I shorted ETH at 1800

This wave is obviously the old foxes of the Freemasons pulling the plate, they think I can't see it?

Laughing to death, within three days, the door will definitely plummet, and then the leeks will cry again and call their mothers, don't blame me for not reminding you of this group of whites, smart people have long followed me to short, understand?

ETH will definitely be 800-1200 why?

Let's see on

🧵

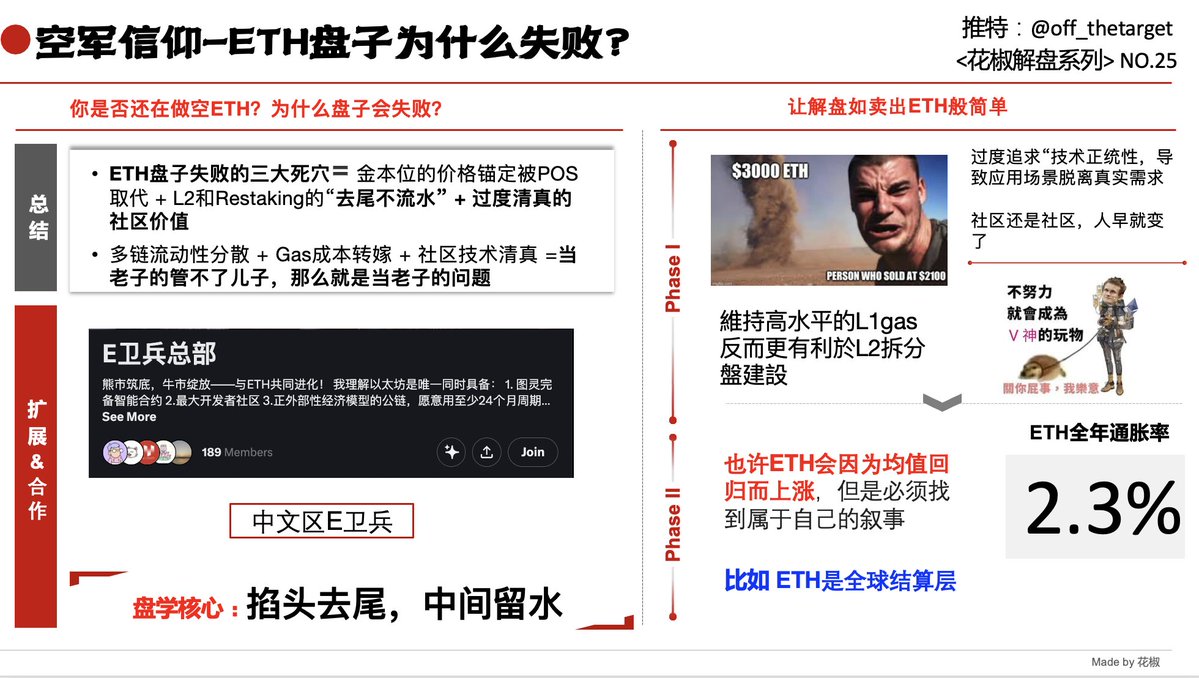

The issue of ETH has always been a matter of strategic decision-making in the structure/narrative of ETH, starting with the earliest pow to pos and then the L2 rollup scramble, over the course of nearly 10 years

The narrative of ETH has been changing and has been introverted, from the earliest sharding plan of ETH to the later zk rollup plan, the technical narrative drive has created countless empty city L2, and we are familiar with the four kings

☀️starknet zksync arbtrium and OP

As a result, starknet has not improved, zksync secretly withdraws money from the treasury, op is building L3, and arb is the "best" one in the ecosystem

What about earlier? ETH's thunder is actually buried from pow-pos

🌱 "Round 1: ETH Dividend Transformation"

What is the core premise of the dividend market? I've been looking for a good word to describe it, whether it's [physical anchor chain] or [physical miner anchorage], in fact, the owner's @thecryptoskanda {gold standard} is a good word

The sunk cost of depreciation of electricity/mining rigs in the real world is the cost line, and the cost line of different enterprises in different countries and different policies is different, and the token of a pow is from the manufacturer→ distributor→ logistics→ mining farm→ mining pool, → exchange, and there are many upstream and downstream. It does not include power grid companies, energy intermediaries, mine hosting, water cooling equipment, heat dissipation accessories

The cost price of entering at different times is different, and the upfront cost of mining and the sense of reward of daily gold coins (in fact, it is also a transmission chain) are huge, and the early ETH is dominated by Chinese miners, which is actually easier to shape a closer community

Building a value support line for ETH through the sunk cost of the gold standard -> = That's why there is a so-called shutdown price - > market psychological implications

After the POS era, validators only need to stake ETH (no hard cost), and can "unlimited digging and selling" The interest chain is broken, the sunk cost of the gold standard is transformed into a 0 cost pledge, and the pledged ETH can only provide 3-4% of the income, which is far less than the 5-6% coin standard of solan

To sum up: Failure of the dividend order = the cost line of the gold standard becomes 0 cost of the POS

🌱 [Round 2: Why does the split disk fail?] 】

The technical architecture absolutely determines the failure of the splitting mechanism of the economic model + the loss of an effective supply mode from L1 to L2

In fact, there are several reasons for returning to the sect

/Multi-chain liquidity decentralization

The /L2 technique limits some of them, such as OPs, to have challenging periods

/Gas cost pass-through

/All data disclosure cannot be done in a black box

/eth's community is too fancy and not enough to land

The tail of /restking does not go off, and the water does not remain

No matter what kind of plate it is, if you want to make it for a long time, you must meet three points (information black box/manual intervention that can be made/dynamic balance)

-> disks are very simple, 1) how to have continuous increments and 2) how to have more information endorsements

=> Let's start with the first point about restaking

The problem with restking is that ETH converted through "interest-bearing assets" is not directly invested back to the ecosystem

In other words, the ETH after the "interest-bearing asset" is no longer ETH, but has become USDT to speculate on different chains, and the released liquidity cannot be replenished to the ETH ecosystem

You can calculate the account, staking 32 ETH can get a 3% return on the year, if the 3% return can bring you 6-10% return every month on other chains, then the actual annual life is not worth 3%, the precipitated funds are actually not on the ETH chain, and an unrestricted outflow of the plate is dangerous

Therefore, in terms of panxue, Sichuan pepper will always emphasize that "pinch the head and remove the tail, and leave water in the middle" If the tail is not removed, it is dangerous to continue to flow out

=> Layer 2 technical limitations contradict liquidity

Let's talk about the four kings first: starknet, zksync, arbtrium, and OP

User funds are dispersed across multiple Layer2 chains (such as Base, zkSync), and the proportion of TVL on the main chain will drop from 80% in 2021 to 40% in 2024, resulting in serious liquidity fragmentation

"The king is not the king, the minister is not the minister, the father is not the father, the son is not the son"

When Lao Tzu can't control his son, then it's the problem of being Lao Tzu

Secondly, the split disk tries to be deployed through multiple chains, but the interaction between Layer 1 and Layer 2 is insufficient, and the capital scheduling efficiency is low, so it is impossible to evenly improve and balance the liquidity of each sub-chain from the perspective of liquidity

Maintaining a high level of L1gas is more conducive to the construction of L2 powder split disk, and here it has to be folded back, L1's own gas use cannot be improved because there is not too much use case, so you L2 should not expect to be able to improve gas (use case such as defi can not step on the right foot for a long time with the left foot, etc.)

After a long time, even the sweetest melons and fruits will rot...... Whether it is naturally rotten, or someone urges it to rot, it is always rotten, and if it is broken, it cannot be eaten, and if it cannot be wanted, it must be discarded, which is the failure of the split plate

= > refined community and ungrounded developer path dependency

The excessive pursuit of "technical legitimacy" (such as ZK proof, decentralization) leads to the application scenarios detached from real needs, technology has never been a high-level building, but a down-to-earth one, and the technological revolution every day is all doing middleware business, not to C business, the community is still the community, and people have long changed

The valuation of the "halal project" led by VC is inflated, spanning several years, puA years, there are very few real users, and this circle is full of smart people, and there are no fools

The three dead ends 🟰 of ETH plate failure The price anchoring of the gold standard was replaced by POS + L2 and Restkeing's "tailing and not flowing" + over-halal community value

So, are you still short ETH?

Show original

87.25K

91

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.