The potential list I observed that officially includes Resolv

In summary, Resolv: an enhanced version of on-chain Ethena, the biggest Alpha marker for stablecoins.

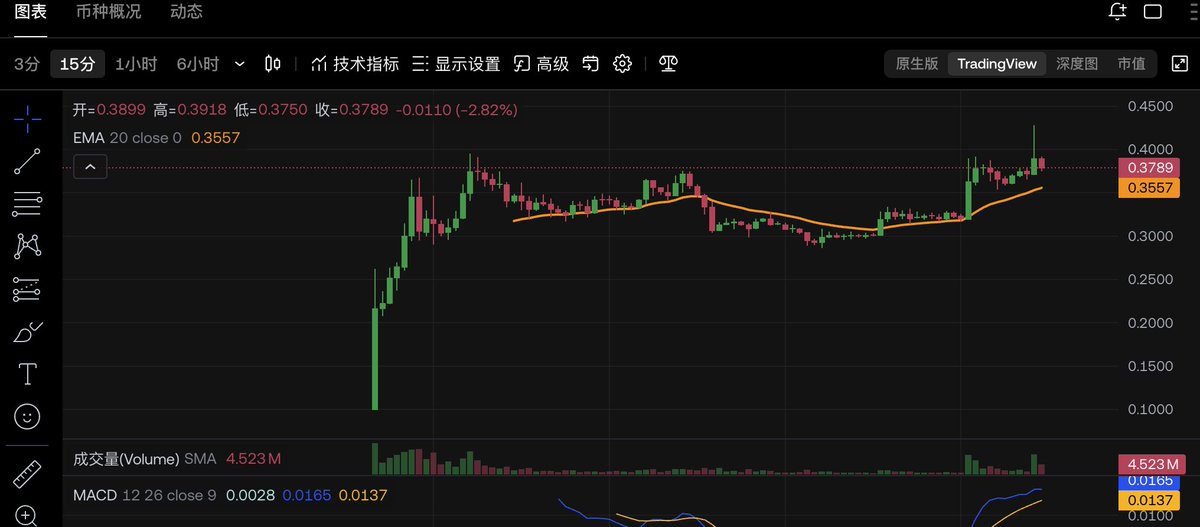

Currently, Resolv's price is $0.38, with a circulating market cap of $50 million (undervalued), and an FDV of $380 million. In comparison to similar projects like Ethena, Ethena has a circulating market cap of $2.2 billion and an FDV of $5.4 billion. Of course, Ethena's TVL is also higher, which mainly indicates that the ceiling for this sector is quite high, meaning there is a lot of imagination.

In terms of investment background, both Coinbase and Delphi have invested, along with Gumi Cryptos. Gumi is a well-established Web3 VC that is very cautious in the fields of stablecoins, structured finance, and infrastructure. For stablecoins, it is indeed important to look at the investment background, as stablecoins require scenario expansion, endorsements, and support from investors.

Why am I optimistic about Resolv's future price?

1. The stablecoin sector is too tempting. For example, the recent IPO of Circle, the parent company of USDC, represents traditional players who do not use crypto assets as collateral and do not share benefits with the crypto circle. The new players, like Ethena, adopt a delta-neutral strategy to maintain stability, transferring benefits to crypto users.

@ResolvLabs is an enhanced and optimized version of Ethena, supported by ETH/BTC derivative holdings and RLP (Risk Control Insurance Pool), while Ethena only has a single token model (USDe), where all risks and returns flow to stablecoin holders.

2. The overall valuation is relatively low, which is the biggest advantage of this round of investment. This round has indeed removed the huge bubble from past VC rounds in the crypto space, so the VC projects launched in this round are all undervalued, providing a good safety net. The biggest advantage of Resolv is precisely that it has a pioneer like Ethena as a benchmark; Ethena's FDV is $5.4 billion, while Resolv is only $380 million, less than one-tenth of Ethena, making it very suitable for value investment with a solid safety net and potential valuation.

Regarding the fundamentals of Resolv itself, the protocol's fee-sharing plan has not yet been launched, but if implemented, it will significantly enhance intrinsic value; the growth tied to USR means that the more USR is issued, the higher the governance value. In the foreseeable future, steady growth of USR is highly likely.

However, on June 27, there will be a small unlock for investors and liquidity providers (about 1.3% of the total), so market reactions should be monitored for optimal participation.

The core reason for including Resolv in my observed potential list is that its relatively low valuation provides a safety net, along with the foreseeable growth tied to USR leading to an increase in token prices, and the success of Ethena as a reference point and model, making it very suitable for long-term positioning.

Show original

66

35.7K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.