📢[Weekly Cryptocurrency Report] Liquidity Expansion: Increase in Stablecoin Liquidity Due to USDC Growth

[Weekly Report]

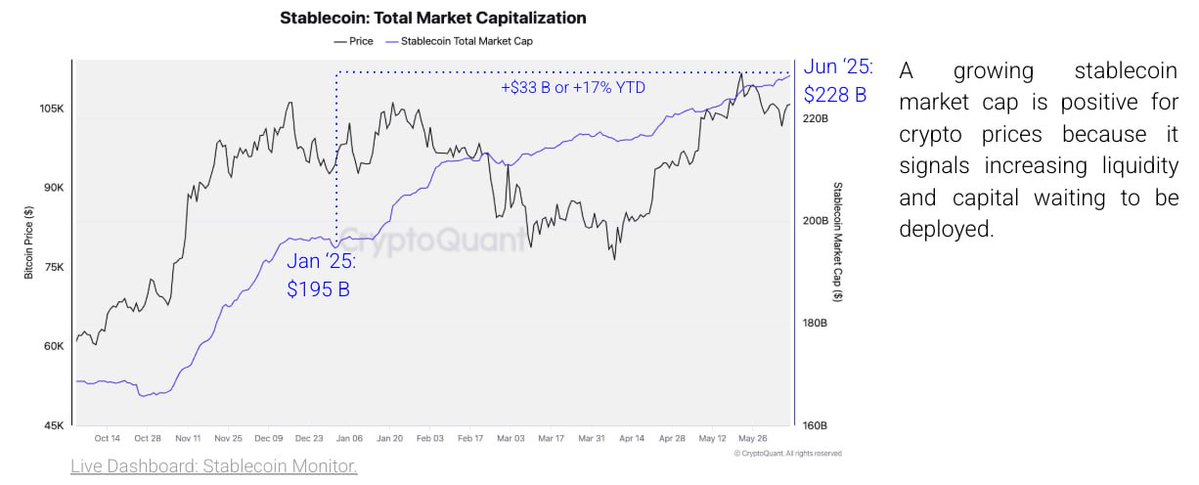

The market capitalization of stablecoins has reached an all-time high of $228 billion. This marks an increase of $33 billion, or 17%, since the beginning of 2025. This growth can be attributed to three main factors: (1) an increase in cryptocurrency trading activity, (2) the expanded use of stablecoins in payments and remittances, and (3) improved clarity in the regulatory environment in the U.S. since the Trump administration took office.

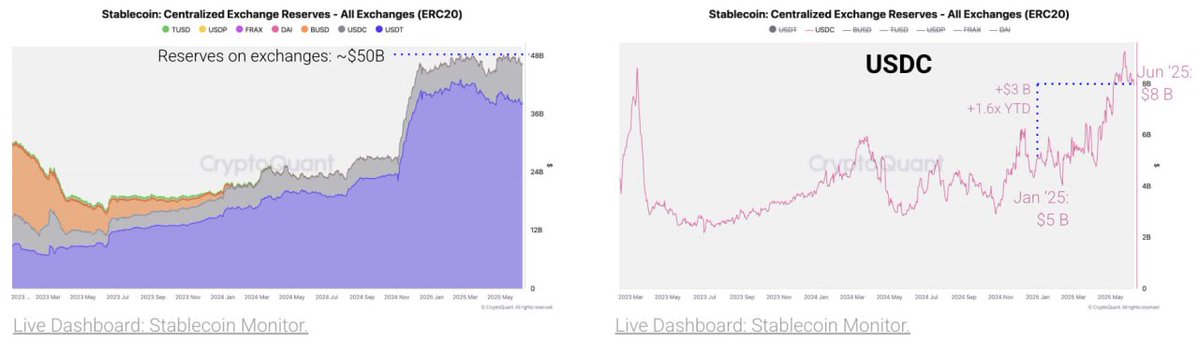

The growth of the stablecoin market is led by two major stablecoins: Circle's USDC and Tether's USDT. USDC has raised its market cap to an all-time high of $61 billion, which is an increase of $17 billion, or 39%, since the beginning of 2025. USDT recorded $155 billion, growing by $18 billion, or 13%, compared to the start of the year.

Additionally, the amount of stablecoins held on centralized exchanges has also reached a new all-time high, supporting cryptocurrency trading liquidity. The total value of ERC20 stablecoins on centralized exchanges is approximately $50 billion. Most of this increase is due to the growth of USDC reserves, which have risen to about $8 billion, 1.6 times higher since the beginning of 2025.

The value of staked stablecoins, which can earn interest, has shown a recovery and reached its highest level since the end of March. The total value of major staking stablecoins is $6.9 billion, representing a 28% increase since the lowest point on May 23. This increase is attributed to the rise of sUSDe by $1.23 billion and sUSDs by $700 million, or 35%, during the same period.

For more details, please refer to the weekly report. 🤗

Show original

5

2.7K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.