5 Things to Know as Ethereum Price Rockets 35% Monthly

Key Insights:

- The Ethereum price rally is sparked by several positive ecosystem factors from the start of the year.

- Whales and firms like SharpLink and Abraxas are leading the Ethereum as a Treasury asset drive.

- Binance’s ETH reserves have reached 5 million, as analysts are watching for any shift to topple the current price balance.

Ethereum, the biggest altcoin, has maintained a 23% upsurge since the start of this month.

Bitcoin’s strong run backed the move, complemented with consistent demand from ETFs, significant wallet acquisition, and more.

The triggers for the Ethereum price breakout are glaring, and analysts are now watching to see if it can push higher before the end of the year.

Here are five things to note amid price breakout for ETH and the expectations of an altseason.

Ethereum Price Rally Is Influenced By Bitcoin Breakout

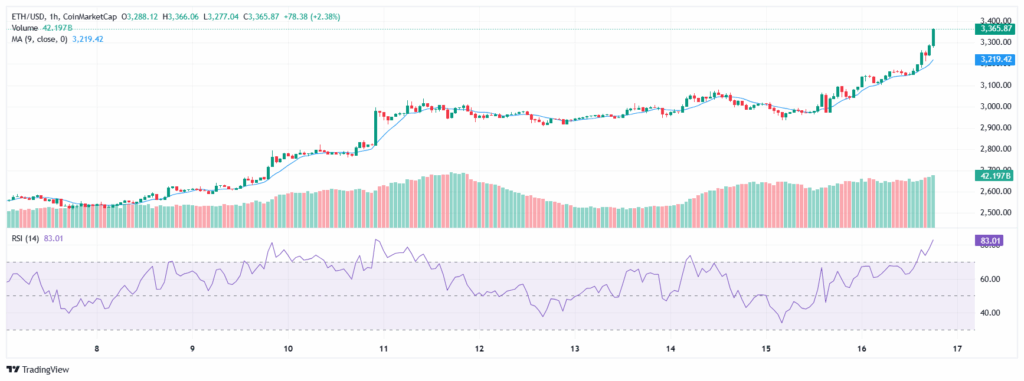

According to on-chain data, the Ethereum price has sustained a more than 23% upsurge, jumping as high as $3,238.35 as of the time of writing.

The price rally was seen across major exchanges, with trading activity especially strong on Binance.

A significant part of the move stemmed from Bitcoin surpassing $123,000 during the same period. As Bitcoin rose, it also lifted other top assets, including Ethereum, showcasing strong correlations.

In addition to the broader market trend, Ethereum also got a boost from its Pectra upgrade in May.

The update improved the network’s speed. This has made it more attractive to investors and developers.

As of the time of writing, CoinMarketCap data indicates that the trading volume for Ethereum was pegged at $38.76 billion.

Projects running on Ethereum, such as Optimism and Arbitrum, also saw higher activity.

These factors contributed to the strong interest in Ethereum and helped keep its price steady as the month progressed.

Large wallets and institutions significantly increased their Ethereum holdings in July.

Fresh whale ‘0x35fa’ recently withdrew 32,566 ETH (about $89.3 million) from Kraken at an average price of $2,741.

Investment firm Abraxas Capital also withdrew 29,741 ETH (worth approximately $81 million) from Binance and Kraken, with an average entry price of $2,725.

SharpLink Gaming has continued to increase its exposure, buying 6,377 ETH on July 16, valued at $19.56 million. The company now holds a total of 287,083 ETH, estimated at $908 million.

Another whale, 0x8C08, purchased 9,188 ETH for approximately $25 million and added 8,243 AAVE tokens worth $2.5 million.

Signs of Risk as Market Looks Overheated

Some signs suggested Ethereum’s rally might slow down very soon. Market tools showed that the asset was nearing overbought levels.

The data indicates a Relative Strength Index (RSI) reading of 82.01, a level that often signals a potential overselling and an eventual pullback.

Traders were also watching for profit-taking, especially after such a sharp rally had been recorded lately.

If prices dipped below $2,900, support is likely expected to be found in the $2,700 to $2,800 range.

A deeper drop could follow if the overall market turned negative or new regulations hit sentiment.

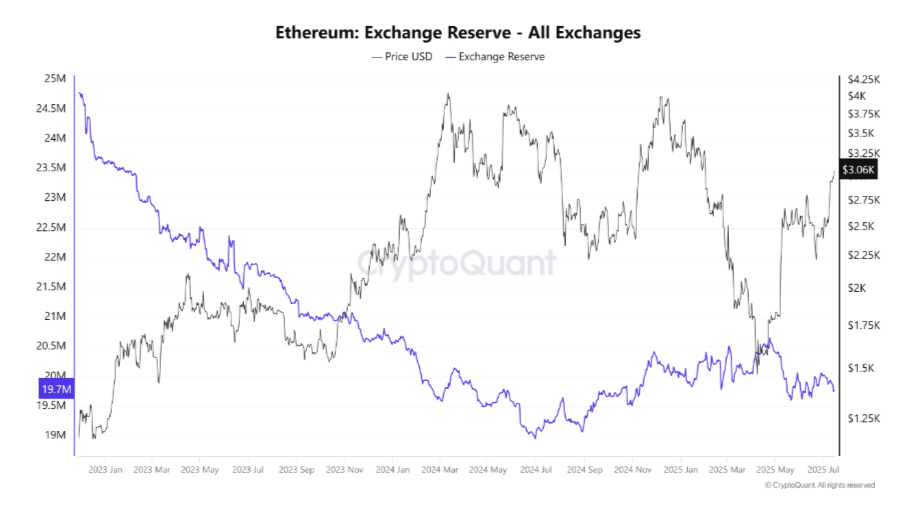

Binance Reserves Hit 5 Million ETH

Binance held close to 5 million ETH by the end of July, according to data from CryptoQuant.

This figure is up from 3.8 million earlier in the year, showing how much the exchange is making up for higher demand.

Additionally, the rise likely stemmed from more users transferring assets to Binance due to its deeper liquidity.

The large holding raised some concern, though, with analysts warning of possible risks if Binance were to face any major bank run or exploit issues.

Still, there were no signs of heavy selling from the exchange, supporting a relatively stable market for Ethereum.

Can Ethereum Hit a New High This Year?

Analysts remain optimistic that the Ethereum price could reach $4,000 if it closes above $3,300 in the coming weeks.

Based on its current price outlook, resistance is expected around $3,500, with support near $3,045.

Forecasts predict possible highs between $3,700 and $5,925, depending on the amount of additional money that flows into ETFs.

A clean break above $3,500 might push Ethereum into new record territory before the year ends.

The post 5 Things to Know as Ethereum Price Rockets 35% Monthly appeared first on The Coin Republic.