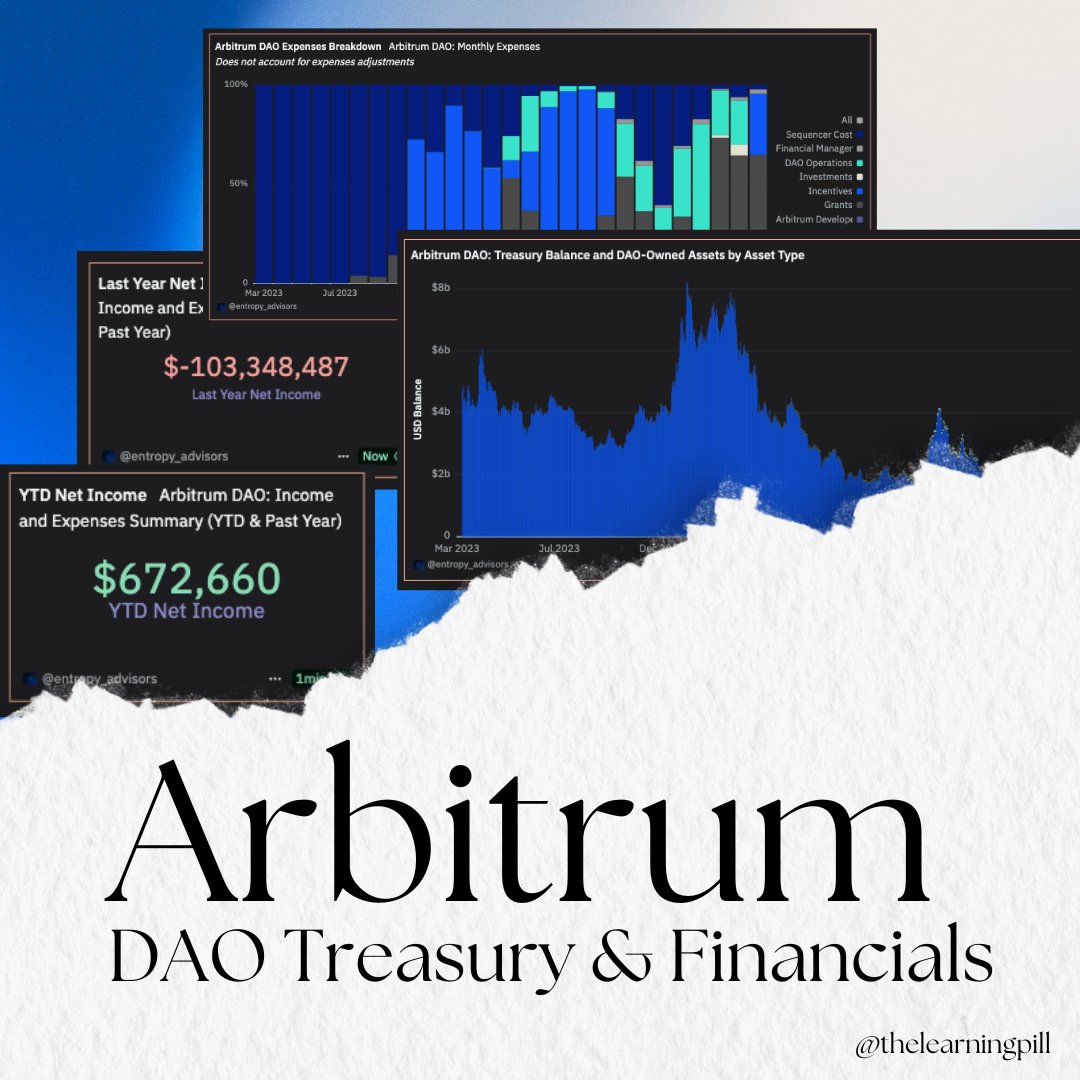

Arbitrum took the limelight for its $1.96 billion $ARB airdrop in 2023

2 years down the road, how does it look?

The state of @arbitrum DAO's treasury and financials 👇

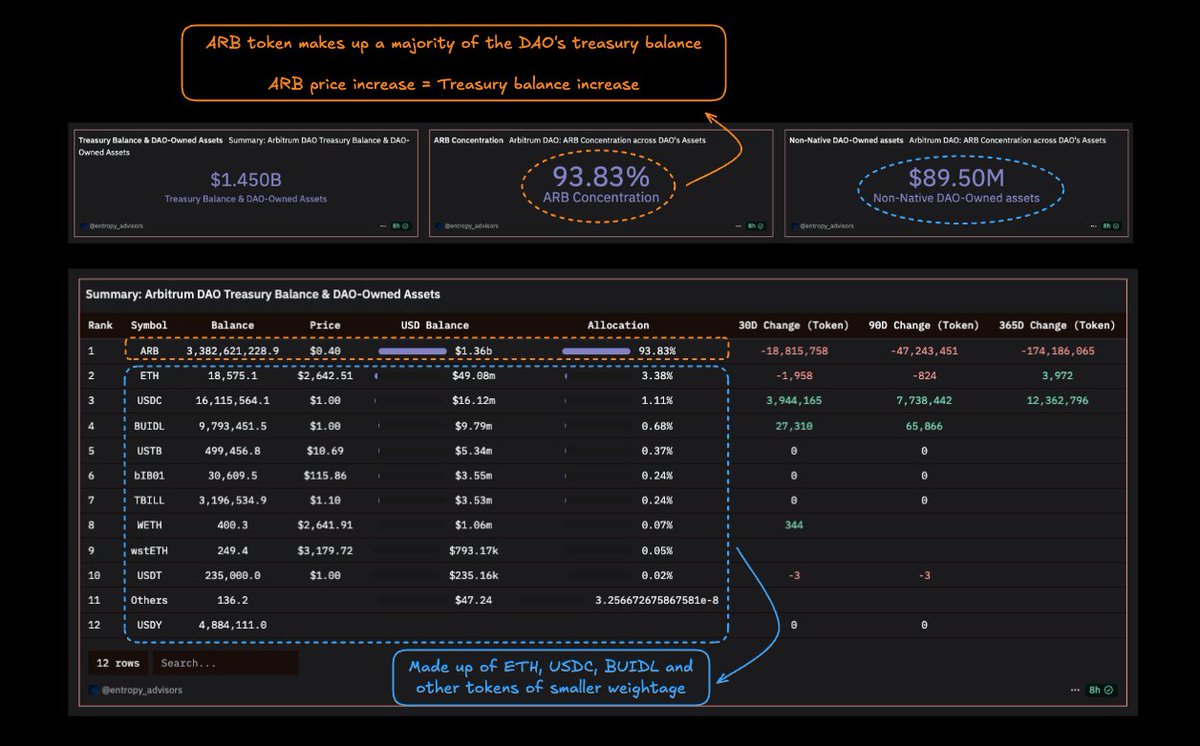

Arbitrum DAO currently has a treasury worth ~ $1.4B, with the majority of it denominated in $ARB.

The remaining 6%+ includes holdings in ETH, USDC, and BUIDL, reflecting a more conservative approach.

Curious to see how Arbitrum DAO has been managing the treasury?

2 main ways: US treasuries and ARB/ETH/Cash strategies

Their STEP initiative mainly composes of investment into lower risk on-chain instruments such as BUIDL, USDY, and USTB.

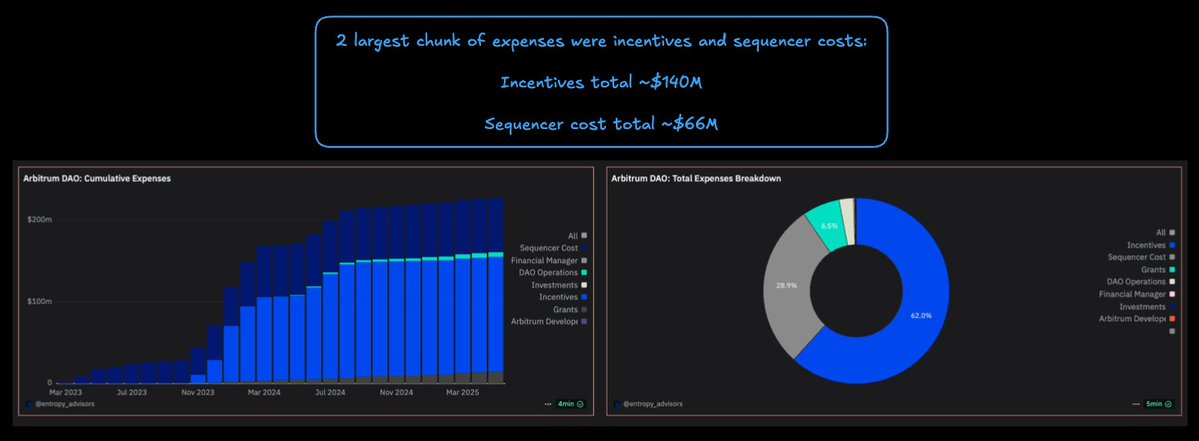

"What were the largest expenses for the DAO?"

Incentives are classified as expenses, and take the largest chunk, while sequencer costs take the 2nd place.

Even without incentives, the cost of running a blockchain is not that cheap, eh?

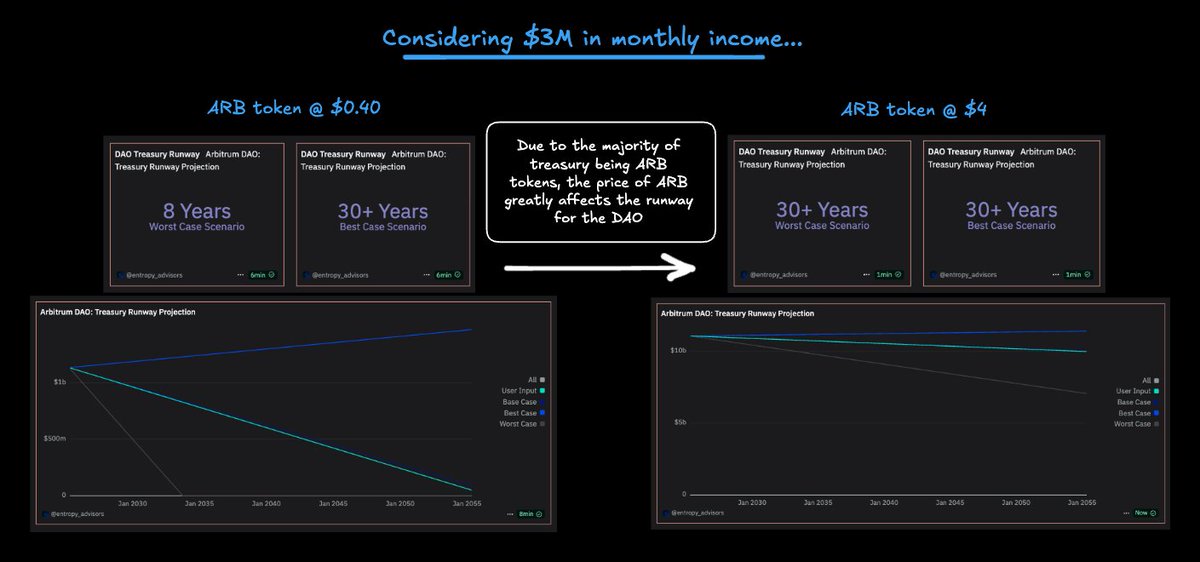

"How long can Arbitrum DAO last?"

As the majority of the Treasury is held as $ARB tokens, the fluctuations can be wild.

Should $ARB be <$0.40, the runway will shorten.

Should $ARB be >$0.40, there's probably some relief in the runway.

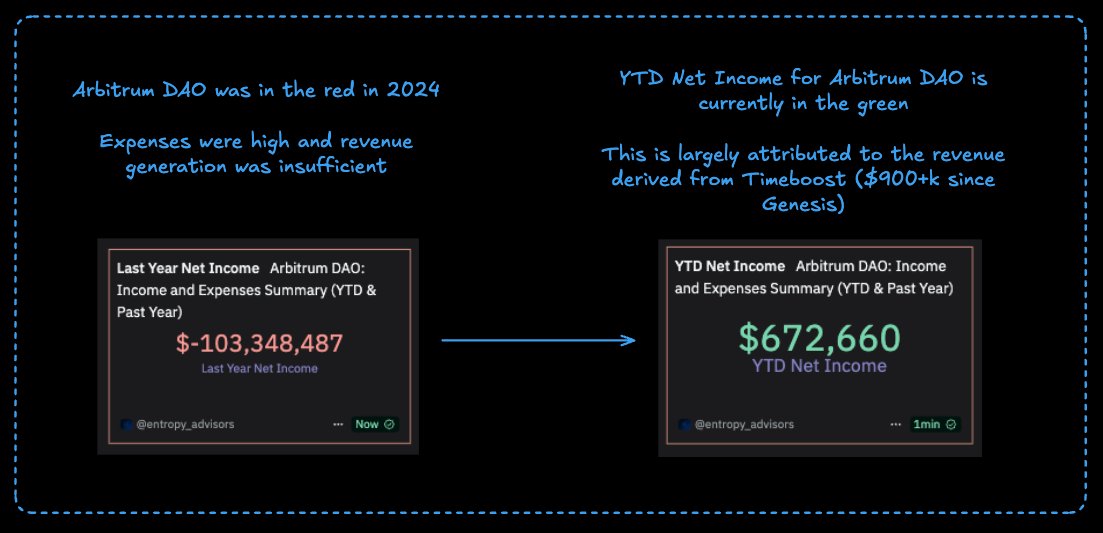

The silver lining? Timeboost's revenue has helped the DAO!

Having generated $900k+ in revenue since genesis, it has pushed the net income into the green.

Timeboost's share of contribution is creeping up, and hopefully we'll see it become a larger booster to the DAO's revenue.

What I think can be done (having no insight into their mandate):

• Increase exposure to low-risk yield products

• Increase yield farming on DeFi protocols - I can see how Pendle's stable PTs can come into play here

On one hand, it's assuring to see the DAO putting their treasury to work (e.g. STEP), but on the other, there seems to be centralization and over-reliance in its holding category (i.e. $ARB).

Personally observing how the current initiatives can be sustained, and if the DAO will step up its treasury management programs to attract more usage and drive revenue figures.

Thoughts on Arbitrum DAO treasury and financials?

@monosarin

@0xAndrewMoh

@CryptoShiro_

@poopmandefi

@0xelonmoney

@eli5_defi

@marvellousdefi_

@0xCheeezzyyyy

@crypto_linn

@YashasEdu

@CipherResearchx

@splinter0n

@iam_LeriK

@TweetByGerald

@CryptoGideon_

@belizardd

@lenioneall

@FabiusDefi

@St1t3h

@the_smart_ape

@cryppinfluence

@TheDeFiPlug

@0xMrDiaz

@defi_mago

@0xDefiLeo

@kenodnb

@bullish_bunt

@AlwaysBeenChoze

@Mars_DeFi

@nursexxl

@Defi_Warhol

@0xTindorr

@PenguinWeb3

What are your thoughts?

Thanks for reading till the end, hope you enjoyed it!

Disclaimer: All opinions expressed remain objective, and are for informational and/or entertainment purposes only. NFA, as always DYOR.

I will be diving deeper and sharing more alpha along the way!

106

9.63K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.