BTC charts showing WHERE we are: 🧵

My view is we are moving higher because macro liquidity is expanding and this geopolitical risk is likely to fade. The Credit cycle is in full swing

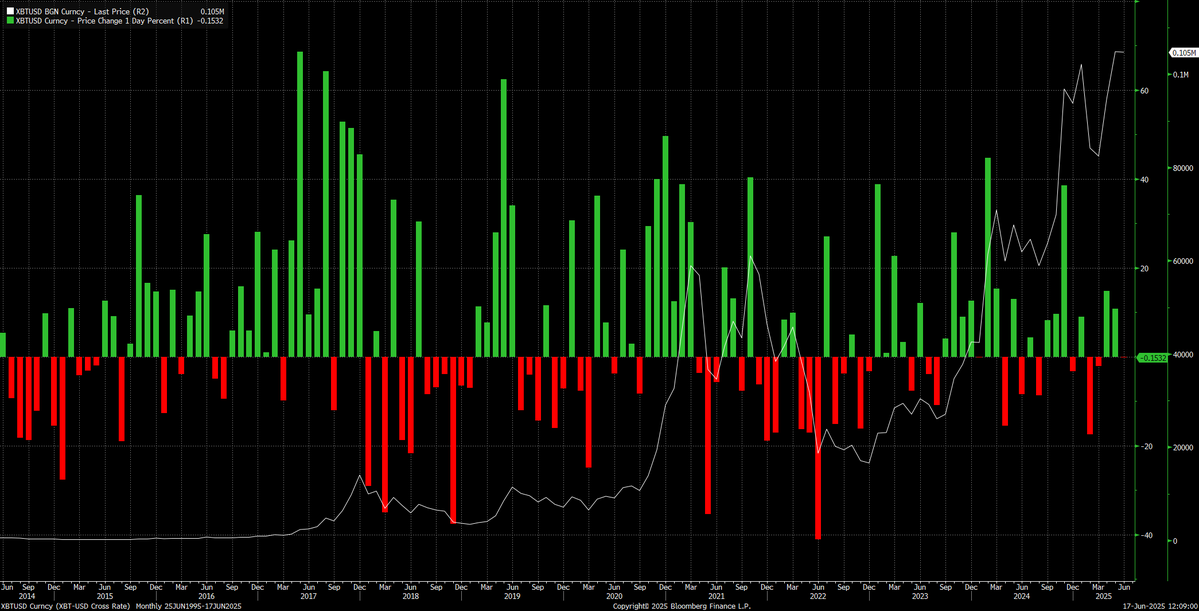

Monthly returns for BTC have been positive over the last two months

As I laid out here, equities are likely to melt up and BTC will move in lockstep with this.

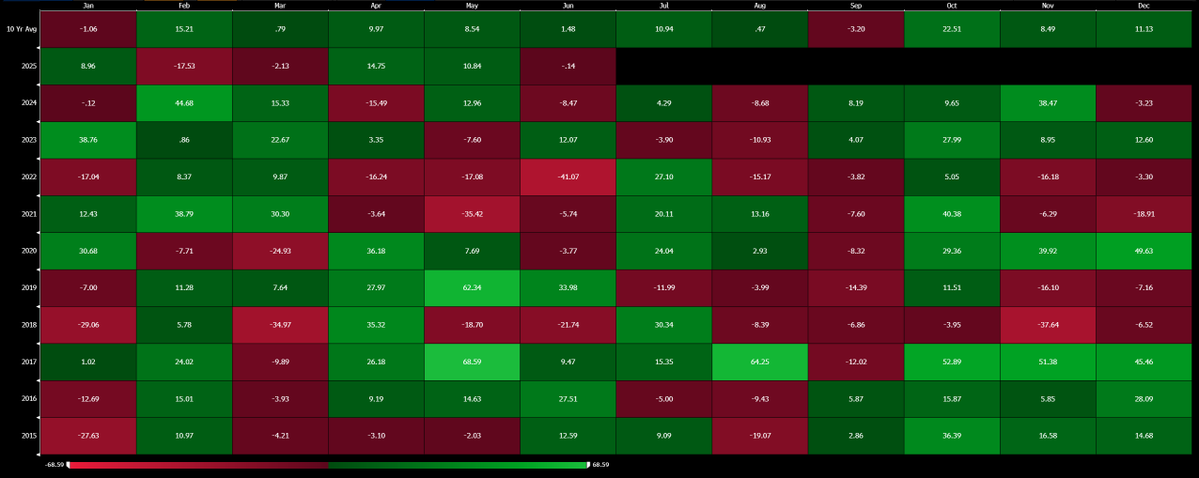

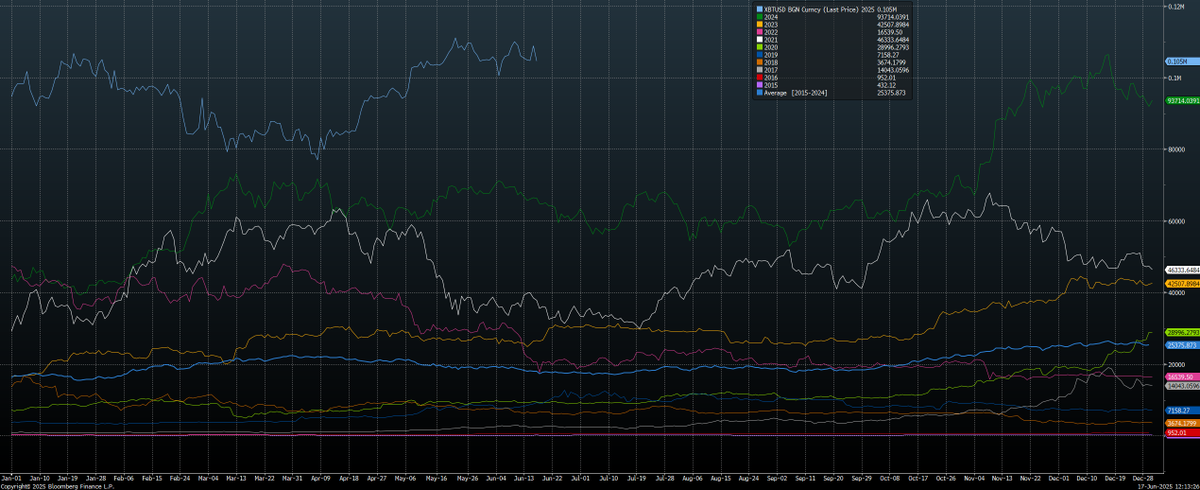

Bitcoin seasonality shows the drawdown at the beginning of the year is a bit abnormal but we are likely to mean revert off the back of these now

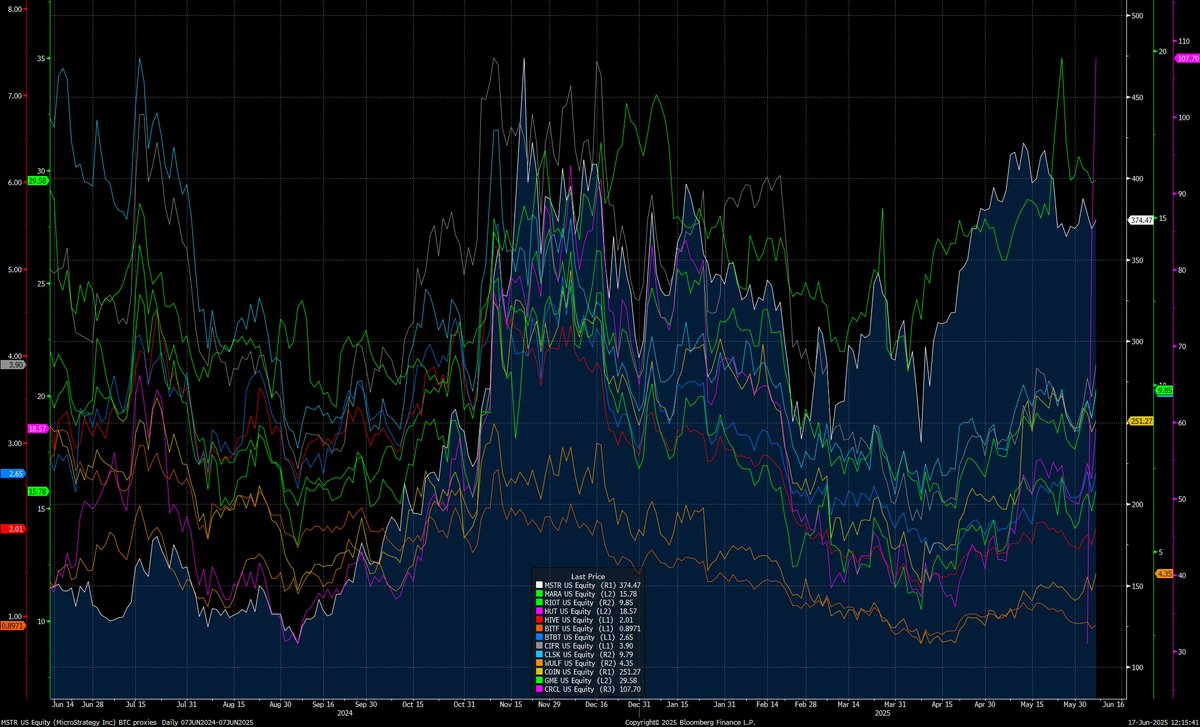

We continue to see the BTC proxy names rally with $CRCL rallying the most and leading the way:

The BTC proxies rallying is an indication of capital moving out the risk curve in a uniform fashion:

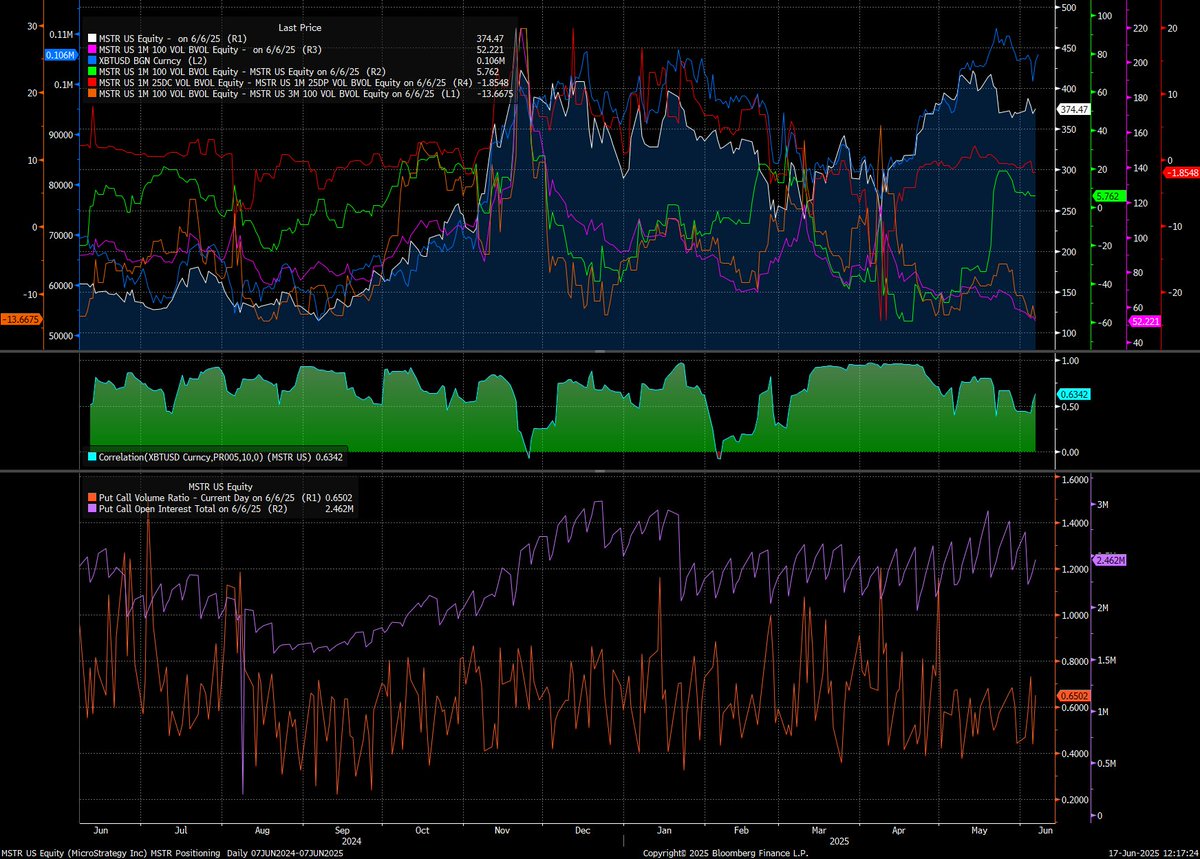

MSTR positioning isn't going overbought conditions or massive complacency. There is a marginal implied volatility premium but MSTR is lagging behind BTC which is likely due to the equity weakness.

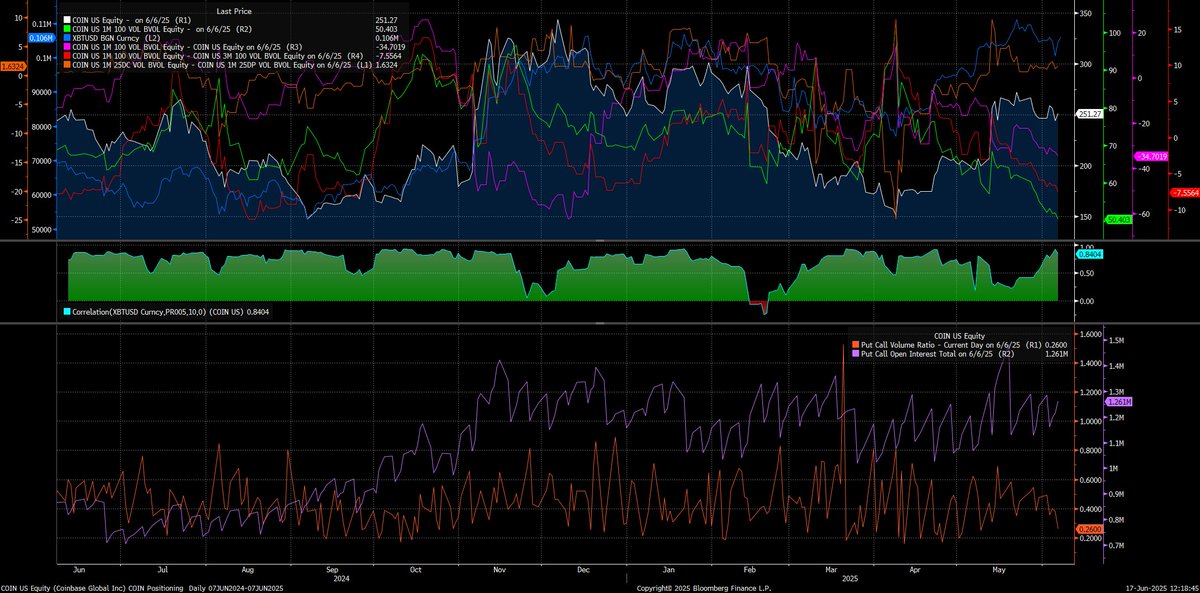

Similar dynamic in COIN

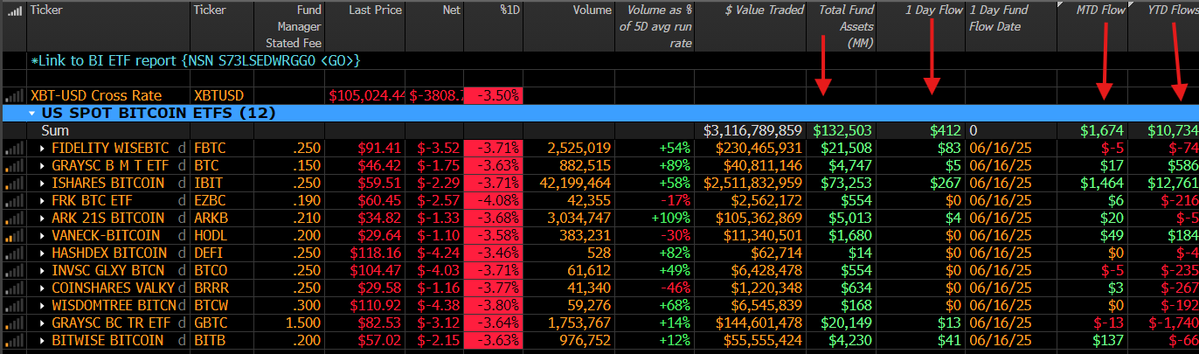

The net daily flows are still positive on the back of positive MTD and YTD flows into the ETFs. This will continue to be a buyer, but as I have said many times, to get BTC to 1m, you need to bring in a lot more buyers who aren't hodlers, which means a lot more washouts and weak money.

I explained HOW all of these factors are coming together and connect to macro liquidity in this video and connected report:

Everything is laid out here:

@Globalflows

115

20.26K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.