Bitcoin is approaching new highs, what do traders think?

Driven by regulatory breakthroughs, the entry of structured funds and the recovery of market confidence, Bitcoin is once again approaching all-time highs. With the "GENIUS Stablecoin Act" advancing to the final vote of the Senate, a channel for hundreds of billions of funds to flow into the crypto market is about to be opened, and the SEC in the United States has also launched a new round of crypto rules drafting, releasing an unprecedented policy-friendly signal.

At the same time, on-chain data shows that Bitcoin's illiquid supply is at a record high, and chips are steadily migrating from short-term speculators to long-term holders. Spot ETFs continue to attract gold, and funding rates run at low levels, suggesting that this round of rally is not overheated, but driven by institutional buying and structural tightening.

Bitcoin is moving away from the speculative logic of its early days and entering a new cycle that is more mature, stable, and capital-led. At a time when market sentiment is still restrained, volatility has not yet expanded, and traders and institutions have different judgments on new highs, BlockBeats has compiled it for readers' reference.

Traders' analysis

positions do not break new highs, and the price breaks first = healthy rise?

@CryptoPainter_X

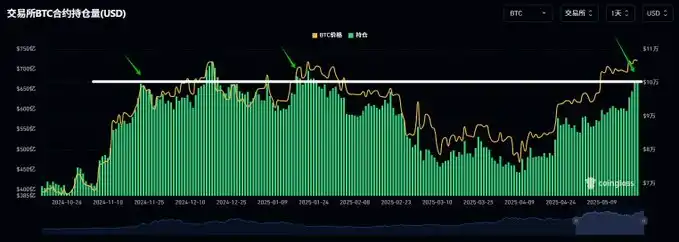

BTC's current holdings are finally close to the all-time high!

From the previous position of $69.568 billion when the price broke new highs, there is still $2.9 billion of room for improvement;

The current price is only $2,000 away from breaking a new high, so even if it is completely pulled by futures, it will not necessarily lead to an increase in positions of $2.9 billion, that is, it is difficult to form a divergence between positions and prices;

If there is a pullback in the price, and after the correction the position begins to gradually increase or even exceed the all-time high, then there is a possibility of a position divergence, which is a large structural bull divergence, which occurred at the end of 2021.

So the current logic is very simple, the price broke a new high before the position broke the new high, which means that the market is still not over-FOMO, which is very healthy!

Before the price breaks a new high, the position breaks a new high, which means that the speculative sentiment is too strong, and the market will easily come to kill the position.

"Rise instead of Fall": Active Buying Defuses Selling Pressure

@biupa

Judging from the Coinkarma indicator, Bitcoin's "Rise instead of Fall" continues

Yesterday, I was in the live broadcast of Tencent Meeting, and I thought that there would be a wave in late May that would continue to break through the previous highs to the upside. On the one hand, there is the expectation of a pull-up before the Bitcoin conference, and on the other hand, from the CoinKarma indicator, Bitcoin's LIQ is constantly improving. LIQ measures the difference between the upper and lower order books. The presence of "red" means that there are far more spot sell orders above than there are spot buy orders (pending orders) below. Often, this is a "dangerous" sign.

After the first breakthrough of 100,000 (May 9-14), both Bitcoin and Overall (i.e., the "broader market") gave red - the usual "red flag". However, we have also given the expectation of the main rising wave, referring to BTCUSDLONGS and ETHBTCLONGS. Therefore, if we continue to watch, we can see that there are still a few "scattered reds" in the future, but the frequency is getting lower and lower, but Bitcoin is still at a high level above 102,000.

The last time it was red was in the 106000 range. As you can see, the price has increased, but the red prompt of LIQ has decreased significantly, what is the reason for this? This is what I call the "rising instead of falling" market, and it is also the key evidence of the strength of the bulls.

Generally speaking, LIQ red needs to be resolved by a decline. When there are too many sell orders at a certain level (e.g. 105000), Bitcoin moves in the direction of less resistance (down). When Bitcoin falls back to 99000, there will be fewer sell orders at the top and more buy orders at the bottom, and the long and short sides will be rebalanced, so Bitcoin will stop falling, and the LIQ indicator will return to its normal value.

The understanding of "rising instead of falling" is that active buying has always existed, continuously hitting the sell order wall, making the pending orders at the key level of 105000 fewer and fewer until they are completely absorbed. Therefore, when the price continues to move upwards, LIQ has improved.

Observing the objective reality that the 106000 red color only appeared the day before yesterday, and the pullback to the 105000 range LIQ improved significantly, I am actually very confident in going long. THIS ALSO HELPED ME TO HOLD A SERIES OF ORDERS SUCH AS PEPE MOODENG IN MY HAND, SO AS TO MAKE A PROFIT.

Based on the principle of seasonality and event-driven, I think there is a possibility of a continuation of the upward trend at least until the 26th. After the 26th, it's time to be cautious. In

addition, the cottage still needs to wait for Bitcoin to stand firm at 110,000 and above before it can hope to make up for a significant increase, and before that, it can only be short.