Debunking Hyperliquid's Top Whales' Trading Codes and Gaming Strategies: The Art of Leverage and Timing

By Frank, PANews

With the recovery of the market, the whale operation on Hyperliquid once again triggered the onlookers of the market.

Known as the "giant whales", these mysterious giants, with their strong financial strength, unique trading strategies and accurate grasp of the pulse of the market, have set off ripples in the platform, and their every move is not only a magnifying glass of market sentiment, but also provides us with a window to observe how top traders gamble.

Analyze their different trading methods, risk appetite and success or failure logic. Here, PANews attempts to uncover the corners of their wealth code and explore the lessons learned by the average investor.

Short-term sniper @qwatio: "50x brother" is event-driven and high-leverage art

The trader is an industry OG who has been tweeting about Bitcoin since 2014 and looks like a loyal Bitcoin fan. For unknown reasons, @qwatio chose to disappear from social media in 2015. Until March 2025, when the profit of shorting Bitcoin by high leverage exceeded $9 million, which sparked heated discussions on social media, on-chain investigator ZachXBT said that its source of funds was related to hackers, and @qwatio chose to publish his identity to respond to the question.

@qwatio trading style is characterized by high risk and high return, often using 50 times leverage, and has a keen ability to capture the market. For example, before and after the Fed's interest rate decision on March 20, 2025, he first went short when the BTC price was $84,566, closed his position after the price fell to $82,000 and made a profit of $81,500, and then went long at $82,200 and closed his position when the price rebounded to $85,000, making an additional profit of $921,000, achieving a total gain of 164%. Therefore, it is called "Hyperliquid 50X brother" by social media.

From the perspective of his trading strategy, @qwatio is good at capturing event-driven and ephemeral opportunities, and also shows a unique market eye. The battle for fame mentioned above is to use the expectation of the Fed's interest rate decision to infer that the market will have a short opportunity to repeatedly manipulate and make huge profits in the swing. At the same time, he can also make a decisive move in times of extreme panic in the market. When Ethereum fell to around 1500, the market was bearish on Ethereum. @qwatio chose to buy 3,715 ETH for $5.5 million (average price 1493.5) and sold it at $2,502, making a profit of $3.74 million.

On May 12, the results of the Sino-US trade negotiations were announced, and the foreseeable market will usher in a wave of shocks. @qwatio chose to short Bitcoin at $104094 and subsequently made a profit of $1.18 million.

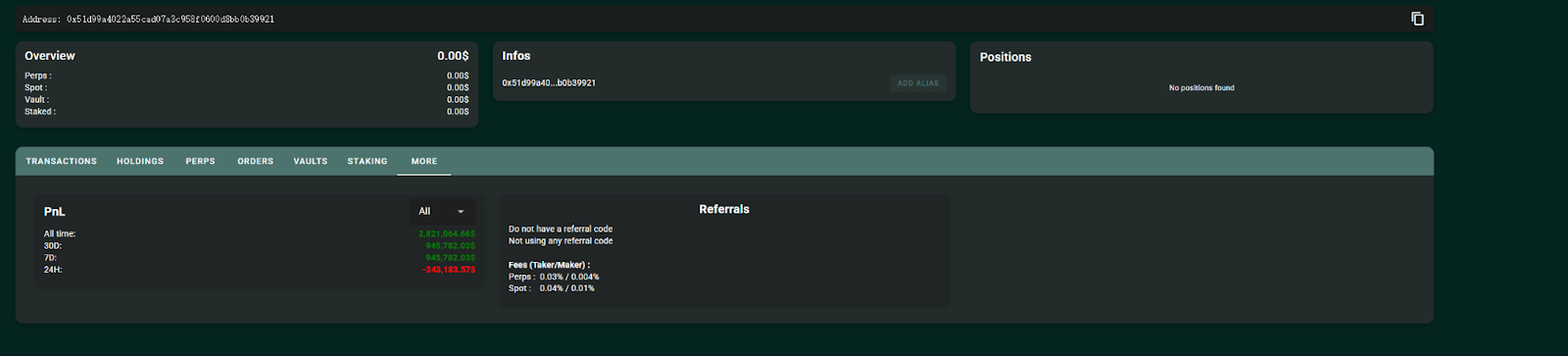

As of May 13, @qwatio made a profit of about $2.82 million on Hyperliquid. In summary, the @qwatio operations are not frequent, and only 3~4 operations are carried out in 2 months. However, each operation can accurately predict a short-term trend, and the artist is bold, and the liquidation is only within a few corners. However, this style is not suitable for the average user to imitate, and he often loses money in the operation of several altcat tokens.

Legends and controversies coexist: James Wynn's MEME coin hunt and big money operation

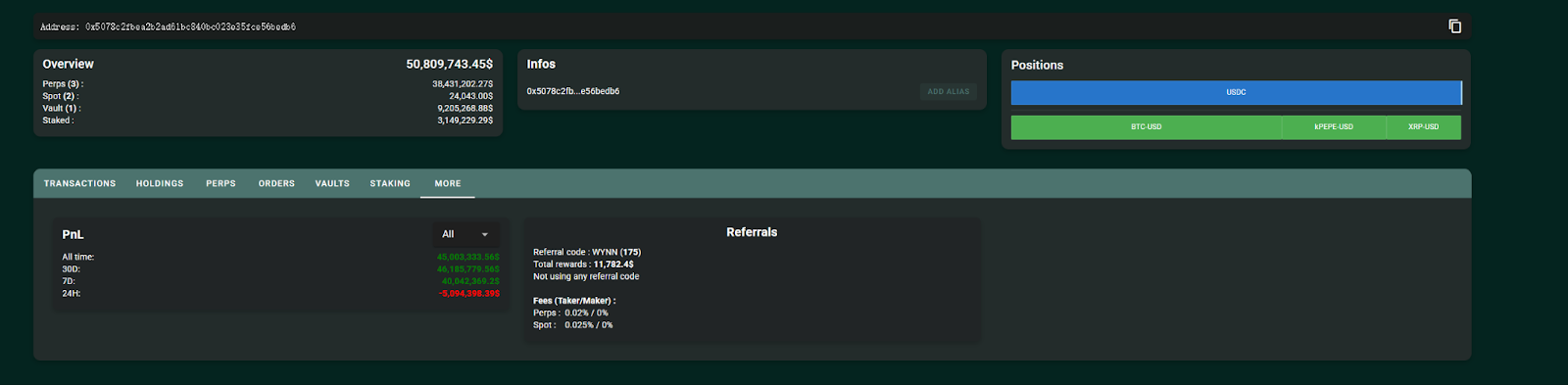

James Wynn has been active in Hyperliquid since March 2025, and in terms of operating style, James Wynn prefers a relatively large period (a few days), and in addition to mainstream tokens, James Wynn also prefers to bet on MEME-themed tokens such as TRUMP, Fartcoin, and PEPE. And the high volatility of the MEME token seems to have become the main source of his profits.

Judging from the positions still held on May 13, the open interest brought to him by the PEPE long order reached $23 million. Far more than other mainstream tokens such as BTC.

However, James Wynn is clearly more conservative in terms of the use of leverage, and he seems to like to set different leverage multipliers for different volatility rates. For example, BTC opens with 40x leverage, while PEPE opens with only 10x leverage.

In addition, James Wynn has set up the largest user vault on Hyperliquid, Moon Capital, but unlike his personal precision, this vault is currently not very effective. Open a long position on BTC at the price of 103533, and the yield on that position is about a 10% loss as of May 13. The loss was about $960,000. Over the past month, the overall yield of this vault has been -8%. Even so, it attracted $10 million in deposits, of which $9.2 million came to James Wynn himself.

Overall, James Wynn earned $45 million in Hyperliquid. His trading strategy is primarily focused on long positions, capturing the opportunity for the market to rise. For example, he opens a 40x long position at the price of BTC at $94,000 and reaches a floating profit of $5.4 million when the price rises above $100,000. Although he has a low win rate (about 47%), he can still make huge profits with large positions and high leverage.

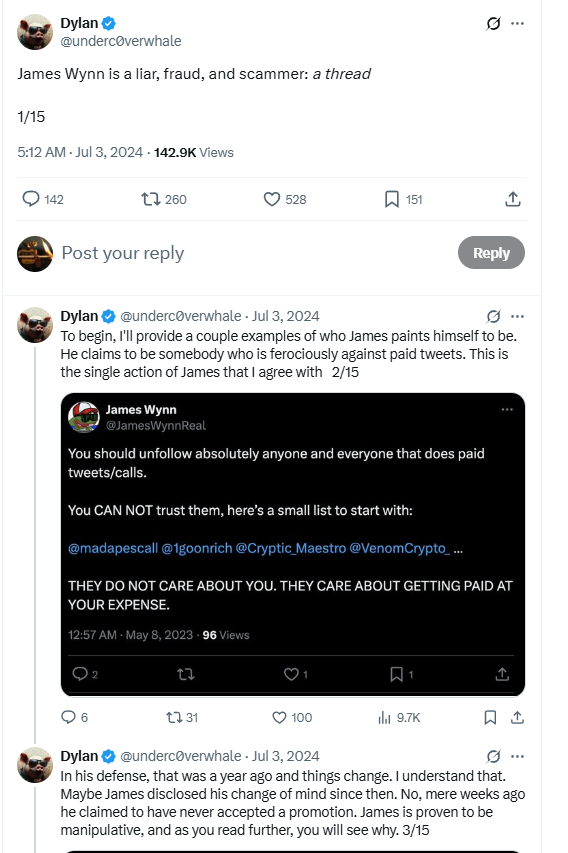

James Wynn is known as a "legendary trader" in the community, but his trading success has also been accompanied by a certain amount of controversy. Some community members accused him of exploiting the community's trust for profit, such as selling off after boosting the price by promoting meme coins, such as the 2024 baby pepe pump-and-dump incident. However, his own response to this is nonsense. As of now, these controversies and responses are in an unsubstantiated state.

Overall, James Wynn's successful trading also benefited from his large positions, which often cost tens of millions or even hundreds of millions of dollars each time he opened a position. This, coupled with a keen insight into changes in the market, has created his high returns. And sufficient margin also allows his liquidation price insurance to reach a high threshold. This style can help him achieve a high win rate, but he can also suffer a big loss if he misjudges the trend.

The Mysterious Whale Emerging from the Edge: Mainstream Coins Test the Waters and Swing Under Low Leverage

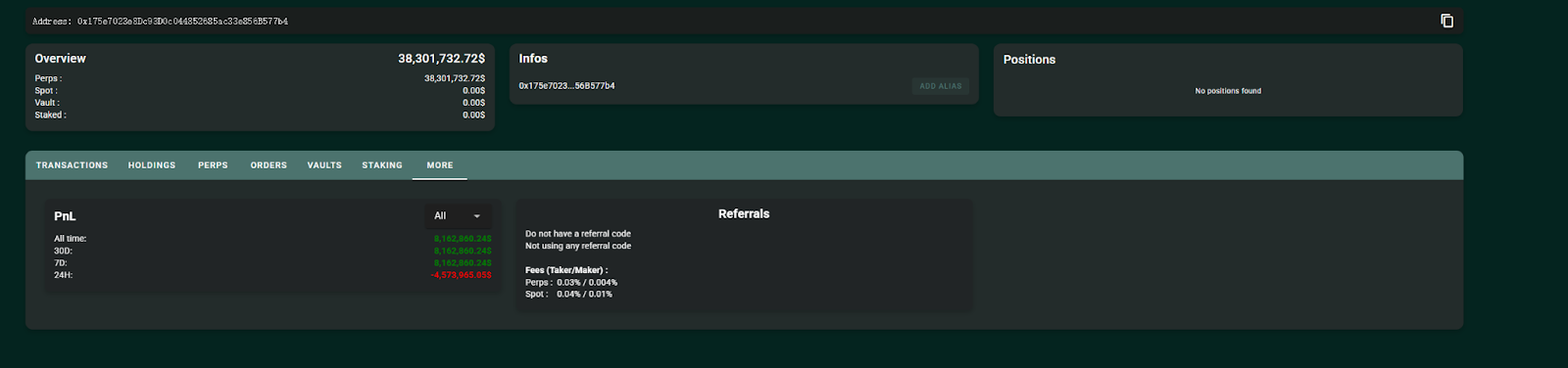

This mysterious whale is another big guy who often appears in news flashes. However, the whale has only started to be active on Hyperliquid in recent days, and the initial reason for the concern was that it spent more than $8 million to go long ETH. Since then, the address has made more than $8.16 million in profits in a week by going long XRP and SOL.

From the perspective of operation style, this giant whale is also characterized by strong financial strength, and the capital of the early opening position reached 36 million US dollars. In addition, this mysterious whale is not keen on short-term operations in the way of extreme speculation, but chooses low leverage and prolongs the holding time to maintain profits.

From the perspective of the choice of trading varieties, this giant whale has only traded three mainstream altcoins: ETH, XRP, AND SOL so far. ETH made a profit, and XRP and SOL suffered losses. Judging from the trading strategy, the whale seems to be indecisive enough, only opened a position in ETH at the beginning, and then chose to open long XRP and SOL at a high level during the market rally. As a result, as the market pulls back, the whale may also have experienced psychological fluctuations. Therefore, closing all orders, although the final result is profitable, is not worth learning from the perspective of the style and thinking of the operation.

The market's staunch contrarian: Can the heavily spent bearish whale have the last laugh?

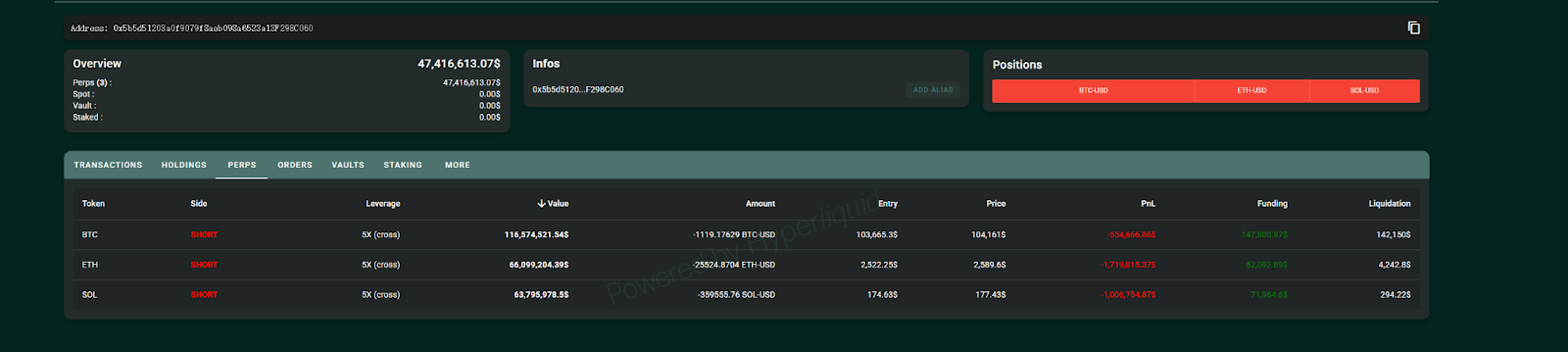

Compared with the giant whale introduced above, this giant whale can be regarded as a temporary negative teaching material, as of May 13, the data shows that the address has lost $3.12 million by shorting BTC, ETH, and SOL.

Since May 10, the whale has been injecting $50.5 million into Hyperliquid for shorting. The total amount of the total holdings exceeded $230 million. Among them, the amount of positions held on BTC exceeded $110 million. The whale seems to be a firm bearish in the market, with $50.5 million invested in positions and held positions for several days without closing them.

However, due to the strong margin, the liquidation price of this address is also relatively difficult to reach (BTC liquidation price is $142,000, Ethereum liquidation price is $4,254, and SOL liquidation price is $294). In terms of profit and loss of the overall position, the current loss is only about 6%.

Of course, we can't conclude whether the whale's final direction is right or wrong. We can only continue to observe in the follow-up to see whether this mysterious market retrograde predicts the market in advance or acts with deep pockets.

Looking at these "dominant" whales on Hyperliquid, it is not difficult to find that their trading routines have their own merits, and there is no one-size-fits-all "holy grail". However, in general, whales are generally still accustomed to choosing several more liquid tokens such as BTC, ETH, SOL, XRP, etc. as operating objects. In terms of trading style, everyone has their own set of habits, some people are keen on high leverage, and some people are used to predicting the market in advance. But the positions and investments of these giant whales are obviously like to lick the blood on the tip of the knife, which is not desirable for ordinary investors and cannot be replicated. After all, in the crypto ocean full of dangerous shoals and rapids, only by constantly learning and forming your own trading system can you sail steadily in the stormy seas.