Don't chase AI, don't buy memes, smart money makes money steadily on the Avalanche C chain

Author: 0xResearcher

In case you haven't noticed, Avalanche's C-chain has been hot again lately.

While most of the ecosystem's TVL is slowly declining and market topics are crowded with AI, restaking, and memes, the C-chain has quietly bucked the trend: active addresses have risen for three consecutive weeks, mainstream protocol TVL has risen again, and even the "forgotten" old project BENQI has made a strong comeback.

At the same time, Avalanche has launched a Visa virtual card, Core Wallet supports gas-free, and on-chain infrastructure continues to upgrade – all of these signs hint at a fact:

The value of infrastructure is being repriced.

And smart money has already quietly been on the bus. They don't tell stories, they don't chase the wind, but they are always ahead of others.

What is "smart money"? Not the richest, but the longest

Many people think that smart money is the "whale", but in reality, the "smart" ≠ has the largest wallet, but the long-term win rate is the highest.

Their three magic weapons:

-

Bet calmly, not greedy, not afraid: not aggressive in a bull market, not pessimistic in a bear market. Only those who can pass through the three rounds of bulls and bears are called alive.

-

Risk control first, revenue last: I don't care how explosive the APY is, I only care about whether the protocol code has been reviewed or not.

-

The chain is transparent and the liquidity is controllable: if you are not afraid of locking up, you are afraid that the lock will not tell you; I'm not afraid of falling, I'm just afraid that there is no place to check the data.

These people are more like a hybrid of fund manager + hacker in Web3: they understand both financial modeling and smart contract code. Usually he doesn't talk much, but when he makes a move, he often becomes the vane of ecology. The recent surge in liquidity like BENQI is one of the choices these "quiet smart people" make on-chain.

The "hedging posture" of smart money: if you don't go crazy, you will be "Buddha"

In the second half of 2024, when the market was volatile and sentiment was sluggish, smart money began to lay out stable income agreements.

For example, the old project BENQI:TVL in the Avalanche ecosystem soared to $520 million, of which the $sAVAX of Liquid Staking reached nearly 10 million AVAX, which is a new high almost every day.

What they chose was not a coin that "can rise tenfold", but:

-

APR stable: currently around 5.2%

-

Reusable assets: sAVAX can participate in lending and staking, without affecting liquidity

-

The mechanism is clear and transparent: no bells and whistles

-

User-friendly: It's easy for non-technical users to get started

You may not see it, but the on-chain data doesn't lie: there are addresses that convert AVAX to sAVAX for several days in a row, and then use it for lending and recycling, totaling more than $1 million. This combination of "income-mortgage-compound interest" is a typical "fear of death but not idleness" strategy of smart money.

Not an outcast, but an ace

Many people mistakenly believe that Avalanche's push of subnet multi-chain means that the main chain C-Chain will be marginalized. But the reality is that the C-chain is becoming the core of infrastructure construction.

Take a look at these "big moves of silence":

-

Avalanche Visa virtual card online: USDT / USDC / AVAX can be used for direct consumption, and even Alipay can be linked.

-

The Core wallet supports gas-free operation: the threshold for the new user experience is greatly reduced.

-

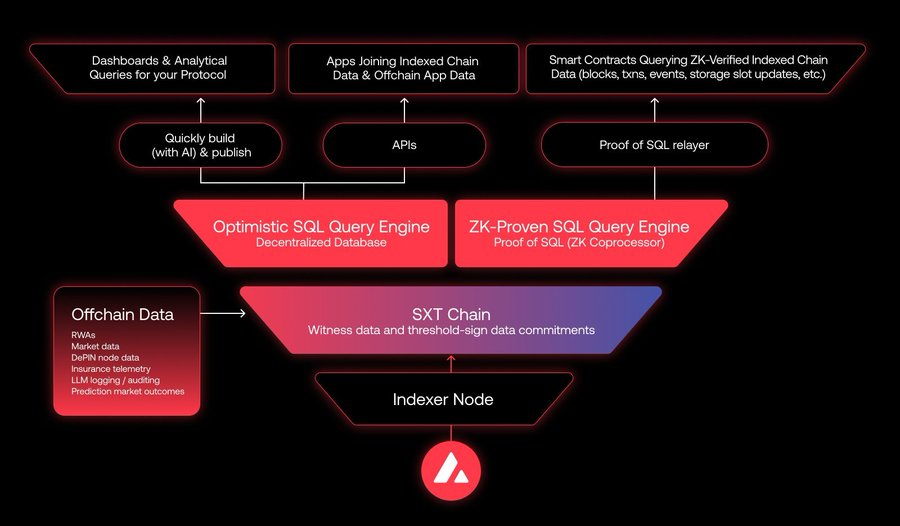

On-chain data service upgrade: Developers and investors can query contract and asset data with one click.

The meaning behind this is that the C chain is not to show off its skills, but to catch the inflow of real users and assets.

For smart money, that's the core logic of their bet on Avalanche: when everyone is telling a story, it's the infrastructure that really gets through the cycle. And BENQI, as part of the early infrastructure, is gradually being re-evaluated and repriced.

Stable income is not just a transition plan for a "bull market".

If you zoom in, you'll find that smart money is not investing in a specific project, but in a long-term logic:

Stable income is the moat during the market panic period.

Whether it's BENQI's $sAVAX, Lido's $stETH, or Frix's sfrxETH, they're all finding new ways to release "non-exchangeable assets."

You'll also find that they're constantly laying out:

-

Frax focuses on stable pools such as sDAI to improve asset utilization;

-

Pendle's structured income products continue to be popular, and a variety of APR curve combinations have triggered arbitrage strategy innovation;

-

Maker launched SubDAO to decentralize governance pressure and enhance long-term stability;

-

EigenLayer uses "Restaking" to leverage a new yield layer to attract TVL reunions.

These choices may seem conservative, but they are the foundation of the next bull market – fine, transparent, and sustainable.

Don't ask the story, ask the underlying logic

If you're still asking "which coin can go up 10 times", then smart money will tell you:

"It's sentiment, not value, that goes up 10 times."

What they really care about is:

-

Is the exposure to this protocol manageable?

-

Are the revenue streams real and sustainable?

-

Is on-chain liquidity real? Is the TVL data solid?

-

Is the team constantly iterating? Is the community active and feedback?

When the answer to these questions is YES, they press the familiar "Confirm" button.

The starting point of the next bull market is not a certain god chain, nor a certain god narrative, but these quiet but firm "smart choices".

If you want to be smart, start with these four things

If you see this, congratulations, it's already "smarter" than 90% of the market. Here's another checklist to help you step on fewer pitfalls:

-

Look at audit and open source: Is the project audited by a third party, and is the contract open source?

-

Check on-chain data: TVL, active wallets, asset structure, can it be verified on-chain?

-

Analyze asset availability: Can I borrow or combine after staking?

-

Assess team and community vibrancy: Are there ongoing product updates to engage in dialogue with the community?

A bull market is not far away, but learn smart first. The tuyere can be expected, and the foundation must be stable. Don't chase the heat, be smart.