It's just the beginning of the $RHEA cross-chain solution.

The chain-abstracted liquidity solution is not just a narrative—it's a product-market fit serving a vast, untapped market.

If you’ve used .@rhea_finance lately, you’ve probably noticed: Near Intents is fully integrated into Rhea’s smart routing / order flow.

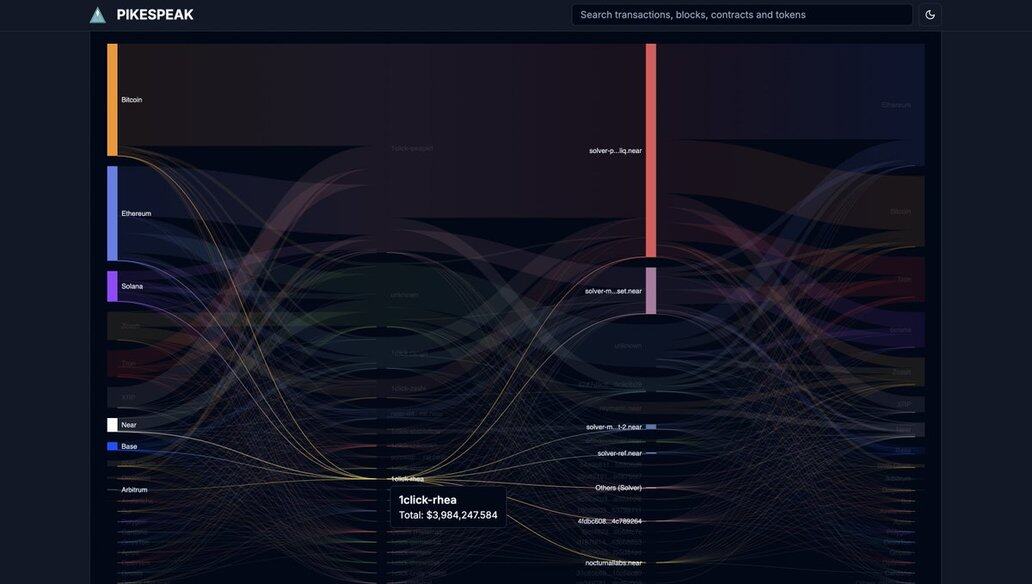

Early, but trending up, Rhea has already routed ~$4M to Intents via its referral gateway: 1click-rhea.

Dig into the breakdown:

Notable: over the past 30D, Rhea has already processed more Intents volume than Kyberswap and Infinex.

Two things I’m watching as we head into 2026:

* Turning on Intents referrals might become a bigger rev line than onchain swap contracts (?)

* Rhea’s multichain lending (beta: unlocks solver JIT liquidity — borrow for minutes/hours to solve flows, repay, repeat. Capital efficiency accelerator.

2.01K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.