker to create trading pairs and add liquidity without the need to transfer unpublished tokens, bypassing the transfer restrictions (MODE_TRANSFER_RESTRICTED) prior to the launch of Four.meme tokens.

In the end, the attacker successfully stole the liquidity of the pool by adding liquidity at an unexpected price.

"What are some of the best articles to read in the last 24 hours"

When, Where, and Right: Spring is Coming at CZ?

CZ: Compliance, meme, liquidity, I want them all.

"Forcibly" recast 70 billion CROs, decentralized governance reduced to a joke?

Heard of chain rollbacks, but have you ever heard of token "rollbacks"?

Can AI bots steal your cryptocurrency? Learn about the rise of digital thieves in one articleAI bots

stealing cryptocurrency, there are already victims, take a quick look!

In Search of the God of Bitcoin: A Reporter's Fifteen-Year Long Investigation of Satoshi Nakamoto

Satoshi Found Satoshi?

Dragonfly Partner: How did I miss out on investing in Solana's seed round?

Missing out on 3250x gains, one of the most expensive investment memos in crypto history.

Web3 AI's Innovation Puzzle: How to Find Your Way Under the Edge of Web2?

Some upstream distributed framework layers, some distributed trust frameworks and incentive network designs that Web2 is unwilling to touch, and component designs such as the implementation of interactive communication on the chain outside the agent computing layer are the points worth making efforts in Web3.

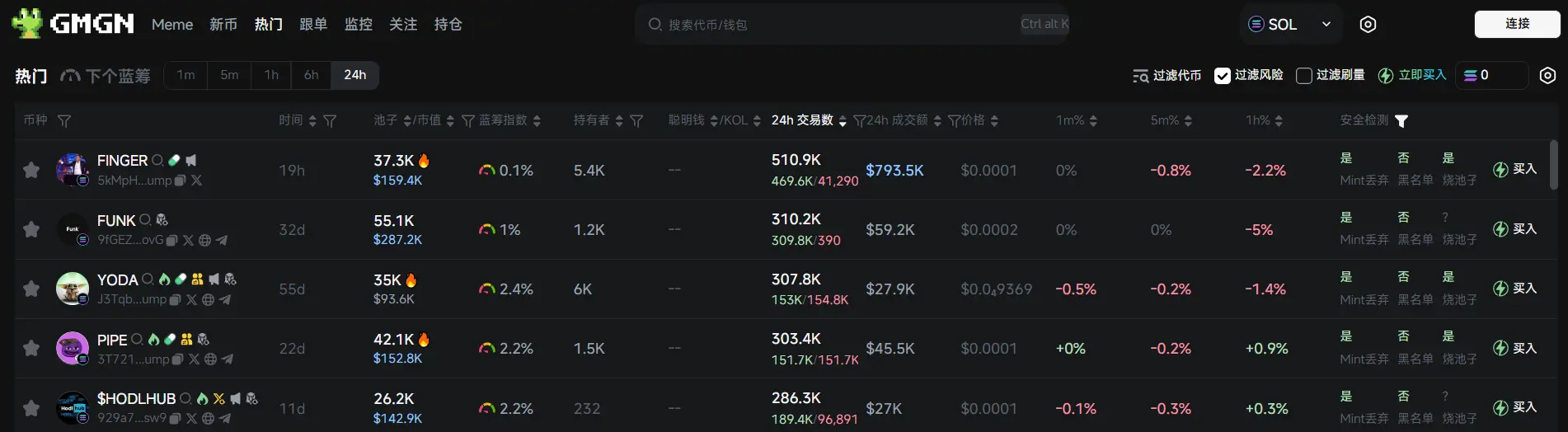

According to the market data of GMGN, a meme token tracking and analysis platform, as of 19:50 on March 18:

Thetop five popular Ethereum tokens in the past 24 hours are: DOPE, RFUN, NMR, PEPE, SPX

top five popular tokens of Solana in the past 24h are: FINGER, FUNK, YODA, pipe, $HODLHUB