In a copycat bear market, which tokens are the most cost-effective for shorting?

Original | Odaily Planet Daily (@OdailyChina)

Author|Nanji (@Assassin_Malvo)

Since BTC peaked in early February, falling below the $100,000 mark again, market sentiment and trends have begun to decline significantly. Especially after the collapse of Libra Solana Meme, the few active tracks in the market also fell silent, and SOL fell from a high of $295 to a low of $95, a drop of 67.8%.

In this context, the old VC coins and meme coins began to dump one after another, and tokens such as ACT and OM staged a farce of halving and halving again in a short time. At the same time, the token valuation bubble has been punctured, and newly launched VC tokens such as SHELL have a circulating market value of only $30 million, and few projects can exceed $100 million in market capitalization.

Therefore, for tokens with high valuations in the early stage and low unlocking ratios, they are likely to be high-quality short-selling targets. This article will collate the token data of the listed Binance futures and provide readers with this data as a potential reference for operation.

Basic statistics

object: Tokens that are still tradable in the Binance futures market, listed after January 1, 2023Data

source: Token market cap is taken from CoinGecko, token listing time is taken from Binance Futures API, token unlock ratio is taken from token.unclocks and CoinGecko

Further explanation: token.unclocks The unlocking ratio is calculated by the website based on the project white paper and actual announcements, and the department believes that it is a relatively more accurate unlocking ratio, but the coverage is smaller. Therefore, CoinGecko's circulating market capitalization/FDV is also used as a backup unlocking ratio.

The results show that

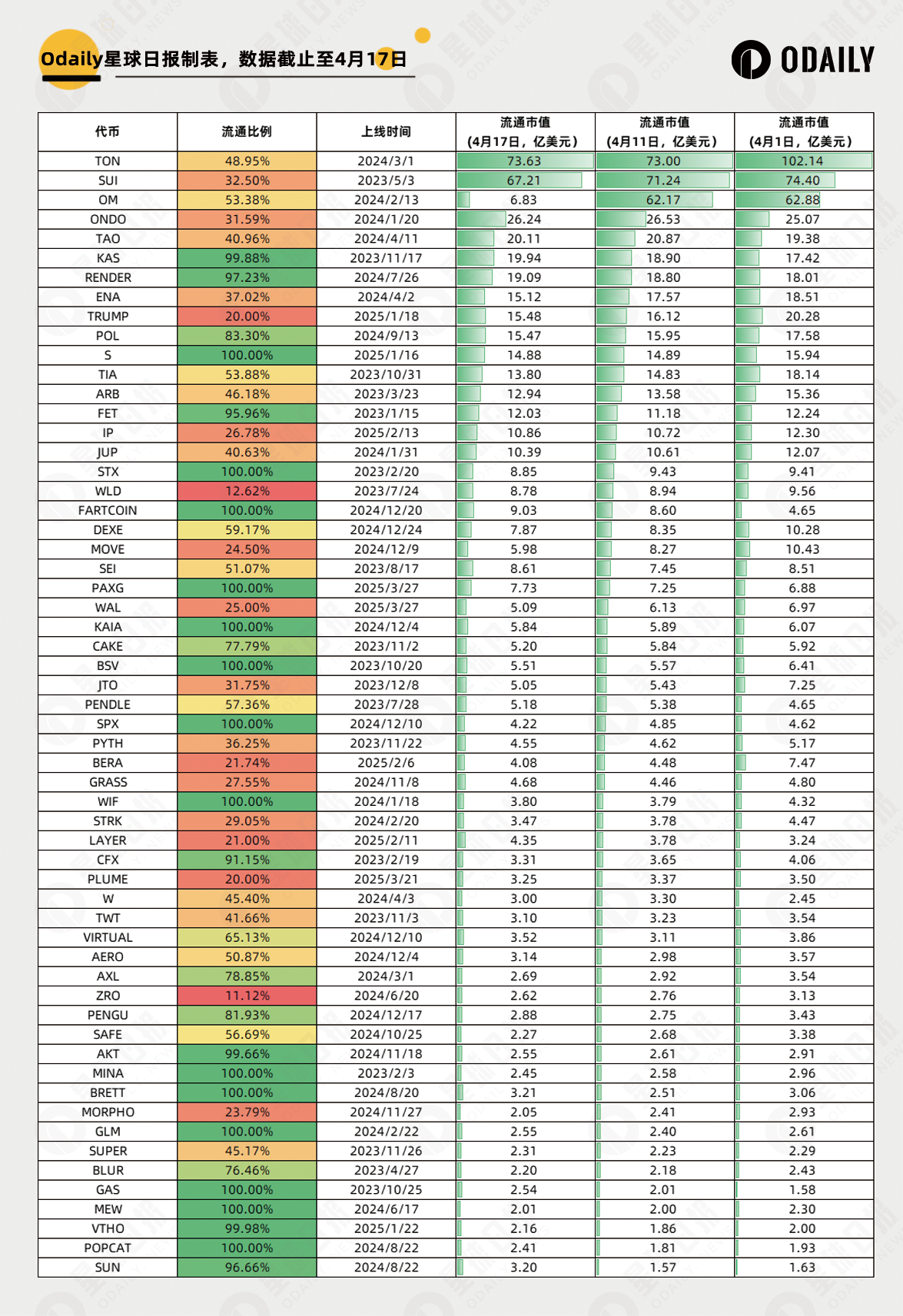

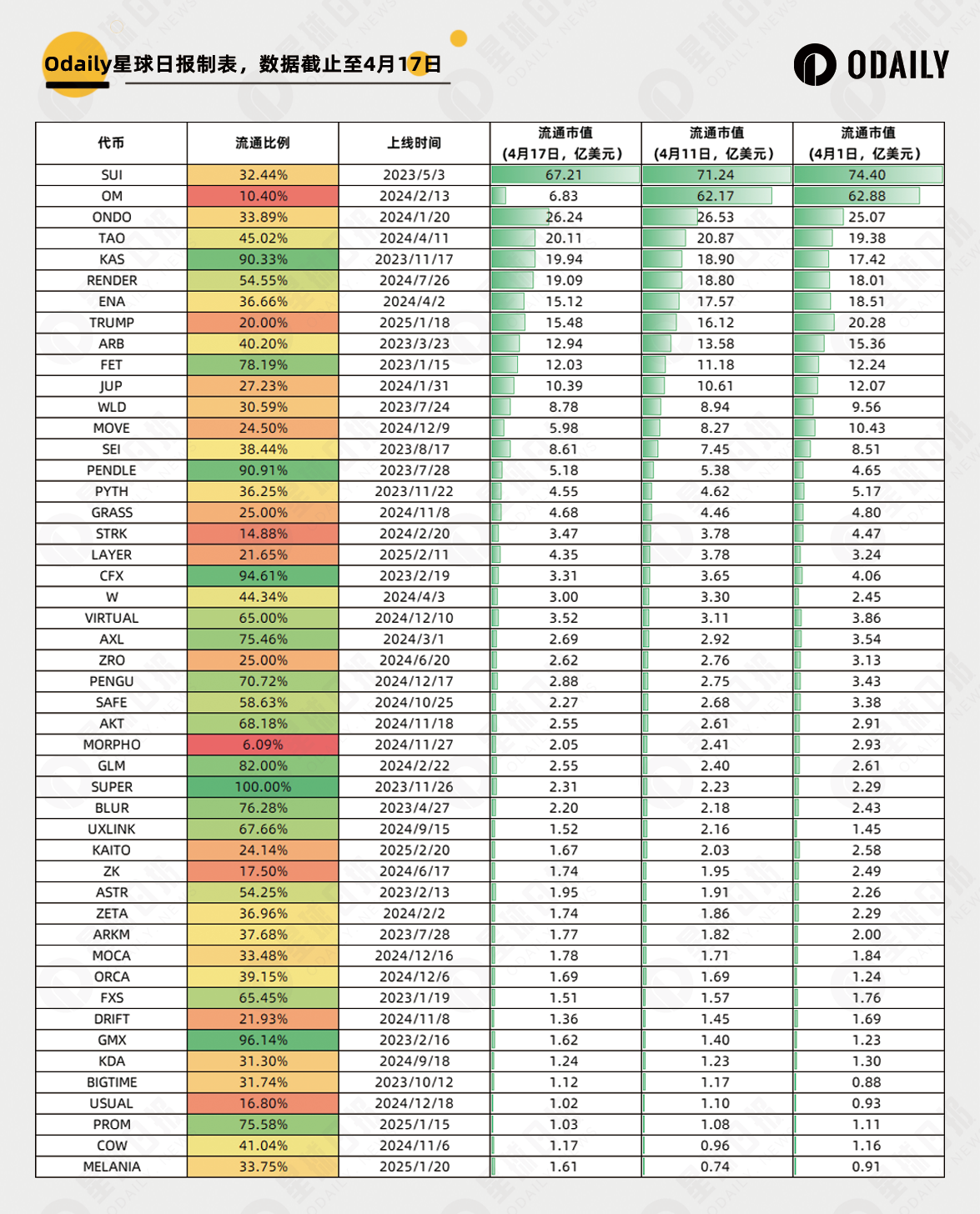

atotal of 216 tokens have been listed on the Binance contract after 23 years, token.unclocks provides unlock data for 106 tokens, and the circulating market capitalization of more than 100 million and less than 100 million is divided into the following two figures:

market capitalization greater than 100 million

For example, when the first statistic, the unlocking ratio was only 10%, but the market capitalization was as high as $6.2 billion, and the odds for shorting were theoretically extremely high.

THOSE WITH A CURRENT MARKET CAPITALIZATION OF MORE THAN $100 MILLION AND LESS THAN 25% UNLOCKED INCLUDE OM, TRUMP, MOVE, STRK, LAYER, MORPHO, KAITO, ZK, DRIFT, AND USUAL. For those with a market capitalization of less than US$100 million and a proportion of less than 2%, readers can refer to the table for their own reference, and will not be repeated here.

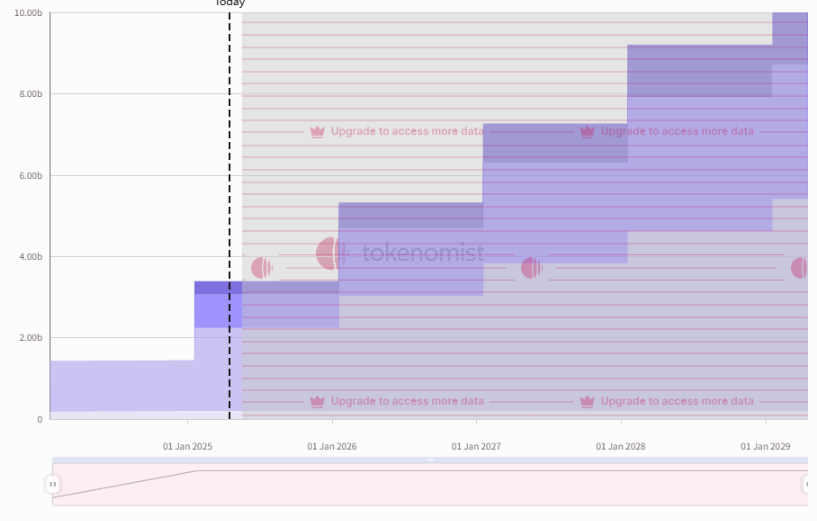

At the same time, it should be noted that it is not possible to directly empty the token if the unlocking ratio is low, but also needs to be decided based on the unlocking situation of the token, for example, although the unlocking ratio of ONDO is not high, it is only unlocked once a year (as shown in the figure below), and there will be no selling pressure from the unlocked token in the market in the short term, and the low unlocking ratio cannot be a reason for shorting.

What else can you choose besides looking at the proportion?

Initially, the author believed that there were three types of tokens that were best not to be empty, including:

-

Historical Demon Coins (SUI, OM, etc.)

-

DeFi tokens with consistent and stable income (PENDLE, etc.)

-

Korean forces (UXLINK, IP)

But judging from the actual situation in the last two weeks, these are currently these "Historical Demon Coins" have entered the closing stage, so some previously strong but recently underperforming tokens can also be included in the shorting category.

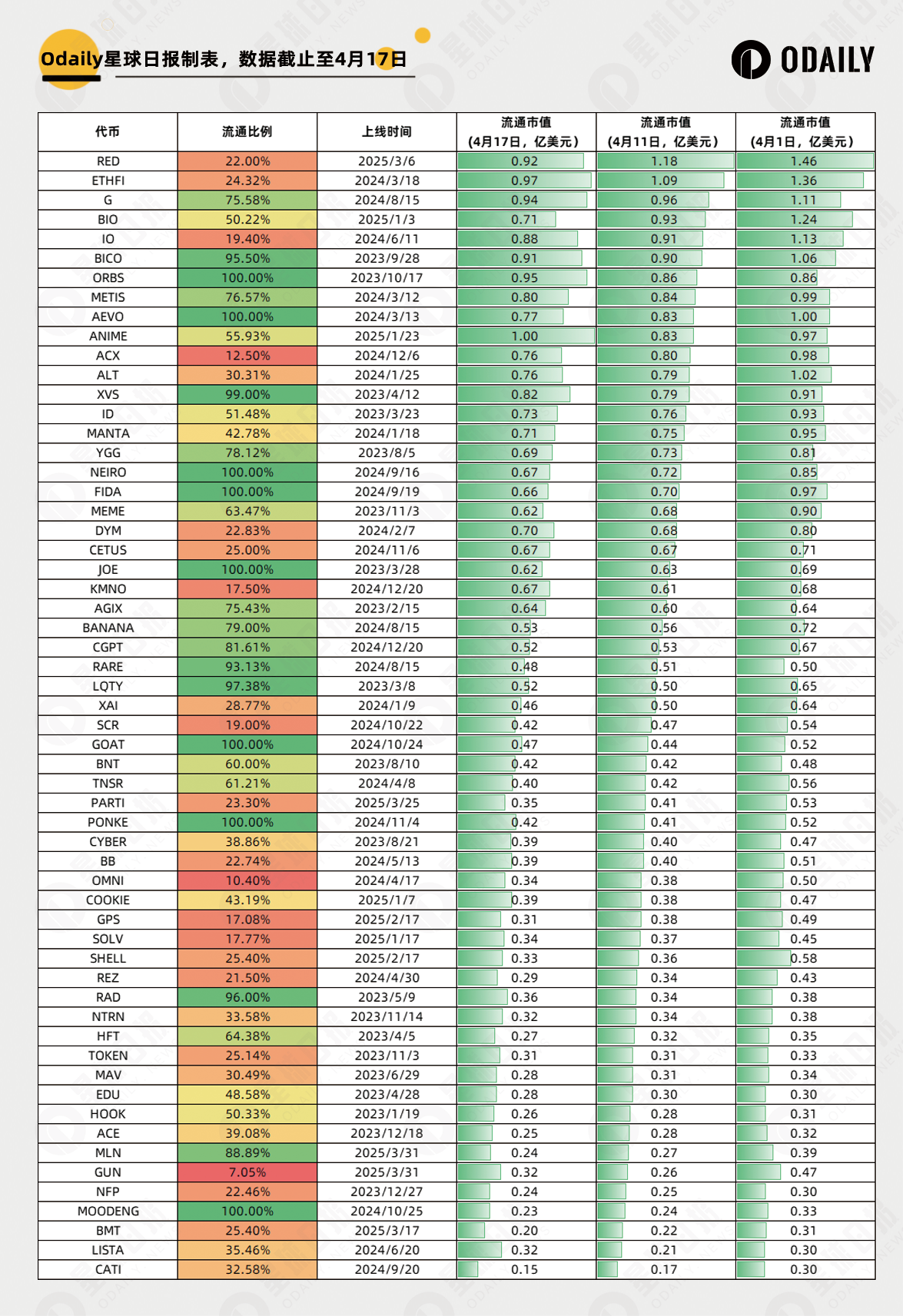

CoinGecko's unlocking ratio refers

to using CoinGecko's circulating market capitalization/FDV as the unlocking ratio, and screens tokens with a market capitalization greater than $200 million as follows.

There is no substantial change in the unlocking ratio for most tokens, but several token.unlocks low-circulation tokens for which no data is provided have been added, including IP, WAL, BERA, and PLUME.