1/TiD Strategies has taken a small position in USDS Yield Token (YT) on Pendle — a points farming play on the upcoming Spark token.

Here’s the thesis 👇

2/

Spark has $7.2B in TVL, ranking as the #4 largest DeFi protocol (June 2025).

It integrates with @Aave and @MorphoLabs and manages $1.5B in active loans.

Notably, Spark is the only $1B+ protocol without a token—but its Spark Points (SP) program may change that.

3/

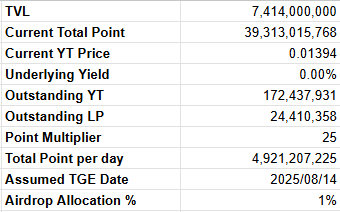

Pendle’s YT-USDS earns no fixed yield, but accumulates Spark Points (SP), which may convert to tokens at TGE.

🗓️ If TGE happens around Aug 14, 2025 (YT expiry)

🎯 And if ~1% of airdrop goes to Pendle LPs...

There may be convex exposure to a DeFi unicorn.

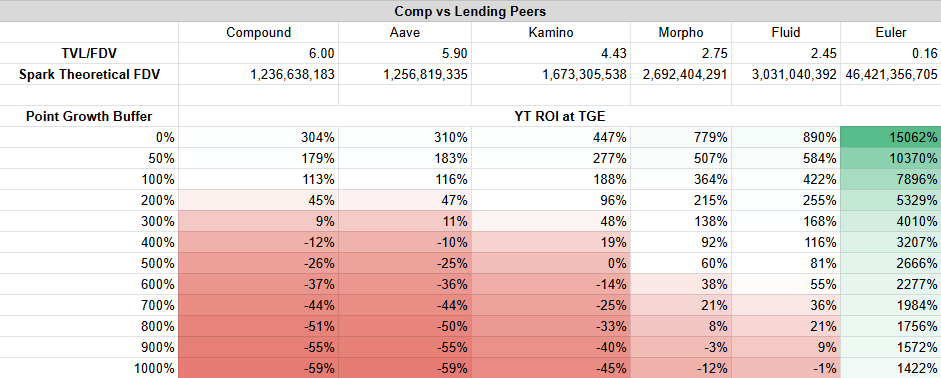

3/ While the YT is built on top of the USDS stablecoin, Spark itself is more of a lending protocol,

so it might also make sense to apply the TVL/FDV valuation multiple of other lending protocols.

5/Why assume 1% airdrop to Pendle YT/LPs?

Spark’s been farming points to depositors/lenders for 2 years.

If they only get 4–5%, Pendle users likely get less. So we assume a conservative 1% slice for this strategy.

6/ 🧠 Risks to watch:

– TGE delayed past Aug

– Pendle YT/LP share of points lower than expected

– Points farming activity dilutes your yield

– Market downturn compresses FDV

– Spark token underperforms vs comps

7/ We took a small starter position (<1% of desk AUM).

For more analysis like this which led to this trade consider subscribing to TID Premium, our actionable paid research:

8/🛡️ Disclosure

TiD Strategies is our internal desk. We deploy only our own capital.

This thread is for transparency and discussion — not investment advice.

📊 Positions & disclosures:

8

6.06K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.