Giant whale fights, billions of dollars bets, and a wonderful confrontation between high-leverage and long-short in one article

Written by: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Last night, when Bitcoin was poised to break through a record high, a "100 million-level showdown" long and short confrontation was staged on the chain.

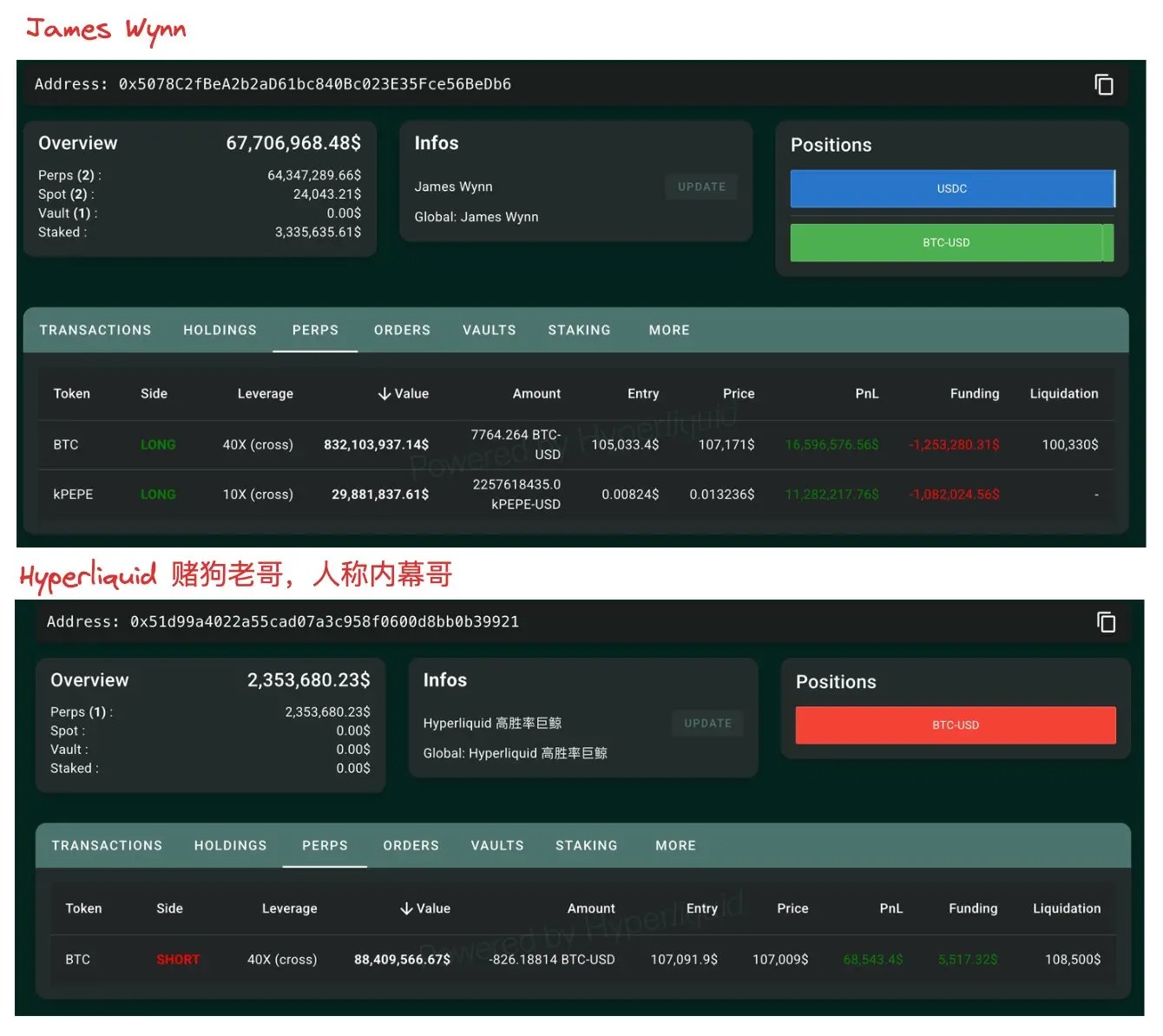

Two aggressive, high-stakes trading giants face each other: legendary trader James Wynn on one side and a high-win player known as the "Hyperliquid 50x Insider" on the other. The duo opened a 40x leveraged BTC counterparty, which instantly attracted high attention from the market.

Leverage magnifies gains, but it also amplifies greed. Let's review the ins and outs of this late-night battle together.

who are they?

James Wynn, a bull player, was once known as the "legendary meme coin hunter" on the chain. His trading started from an extremely low-key point, initially just a "10U God of War", and the amount of wallet interactions hovered in the range of tens of dollars. But in the midst of the PEPE boom, he suddenly changed his style, became aggressive, and became famous. James Wynn took advantage of PEPE's skyrocketing market and earned more than $25 million from his initial investment of $7,644.

James Wynn's contract style can be summarized in three key words: large positions, high leverage, and high frequency. Almost every time he opened a position, he was accompanied by a shouting order. Recently, in the BTC long order, he repeatedly shouted that "$100,000 in bitcoin is very cheap".

The background of the bearish player "Hyperliquid 50x Insider" is even more bizarre. Since January of this year, multiple addresses behind it have frequently used high leverage on GMX, and have made a cumulative profit of about $2.53 million. He is active on gambling platforms Roobet and AlphaPo, has a history of interacting with ChangeNOW, a popular exchange for hackers, and single-handedly snatched $1.8 million from Hyperliquid.

As for his real identity, ZachXBT once posted that this "insider brother" is likely to be related to William Parker (WP). WP is a "professional gambler" with a history of fraud who was arrested in Finland for stealing a total of $1 million from two online casinos in 2023. He has made headlines in the UK for hacking and gambling-related fraud.

According to the data provided by on-chain analyst Aunt Ai, in the early morning of May 21, a legendary showdown on the chain quietly began.

⏰ 2 a.m. – 4 a.m.: Two players add to their positions

at2 a.m., and James Wynn takes the lead to increase his long position in 40x leveraged BTC to 7,764.26 BTC (worth about $832 million).

-

Opening Price: $105,033.4

-

Liquidation Price: $100,330

-

At that time, the floating profit: about $16.59 million

4 o'clock in the morning, the insider entered the market short, and the gambling was full. When BTC hits a short-term high, open a 40x short position on the backhand:

-

Opening size: 826.18 BTC (about $88.41 million)

-

Opening price: $107,091.9

-

Liquidation price: $108,500

-

Floating profit at that time: $68,000

Source: Aunt

⏰ Ai 2 p.m.: BTC broke through $107,500, and the divergence began

to diverge:

-

James Wynn: Long floating profit rose to $19.83 million

-

Insider: Floating loss of $375,000 for short orders

From 3 p.m. to 6:30 p.m.: James Wynn took profit in batches, and his position continued to decline by 3 points: Long orders dropped to 5625.43 BTC, with a floating profit of $9.43 million and a realized profit of 10.48 million ⏰

-

4 points: continue to reduce positions to 46.4026 BTC, floating profit of $7.68 million, realized profit of 11.92 million

-

6 and a half: close part of the position again, only 2524.86 BTC remaining, floating profit dropped to $2.72 million, cumulative realized profit of $14.57 million

So far, James Wynn's long position has dropped from the peak of 832 million to $268 million, and it is gradually in the pocket.

⏰ 9 p.m.: The battle line is held for the time being, James Wynn holds a low-key position, and the insider brother leaves BTC to

pull back to $106,500.

-

James Wynn did not immediately increase his position, holding long positions: 18.1958 BTC ($193 million), floating profit of $2.65 million, realized profit of 15.42 million

-

Insider brother short position: 826.18 BTC, floating profit of $

⏰ 542,000 After 11 o'clock: peak collision, both increased positions, and the smell of gunpowder was full

As BTC broke through $108,000, James Wynn increased his heavy position, and the insider brother also recharged and added margin to open a short backhand:

James Wynn

-

increased his position to 7444.97 BTC ($815 million)

The -

average price of the new position: $107,726.7

-

Liquidation Price: $101,420

-

Current Floating Profit: $13.46 Million

Insider Brother

-

Short Positions Increased to 597.4 BTC ($65.43 million)

-

New Opening Price: $108,185.5

-

Liquidation Price Raised to: $112,320 (Replenishment of 2 million.) USDC margin)

-

Current floating loss: $

⏰ 806,000 11:30 to midnight: Historical-level head-to-head bombardment, the position broke one billion

near 11:30, James Wynn's long position exceeded $860 million, and the liquidation price rose to $101,980, and the insider's short position expanded to $101 million, and the liquidation price was $ 110,780。

Near 11:45, James Wynn's long position approached 900 million.

Approaching midnight: James Wynn's holdings exceeded one billion, reaching the peak of the round, and the head-to-head collision between the two heroes reached a climax

on May 22 Morning Battle Report: James won a big win

BTC fluctuated sharply and broke through 110,000, reaching a record high.

James Wynn added his position to 10,200 BTC worth $1.12 billion and a floating profit of $20.19 million.

Insider Brother originally made a large floating profit on short orders, but continued to increase his position in the range of $106,670-$107,410 and missed the take profit, and the cumulative loss in 24 hours expanded to $5.61 million, and he still held 40x short orders of 449.43 BTC.

Between victory and defeat, James Wynn, the blade of leverage

,writes victory, while the insider pays the price for greed and hesitation. This "100 million-level showdown" not only exploded the data surface, but also sounded the double alarm bell of risk and discipline for the market.

And a similar game may be playing out around you and me. The current open interest in BTC contracts has soared to an all-time high of $80.263 billion. In the past 24 hours, the total liquidation of the crypto market reached $407 million, of which 240 million were short orders and 167 million were long orders.

Under high leverage, floating profit and liquidation are only one line.